Is $AMD Positioned to Disrupt the AI Landscape -- or Be Left Behind?

$Advanced Micro Devices (AMD.US)$ stands at a fascinating crossroads -- a company making substantial strides while contending with the monolithic presence of $NVIDIA (NVDA.US)$ , a juggernaut that dominates the AI and data center landscapes. NVIDIA’s grip on the industry isn’t merely a matter of hardware -- it’s the strength of an ecosystem so seamlessly interwoven it feels almost unassailable.

CUDA, NVIDIA’s cornerstone, isn’t just software -- it’s a fortress. Coupled with HGX supercomputers and cutting-edge AI tools like NeMo, it forges a self-reinforcing cycle that locks in customers and tightens NVIDIA’s stranglehold. Switching providers? Nearly unthinkable. And yet, here’s AMD, defying the odds, pushing forward.

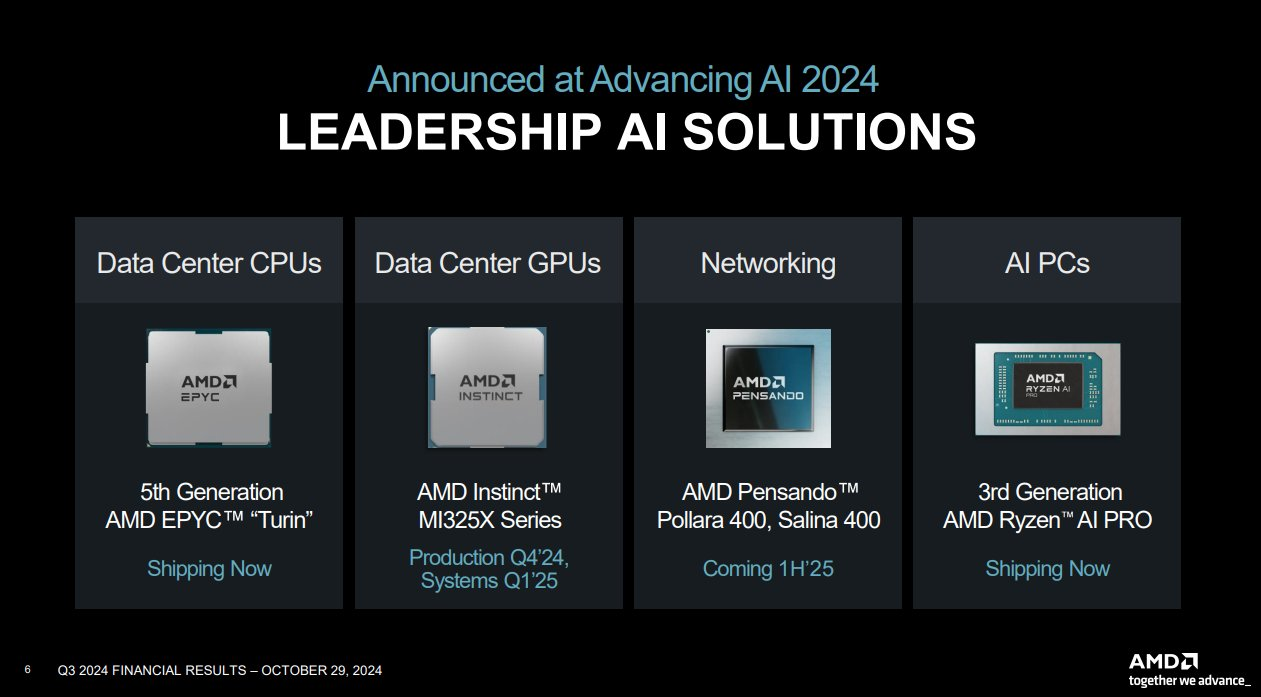

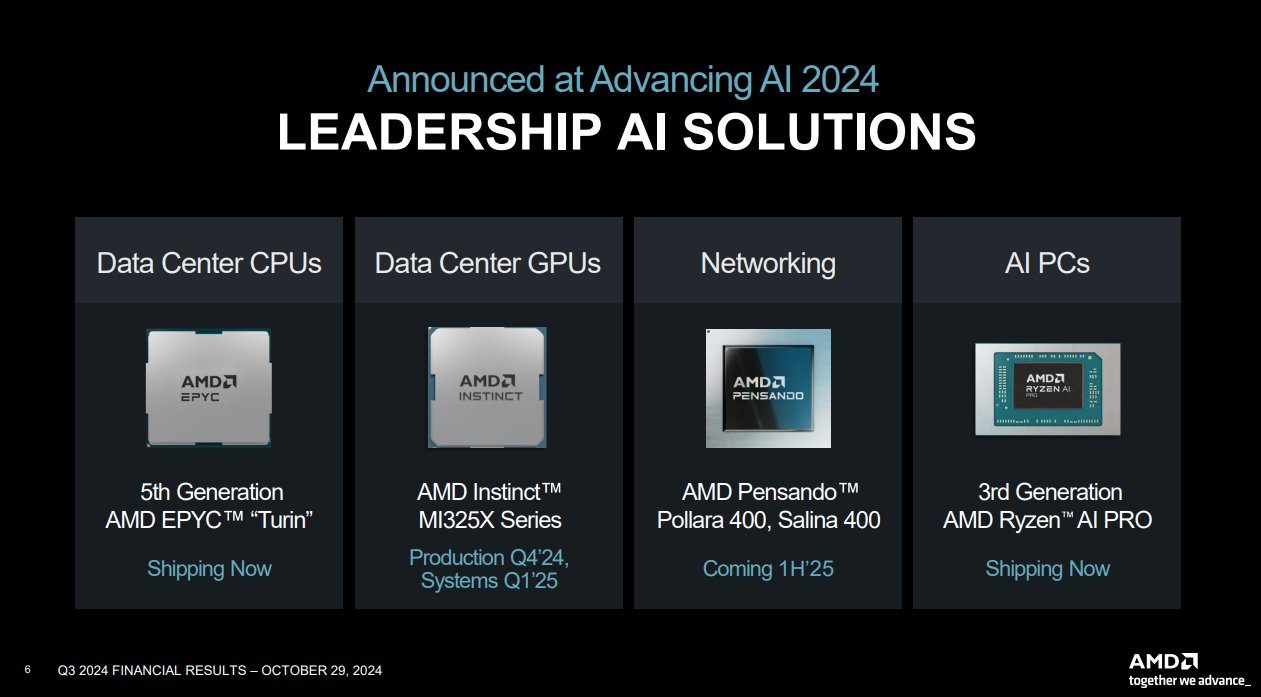

Dismissing AMD as a mere follower would be shortsighted. The company has made bold, attention-grabbing moves, increasing its 2024 data center GPU revenue projection to $5B. This isn’t theoretical optimism— -- AMD is landing serious deals. Partnerships with heavyweights like $Meta Platforms (META.US)$ showcase the real-world adoption of its EPYC CPUs and MI300X GPUs for AI workloads. Financially, AMD is no slouch. With gross margins of 54% and a 34% YoY rise in Q3 operating income, the numbers speak to a company that’s not just surviving but thriving. Its roadmap is no less impressive, with the MI325X accelerator slated for early 2025 and the MI350 series promising exponential leaps in performance by late 2025.

Still, AMD faces a monumental challenge. NVIDIA’s dominance isn’t static -- it evolves, continuously extending the lifecycle of its GPUs and reinforcing its already staggering network effect. AMD is chipping away at this lead with innovative approaches, particularly its ROCm software stack and chiplet architecture. These solutions are cost-effective, scalable, and tailored to meet the escalating demands of AI workloads. Yet, the gap remains wide, and the climb is steep.

