Iron ore and A-share market weekly report and global fund market weekly report 20240108

Overall, looking at it

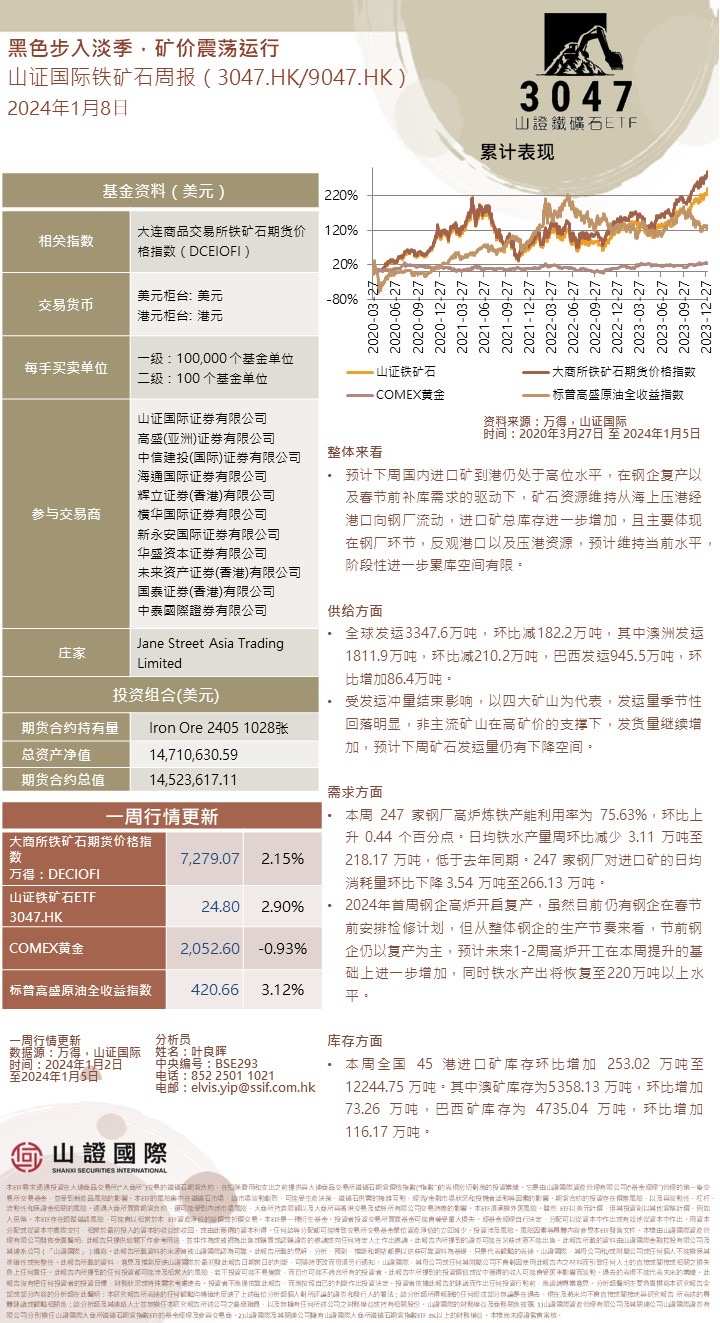

• Estimated that next week, domestic imported ore will still be at a high level, driven by the resumption of steel mills and the demand for inventory replenishment before the Spring Festival. The flow of ore resources will be maintained from the sea to the ports and then to the steel mills. The total inventory of imported ore will further increase, mainly reflected in the steel mill section. On the other hand, the port and pressure ore resources are expected to be maintained at the current level, with limited further accumulation space in the short term. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• Global shipments of 33.476 million tonnes, a decrease of 1.822 million tonnes from the previous period, including 18.119 million tonnes from Australia, a decrease of 2.102 million tonnes from the previous period, and 9.455 million tonnes from Brazil, an increase of 0.864 million tonnes from the previous period.

• Impacted by the end of large-scale shipments, as represented by the four major mines, the seasonal decline in shipments is significant. Non-mainstream mines continue to increase shipments under the support of high ore prices, and it is expected that the ore shipments will continue to decline next week.

