Welcoming 2024: Set your goals, hit the road!

Welcoming 2024: Set your goals, hit the road!

Views 536K

Contents 734

Iron ore and A-share market weekly report and global capital market weekly report 20240102

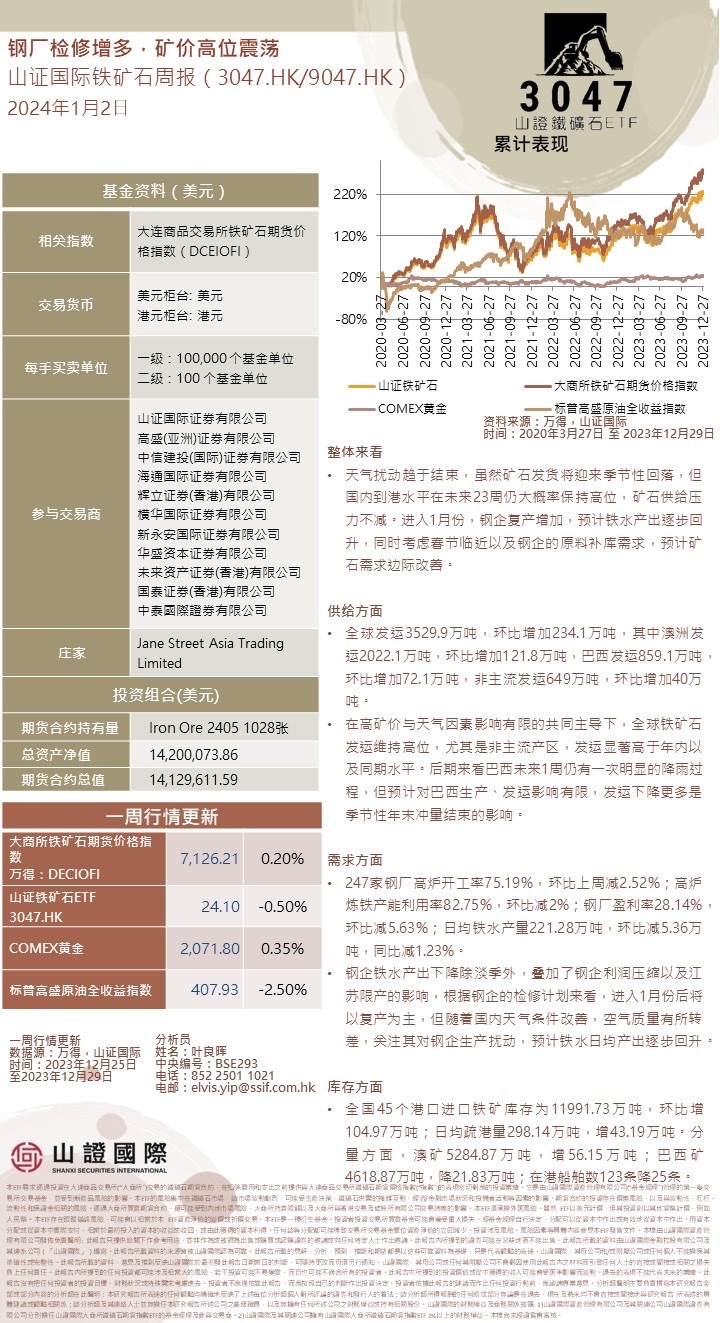

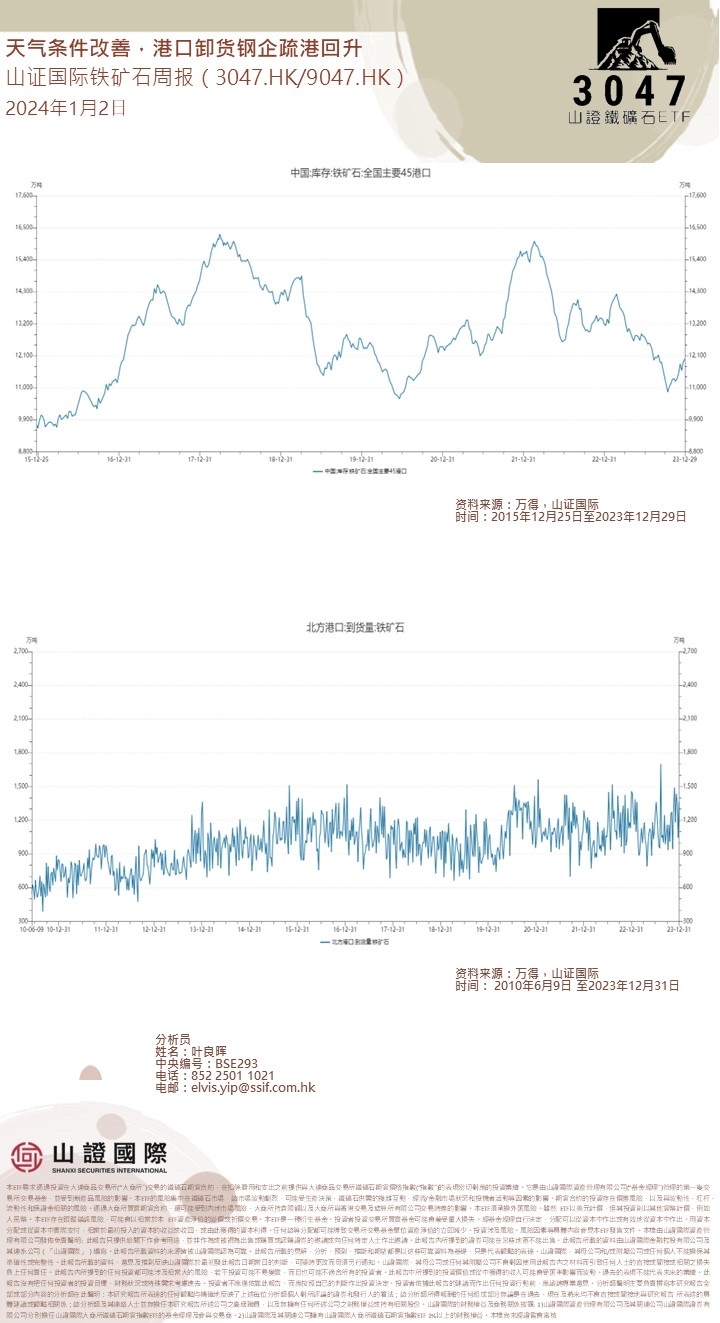

Overall, looking at it.Weather disturbances are tending to end. Although ore shipments will see a seasonal decline, the domestic port level is likely to remain high in the next 23 weeks, with no reduction in ore supply pressure. Entering January, steel mills increase production, and it is expected that pig iron output will gradually recover. Taking into account the upcoming Spring Festival and the raw material stocking needs of steel mills, the demand for ore is expected to marginally improve. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$On the supply sideGlobal shipments total 35.299 million tons, an increase of 2.341 million tons compared to the previous period. Among them, Australia shipped 20.221 million tons, an increase of 1.218 million tons, Brazil shipped 8.591 million tons, an increase of 0.721 million tons, and non-mainstream regions shipped 6.49 million tons, an increase of 0.4 million tons.Under the joint dominance of high ore prices and limited impact from weather factors, global iron ore shipments remain high, especially in non-mainstream production areas, significantly higher than the levels seen earlier in the year and during the same period. Looking ahead, there is still a significant rainy period expected in Brazil in the next week, but the impact on production and shipments is limited, with the decline in shipments more due to the seasonal end-of-year surge ending.On the demand sideOut of 247 steel plants, the blast furnace capacity utilization rate is at 75.19%, a decrease of 2.52% from the previous week; the blast furnace ironmaking capacity utilization rate is at 82.75%, down by 2%; the steel plant profit margin is at 28.14%, down by 5.63%; the average daily pig iron output is 2.2128 million tons, a decrease of 0.0536 million tons compared to the previous period, and a year-on-year decrease of 1.23%.The decrease in pig iron output from steel mills, in addition to the off-season impact, is compounded by the profit compression of steel mills and the