Powell: Not confident rates would lower in March

Powell: Not confident rates would lower in March

Views 649K

Contents 83

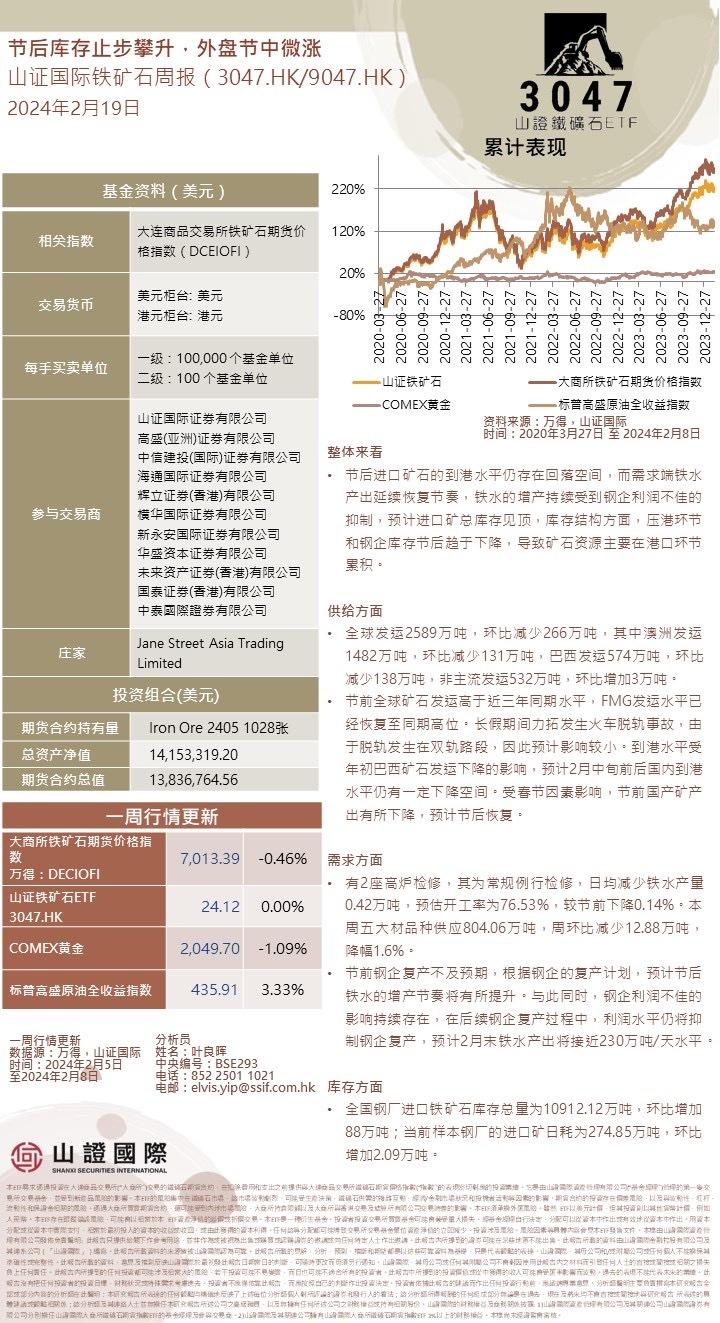

Iron ore and A-share market weekly report and global capital market weekly report 20240219

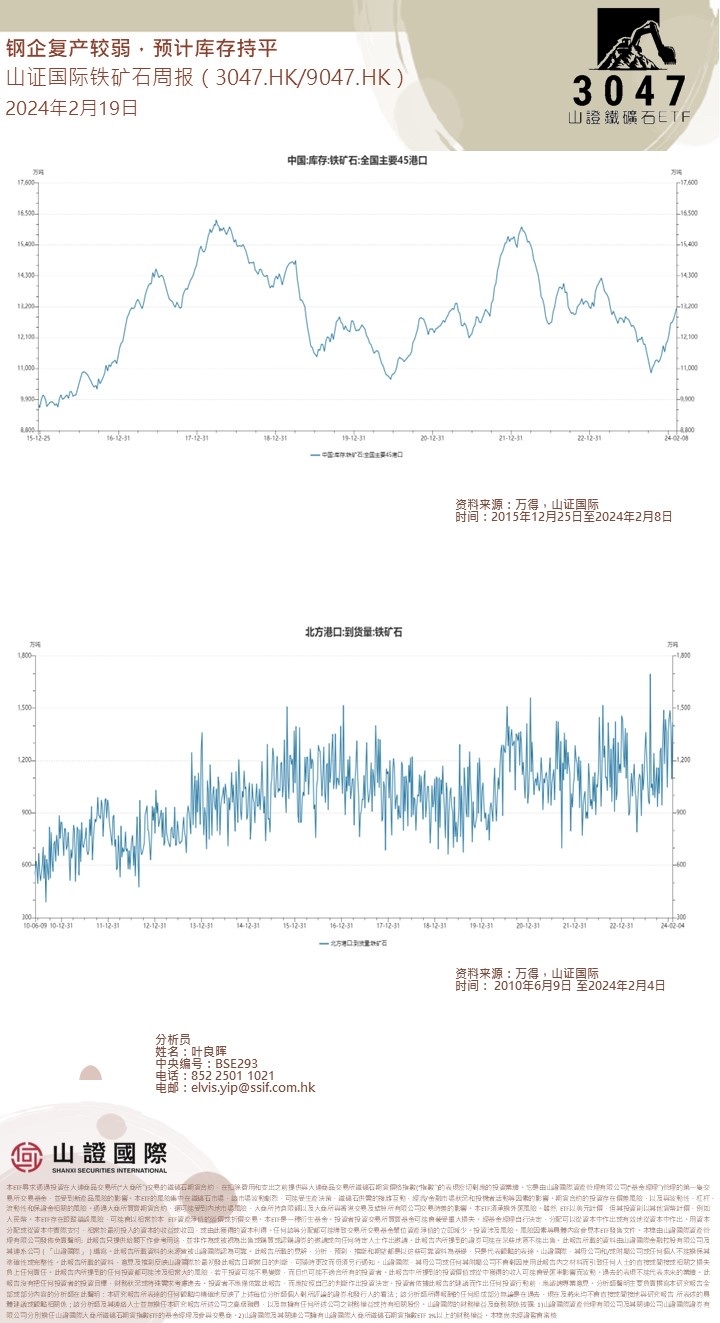

Overall, looking at it-After the holiday, there is still room for a decline in the level of imported iron ore at the port, while the output of molten iron on the demand side continues to recover, and the increase in molten iron production is continuously suppressed by the poor profitability of steel enterprises. It is expected that the total inventory of imported ore will peak, and in terms of inventory structure, the port link and post-holiday inventory of steel enterprises tend to decrease, resulting in the accumulation of ore resources mainly at the port link. $SSIF DCE Iron Ore Futures Index ETF (03047.HK)$On the supply side-The global shipment was 25.89 million tons, a decrease of 2.66 million tons compared with the previous period. Among them, Australia shipped 14.82 million tons, a decrease of 1.31 million tons compared with the previous period, and Brazil shipped 5.74 million tons, a decrease of 1.38 million tons compared with the previous period. Non-mainstream shipping was 5.32 million tons, an increase of 0.03 million tons compared with the previous period.-The global shipment of iron ore before the holiday was higher than the same period in the past three years, and FMG's shipment level has returned to the high level of the same period. During the long holiday, Rio Tinto had a train derailment accident, but since the derailment occurred on a double-track section, the impact is expected to be small. The level of arrival at the port is affected by the decrease in iron ore shipments from Brazil at the beginning of the year, and it is expected that the level of arrival in China will still have a certain space for decline around mid-February. Due to the impact of the Spring Festival, domestic iron ore production decreased before the holiday, and it is expected to recover after the holiday.On the demand side-There are 2 blast furnaces under maintenance, which are routine maintenance, with a daily reduction of 0.0042 million tons of molten iron production. The estimated operating rate is 76.53%, a decrease of 0.14% compared to before the holiday. This week, the supply of major construction materials is 8.0406 million tons, a decrease of 0.1288 million tons compared to the previous week, a decrease of 1.6%.-Before the holiday, the resumption of production by steel enterprises fell short of expectations. According to the resumption plan of steel enterprises, it is expected that the pace of increased production of molten iron will increase after the holiday. At the same time, the impact of poor profitability of steel enterprises continues to exist. In the subsequent resumption process of steel enterprises, the level of profitability will still suppress the resumption of steel enterprises. It is estimated that the output of molten iron at the end of February will be close to 2.3 million tons per day.As for inventory- The total inventory of imported iron ore in national steel mills is 109.1212 million tons, an increase of 0.88 million tons compared to the previous month; the daily consumption of imported ore in the current sample steel mills is 2.7485 million tons, an increase of 0.0209 million tons compared to the previous month. A-share weekly report for this week: Task 1: Chinese assets generally rise, worth investing in.During the Spring Festival holiday (from February 9th to February 18th), China-related assets in overseas markets showed a general rise. In terms of equity markets, both the Chinese stock index in the US stock market and the Hang Seng Index in the Hong Kong stock market recorded gains (4.61%, 2.91%). In addition, FTSE A50 futures recorded a 2.76% gain during the Spring Festival holiday; offshore renminbi remained stable and had a slight appreciation despite the strength of the US dollar index. The general rise in Chinese assets resonates with positive fundamental news. January financial data had a good start. The outstanding performance of assets related to China also reflects the pricing of financial data announced after the A-share market closed. The financial data has bright spots in both quantity and structure. The scale of social financing in January reached a historic high of 6.5 trillion yuan, and the scale of new renminbi loans was second only to January 2023, reaching 4.92 trillion yuan. It was the main driving factor in the increase in social financing, both of which exceeded the market expectations of 5.78 trillion yuan and 4.67 trillion yuan. In terms of structure, corporate bond financing in social financing increased significantly year-on-year in the same month, which echoed the promotion of enterprise financing by the downward movement of interest rates mentioned in the People's Bank of China's "Quarterly Monetary Policy Implementation Report". In terms of credit, household loans increased significantly year-on-year, with medium- and long-term loans increasing by 404.1 billion yuan, the highest level since March 2022. Under the successive