On the demand side

• This week, the capacity utilization rate of blast furnace iron production in 247 steel mills was 75.63%, an increase of 0.44 percentage points from the previous period. The average daily pig iron production decreased by 0.0311 million tonnes to 2.1817 million tonnes on a weekly basis, lower than the same period last year. The average daily consumption of imported ore by 247 steel mills decreased by 0.0354 million tonnes to 2.6613 million tonnes on a weekly basis.

In the first week of 2024, blast furnaces of steel companies resumed production. Although some steel companies still have maintenance plans before the Spring Festival, the overall production rhythm of steel companies shows that production resumption is the main focus before the festival. It is expected that blast furnace operation will increase further in the next 1-2 weeks on the basis of the increase in the current week, and the iron output will recover to a level above 2.2 million tons.

As for inventory

• The national 45 Hong Kong imported mineral inventory increased by 2.5302 million tons to 122.4475 million tons compared to the previous week. Among them, the Australian ore inventory was 53.5813 million tons, an increase of 0.7326 million tons compared to the previous week, and the Brazilian ore inventory was 47.3504 million tons, an increase of 1.1617 million tons compared to the previous week.

A-share weekly report for this week:

1. Are dividends crowded? Trading indicators cannot indicate a 'peak'. In the first week of 2024, the dividend index performed well, and from the distribution of industry gains and losses, there is also a characteristic of 'the higher the dividend yield, the higher the increase this week.' This 'one-man show' market also started to worry some investors about the 'crowdedness' of the dividend style. The experience we gained from the strong cyclical market in August-September 2021 and the AI-themed market in April 2023 is that indicators such as trading crowdedness, proportion of turnover, and the suction effect on funds are difficult to accurately determine a 'peak'. The only possible time point for coupling might be when the previous strong style falls below the previous low, and the above indicators indicating a 'peak' have not yet appeared in the dividend style: the average daily turnover rate of the CSI dividend index is still at a low level since June 2021; the weekly turnover ratio has risen this week, but it has not reached the historical peak;

2. In addition, although the previously strong TMT style has declined, it is still far from the previous low, and it is difficult to say that the dividend style has formed a strong 'fund suction' effect. The real question is whether to break the 'box' of dividend asset valuation. We found that the difference in valuation between the dividend style and the previously widely recognized 'track' has indeed converged to the level of historical lows, and to continue this convergence, it often requires the cooperation of some kind of 'comparative advantage': we have statistically analyzed the industries and styles that have successfully improved and stabilized the valuation premium relative to the CSI 300 since 2010. Among them, the most typical are the food and beverage sector and the 'Maotai index'. During the period from 2010 to 2021, most of the time they steadily increased the valuation premium relative to the CSI 300. During these times, their comparative advantage was that the profit growth rate compared to the CSI 300 remained at a high level and fluctuated little. The secret to the continued profit growth advantage of the 'food and beverage' sector and the 'Maotai index' lies in the macro background of the increasing rate of value-added since 2010, where companies have been able to use their brands as barriers, adapt to the identity of the 'middle class,' and continuously increase prices and gross margins. For the pharmaceutical industry and the 'Ning combination' which have industry trends, the source of high-speed growth is the process of overall 'financialization' of society, where the 'visible hand' guides the tilt of financial resources towards high-end manufacturing and the release of a large amount of production capacity.

Third, beyond the 'dividend yield' itself, the physical resilience constitutes the foundation of the current dividend. Since 2020, the economy has started to 'de-financialize', gradually shifting the economic structure towards manufacturing that consumes more physical assets and has a lower value-added ratio. The growth rate of electricity consumption and raw material production and sales volume has been lower than GDP growth rate for most of the period between 2010 and 2020. However, since 2022, it has been growing stronger than GDP. Even in 2023, when global trade weakened, China's export quantity index still maintained high double-digit growth, which also reflects the resilience of the economy. This resilience lies in 'quantity' rather than 'value', and the focus is on consumption of physical assets. At the same time, there are still bottlenecks and monopolistic restrictions in the supply of some of these 'quantities'. Industries that possess these characteristics may be better than simply relying on the level of dividend yield to seek 'dividends'. $Kweichow Moutai (600519.SH)$

Global capital market weekly report:

Weekly market outlook for US tech stocks: US tech stocks experienced an overall decline last week, but some company stock prices began to recover in the middle of the week. Price fluctuations in the AI field and cryptocurrency sector of the technology sector were caused by expected changes. In terms of performance releases, several tech companies, including Taiwan Semiconductor, Texas Instruments, Microsoft, and Tesla, will announce their financial reports in January. The performance releases will have an impact on stock prices. Taiwan Semiconductor performance outlook: Revenue for the first 11 months decreased by 4.1% year-on-year. The quarterly report will be released soon. Measures have been taken to improve capacity utilization and accelerate the signing of contracts for advanced processes. It is expected that the number of customers for the three-nanometer process will increase.

• Estimated that next week, domestic imported ore will still be at a high level, driven by the resumption of steel mills and the demand for inventory replenishment before the Spring Festival. The flow of ore resources will be maintained from the sea to the ports and then to the steel mills. The total inventory of imported ore will further increase, mainly reflected in the steel mill section. On the other hand, the port and pressure ore resources are expected to be maintained at the current level, with limited further accumulation space in the short term. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$

On the supply side

• Global shipments of 33.476 million tonnes, a decrease of 1.822 million tonnes from the previous period, including 18.119 million tonnes from Australia, a decrease of 2.102 million tonnes from the previous period, and 9.455 million tonnes from Brazil, an increase of 0.864 million tonnes from the previous period.

• Impacted by the end of large-scale shipments, as represented by the four major mines, the seasonal decline in shipments is significant. Non-mainstream mines continue to increase shipments under the support of high ore prices, and it is expected that the ore shipments will continue to decline next week.

On the demand side

• This week, the capacity utilization rate of blast furnace iron production in 247 steel mills was 75.63%, an increase of 0.44 percentage points from the previous period. The average daily pig iron production decreased by 0.0311 million tonnes to 2.1817 million tonnes on a weekly basis, lower than the same period last year. The average daily consumption of imported ore by 247 steel mills decreased by 0.0354 million tonnes to 2.6613 million tonnes on a weekly basis.

In the first week of 2024, blast furnaces of steel companies resumed production. Although some steel companies still have maintenance plans before the Spring Festival, the overall production rhythm of steel companies shows that production resumption is the main focus before the festival. It is expected that blast furnace operation will increase further in the next 1-2 weeks on the basis of the increase in the current week, and the iron output will recover to a level above 2.2 million tons.

As for inventory

• The national 45 Hong Kong imported mineral inventory increased by 2.5302 million tons to 122.4475 million tons compared to the previous week. Among them, the Australian ore inventory was 53.5813 million tons, an increase of 0.7326 million tons compared to the previous week, and the Brazilian ore inventory was 47.3504 million tons, an increase of 1.1617 million tons compared to the previous week.

A-share weekly report for this week:

1. Are dividends crowded? Trading indicators cannot indicate a 'peak'. In the first week of 2024, the dividend index performed well, and from the distribution of industry gains and losses, there is also a characteristic of 'the higher the dividend yield, the higher the increase this week.' This 'one-man show' market also started to worry some investors about the 'crowdedness' of the dividend style. The experience we gained from the strong cyclical market in August-September 2021 and the AI-themed market in April 2023 is that indicators such as trading crowdedness, proportion of turnover, and the suction effect on funds are difficult to accurately determine a 'peak'. The only possible time point for coupling might be when the previous strong style falls below the previous low, and the above indicators indicating a 'peak' have not yet appeared in the dividend style: the average daily turnover rate of the CSI dividend index is still at a low level since June 2021; the weekly turnover ratio has risen this week, but it has not reached the historical peak;