impact of production restrictions in Jiangsu. Based on the maintenance plans of steel mills, production will mainly focus on resuming in January. However, with the improvement in domestic weather conditions and a slight deterioration in air quality, attention is being paid to the disturbance it may cause to steel production. It is expected that the daily pig iron output will gradually recover.On the inventory side.- 45 ports nationwide imported iron ore inventory was 119.9173 million tons, an increase of 1.0497 million tons month-on-month; the average daily port throughput was 2.9814 million tons, an increase of 0.4319 million tons. In terms of composition, Australian ore was 52.8487 million tons, an increase of 0.5615 million tons; Brazilian ore was 46.1887 million tons, a decrease of 0.2183 million tons; the number of ships in port decreased by 25 to 123. A-share weekly report for this week: 1. Key market operations in response to early springMarket trend determination: The current market is relatively slow, chasing after gains is illogical, and the rhythm should be controlled. Beware of the possibility of a significant retracement. 2. Tencent stock price and spring market trendsThe weakened technical structure of Tencent has led to a lack of rebound. Even if negative news is eliminated in the future, the rebound will not be particularly strong. The oversold sectors are rebounding. Last week, the overall market showed an oversold rebound. The structure of sectors such as brokerage, semiconductor, and pharmaceuticals has improved and adjusted properly, showing a bottom divergence. The structure of public security and infrastructure decline is complete, and the decline of some financial stocks such as Ping An Bank is nearing its end. The mid-term bottom of the market has not yet been confirmed, and market confidence is still in a short-term trading mentality. Retail investors will still dominate the market in January to May this year. $TENCENT (00700.HK)$ $BEIGENE (06160.HK)$ Mastering the strategy for the spring market operation.Market trend prediction: Since the current market decline is caused by interest rate differentials and risk aversion, the return to stability depends on the balance of interest rates between China and the United States and the impact of risk aversion. The impact of Contemporary Amperex Technology: Due to the sharp decline in the stock price of Contemporary Amperex Technology, the CSI 300 index has contributed to a drop of over 6% since December 2021, significantly affecting the index. However, as the sales of electric vehicles in 2024 have entered the mid-term phase, transitioning from rapid growth to moderate growth, the probability of Contemporary Amperex Technology's rapid rebound in the first half of this year is not high. Resistance level analysis: The market's key resistance level is estimated to be around 3050, market confidence and investors' long-term expectations have not yet recovered, looking forward to the second half of the year. Global capital market weekly report: We wish all readers health, happiness, and prosperity in 2024. The major surprise in 2023 was that global economic growth far exceeded expectations (1 percentage point higher than expected), and inflation rapidly normalized in the second half of the year. The unexpected growth reflects the weakening drag of monetary policy tightening (as the lag time from financial conditions changing to economic growth is much shorter than generally believed) and the recovery in income growth that keeps consumer spending robust. Although economic growth is steady, the progress made in inflation highlights the uniqueness of this cycle. Despite the unemployment rate remaining low, the labor market has successfully rebalanced as excess job vacancies are filled, and labor supply has surpassed expectations (due to favorable job prospects and immigration rebound). Combined with improved global supply conditions (which reduce core commodity and overall inflation), this alleviates upward pressure on wage growth, and wage growth is expected to stabilize at a sustainable level in the coming year. As inflation approaches the finishing line, the threshold for interest rate cuts has been lowered, and the central bank should begin policy normalization next year. With the implementation of the 'soft landing' and the economy returning to normal levels, we still focus on the long-term driving factors of the economic outlook, including the upward growth potential generated by artificial intelligence.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more 1

1