introduction of real estate policies, the willingness of residents to increase leverage has rebounded. The intervention of the stabilizing force before the Spring Festival has eased the liquidity risk of small and medium-sized cap stocks. After large fluctuations, the driving force will return to the market and the fundamentals themselves, and the "elasticity" may lie in the large cap stocks rather than the small and medium cap stocks. $CHINA RES LAND (01109.HK)$ 2 "Homework 2": Overseas inflation returns, "copy" upstreamThe U.S. CPI increased by 3.1% year-on-year in January, exceeding Bloomberg's consensus expectation of 2.9%. The core CPI in January increased by 3.9% year-on-year, exceeding Bloomberg's consensus of 3.7%. Service inflation was the main driver, and PPI data pointed to the same conclusion. After the data was released, the probability of a rate cut by the Fed in March is now less than 10%, and the probability of a rate cut in May has dropped to 30%. The rate cut cycle is likely to start in June 2024 and beyond. At the same time, the 2-year U.S. Treasury yield has jumped, and the term spread has deepened compared to before the Spring Festival. Meanwhile, extreme weather and geopolitical disputes have become the supply-side support for international oil prices, laying hidden dangers for future Fed control of inflation. For A-shares, when inflation returns, the upstream certainty is strong. Due to its global pricing nature, when commodity prices rise, the profitability of Chinese energy companies can also increase. In relative terms, downstream enterprises face increased competitive pressure on the profit side. 3 "Homework 3": "New" and "old" growth alternation, "copy" structureAround the Spring Festival holiday, two major technology products were launched: Apple's Vision Pro and Open AI's Sora. From the Baidu search index and the news index, it is clear that social attention and discussion heat on the latter are significantly higher than the former. This also indirectly reflects the replacement of the technology wave, transitioning from the past "consumer electronics" to "artificial intelligence." In the new wave of technology, limited by "anti-globalization" and participation thresholds, the breadth and depth of Chinese companies' involvement in the industry chain are not as extensive as the previous wave. This makes the new wave of technology unlikely to translate into capital returns on Chinese company financial reports in the short term. In terms of consumption, the "elasticity" of service consumption reflects a narrowing consumption gap. Under the guidance of "common prosperity," perhaps it is the growth pole of future consumption. 4 "Homework": Don't copy everything, the key is physical flowDuring the Spring Festival, Chinese assets generally rose, resonating with the "red envelope" resonance of financial data in January, reflecting investors' pricing of China's fundamentals repair. However, overseas market asset prices during the Spring Festival holiday cannot be completely "copied." From the three clues reflected in the prices of major asset classes—inflation, technology, and expectations of China's asset repair—our recommendations are as follows: First, prioritize resource chains with physical attributes: oil, coal, copper, shipping, aluminum, gold. From a dividend perspective, the cost-effectiveness of cyclical dividends is currently better than that of traditional stable dividend assets. Second, the Shanghai and Shenzhen 300, as a broad Chinese asset, can be actively positioned. The bottom of the large-cap growth style may have appeared (for example, in the CSI index and large-cap stocks in the Ning portfolio). Considering the policy-end demand for state-owned enterprise market value management, we recommend industries with low valuations and high proportions of state-owned enterprise market value: banks and non-bank financial institutions. Third, stable dividends still have long-term allocation value: including public utilities with monopoly operating characteristics (electricity, water affairs, gas) and transportation (roads, ports). Global capital market weekly report: We are raising our year-end target for the S&P 500 Index from 5100 points to 5200 points, a 4% increase from the current level. The increase in profit forecasts is the driving factor behind this revision. We are raising our 2024 EPS forecast to $241 (an 8% increase), higher than the median of $235 (a 6% increase) forecast by top-down strategists, reflecting our stronger economic growth and higher profit expectations for the information technology and communications services industries, including 5 of the 'Fabulous Seven' stocks. We expect the P/E valuations multiples of the equally weighted S&P 500 Index (16x) and the market cap weighted index (20x) to stay near current levels, making earnings growth the primary driver for this year's uptrend. $NVIDIA (NVDA.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more 3

3