2. In addition, although the previously strong TMT style has declined, it is still far from the previous low, and it is difficult to say that the dividend style has formed a strong 'fund suction' effect. The real question is whether to break the 'box' of dividend asset valuation. We found that the difference in valuation between the dividend style and the previously widely recognized 'track' has indeed converged to the level of historical lows, and to continue this convergence, it often requires the cooperation of some kind of 'comparative advantage': we have statistically analyzed the industries and styles that have successfully improved and stabilized the valuation premium relative to the CSI 300 since 2010. Among them, the most typical are the food and beverage sector and the 'Maotai index'. During the period from 2010 to 2021, most of the time they steadily increased the valuation premium relative to the CSI 300. During these times, their comparative advantage was that the profit growth rate compared to the CSI 300 remained at a high level and fluctuated little. The secret to the continued profit growth advantage of the 'food and beverage' sector and the 'Maotai index' lies in the macro background of the increasing rate of value-added since 2010, where companies have been able to use their brands as barriers, adapt to the identity of the 'middle class,' and continuously increase prices and gross margins. For the pharmaceutical industry and the 'Ning combination' which have industry trends, the source of high-speed growth is the process of overall 'financialization' of society, where the 'visible hand' guides the tilt of financial resources towards high-end manufacturing and the release of a large amount of production capacity.

Third, beyond the 'dividend yield' itself, the physical resilience constitutes the foundation of the current dividend. Since 2020, the economy has started to 'de-financialize', gradually shifting the economic structure towards manufacturing that consumes more physical assets and has a lower value-added ratio. The growth rate of electricity consumption and raw material production and sales volume has been lower than GDP growth rate for most of the period between 2010 and 2020. However, since 2022, it has been growing stronger than GDP. Even in 2023, when global trade weakened, China's export quantity index still maintained high double-digit growth, which also reflects the resilience of the economy. This resilience lies in 'quantity' rather than 'value', and the focus is on consumption of physical assets. At the same time, there are still bottlenecks and monopolistic restrictions in the supply of some of these 'quantities'. Industries that possess these characteristics may be better than simply relying on the level of dividend yield to seek 'dividends'. $Kweichow Moutai (600519.SH)$

Global capital market weekly report:

Weekly market outlook for US tech stocks: US tech stocks experienced an overall decline last week, but some company stock prices began to recover in the middle of the week. Price fluctuations in the AI field and cryptocurrency sector of the technology sector were caused by expected changes. In terms of performance releases, several tech companies, including Taiwan Semiconductor, Texas Instruments, Microsoft, and Tesla, will announce their financial reports in January. The performance releases will have an impact on stock prices. Taiwan Semiconductor performance outlook: Revenue for the first 11 months decreased by 4.1% year-on-year. The quarterly report will be released soon. Measures have been taken to improve capacity utilization and accelerate the signing of contracts for advanced processes. It is expected that the number of customers for the three-nanometer process will increase.

Developments in the US tech chip industry: Taiwan Semiconductor plans to collaborate with Samsung to advance the mass production of the advanced 2-nanometer process, which is expected to further progress in 2025. The 1.4-nanometer process is planned to be mass-produced between 2027 and 2028. Qualcomm's key development directions are improving 5G communication efficiency and AI intelligence. The performance of PC AI chips has significantly improved under low power consumption. Mobile chips have enhanced AI model support, achieving higher energy efficiency and GPU performance compared to previous generations. AI technology continues to be optimized, and the inference capability of edge chips has significantly improved. With the optimization of NPU performance and speculative sampling technology, it is expected to achieve a generation rate of 40-50 tokens per second for 7B-parameter models in 2025.

Advantages and progress of AI small models and applications in the field of cryptocurrency: Small models in the field of cryptocurrencies have attracted more attention due to their high efficiency, low cost, and customization capabilities. Research from Stanford AI Lab shows that small models can save up to 75% in inference costs, and their performance after fine-tuning is comparable to large models. $Microsoft (MSFT.US)$

Advantages and progress of AI small models and applications in the field of cryptocurrency: Small models in the field of cryptocurrencies have attracted more attention due to their high efficiency, low cost, and customization capabilities. Research from Stanford AI Lab shows that small models can save up to 75% in inference costs, and their performance after fine-tuning is comparable to large models. $Microsoft (MSFT.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment