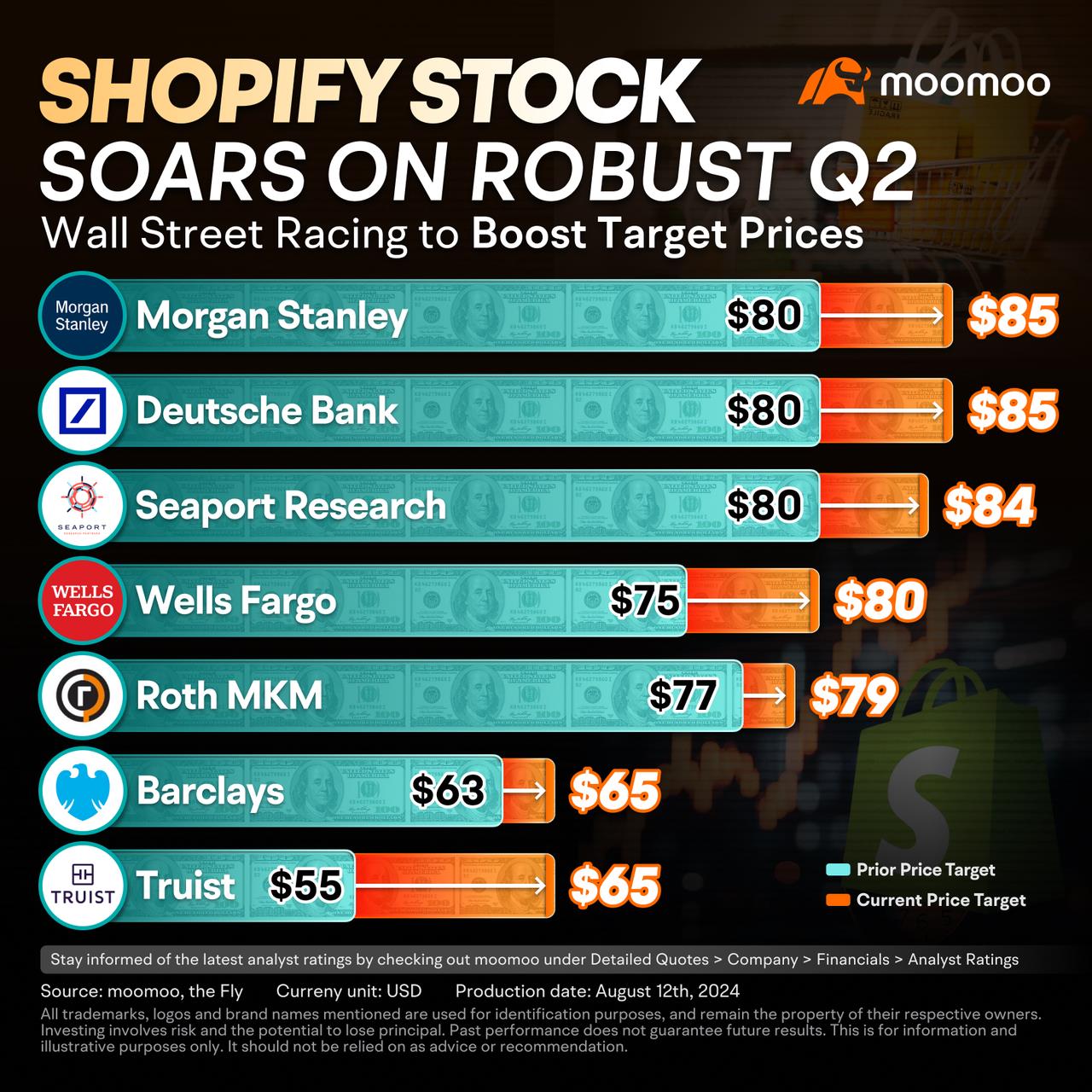

Truist analyst made a more modest increase in their price target, from $55 to $65, while maintaining a Hold rating. They recognized Shopify's strong execution in Q2, which exceeded estimates for revenue, Gross Merchandise Volume (GMV), profit, and cash flow. The analyst's outlook improved for both the top and bottom line following the Q2 report. The increased target price reflects a more positive stance on Shopify's capacity for sustainable growth in the 20% range and consistent profit growth. However, Truist maintains a Hold rating, indicating a cautiously optimistic view of the stock, particularly after the significant intraday gain that followed the earnings report.

Laine Ford : no comment

Isaiah Mosley : r $Virgin Galactic (SPCE.US)$