This price has acted as both resistance and support in the recent past. It could possibly act as support again. Last week, the $25.50 price held up the index as a strong support level. If the price can climb out of the short-term price channel I've highlighted, then a bullish swing trade might be warranted. Personally, I would make it a short-term swing trade because the technical and macro picture just look so grim.

Gilley : Americas market is looking more fake then any other markets seem svsmmy as all hell righ t now its something that looks purely set up and controlled

SpyderCall OP Gilley : Yup. it always looks like that it seems. The market is very irrational. That is why I just swing trade trade the trends.

BirzeArt1 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

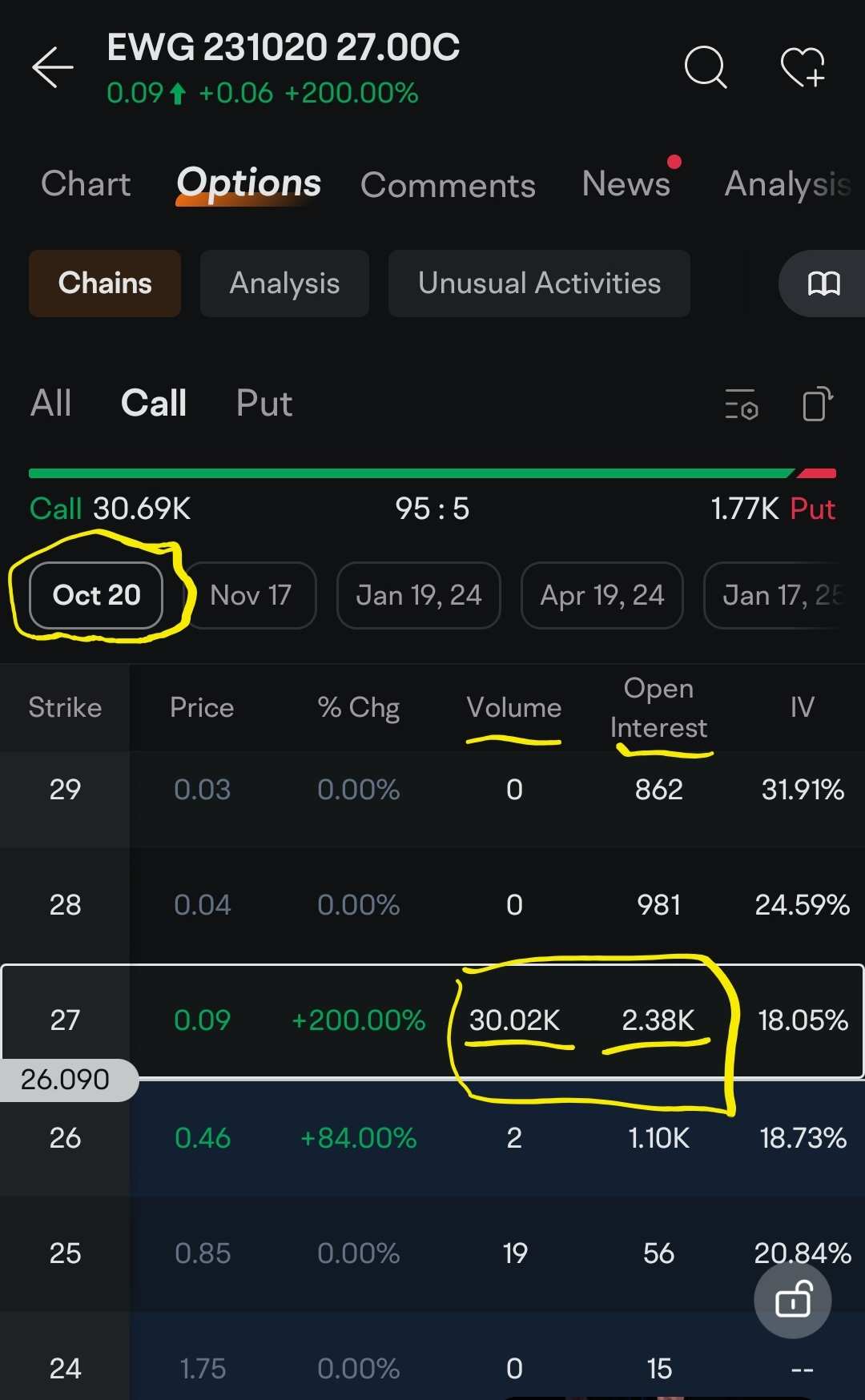

SpyderCall OP Gilley : Whoever bought those options contracts made big money this week.

AkLi : Hard to tell right now. Germany in a recession (before most others if they do go into recession), conflict close by both political and environmental, the energy crisis mentioned yesterday per bloomberg. Might need to see how the rest of the world goes Q1 and Q2 next year maybe

SpyderCall OP AkLi : Agreed. I'm still waiting.

md lukman rahi : Hai