From a valuation perspective, however, AMD becomes harder to ignore. A forward PEG ratio below 1.0 and an expected EPS growth of 45% over the next 3-5 years paint the picture of a company underestimated by the market. AMD’s chiplet technology, which combines performance, efficiency, and cost advantages, uniquely positions it to handle the massive computational loads of AI training and inference. This flexibility is opening doors into custom silicon solutions -- broadening AMD’s addressable market beyond merchant GPUs and into bespoke ASICs.

The backdrop for all of this is an AI accelerator market primed for explosive growth. With a CAGR of 60%, the market is forecasted to reach $500B by 2028. While NVIDIA’s supremacy is unlikely to waver significantly, AMD is carving out a share in this vast and rapidly expanding sector. Its partnerships with hyperscalers like $Microsoft (MSFT.US)$ , $Alphabet-A (GOOGL.US)$ , and $Amazon (AMZN.US)$ -- expected to collectively spend $200B in CapEx on AI infrastructure in 2024 -- underline AMD’s growing relevance in the space.

Momentum is building, especially in AMD’s data center business, which has undergone a transformation. In Q3, data center revenue surged by an astounding 122% YoY, making up 52% of the company’s total revenue. High-profile wins, such as Meta’s deployment of MI300X accelerators for its Llama 3.1 workloads and Microsoft’s integration of the same GPUs into its Copilot services, validate AMD’s AI strategy. With production of the MI325X ramping up and the MI350 series on the horizon -- AMD is positioning itself for sustained growth. As the AI accelerator market continues to expand, AMD’s story isn’t about dethroning NVIDIA -- it’s about cementing its place in a rapidly emerging duopoly.

I’m intrigued by AMD’s progress and see it as a company worth watching closely. However, for now, I remain in wait-and-see mode, monitoring how its execution and innovation unfold in the face of NVIDIA’s dominance. AMD is showing promise, but for me to commit further, I need to see more.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment