NVDA

NVIDIA

-- 105.440 TSLA

Tesla

-- 252.570 PLTR

Palantir

-- 83.371 AMZN

Amazon

-- 188.220 GOOG

Alphabet-C

-- 155.405

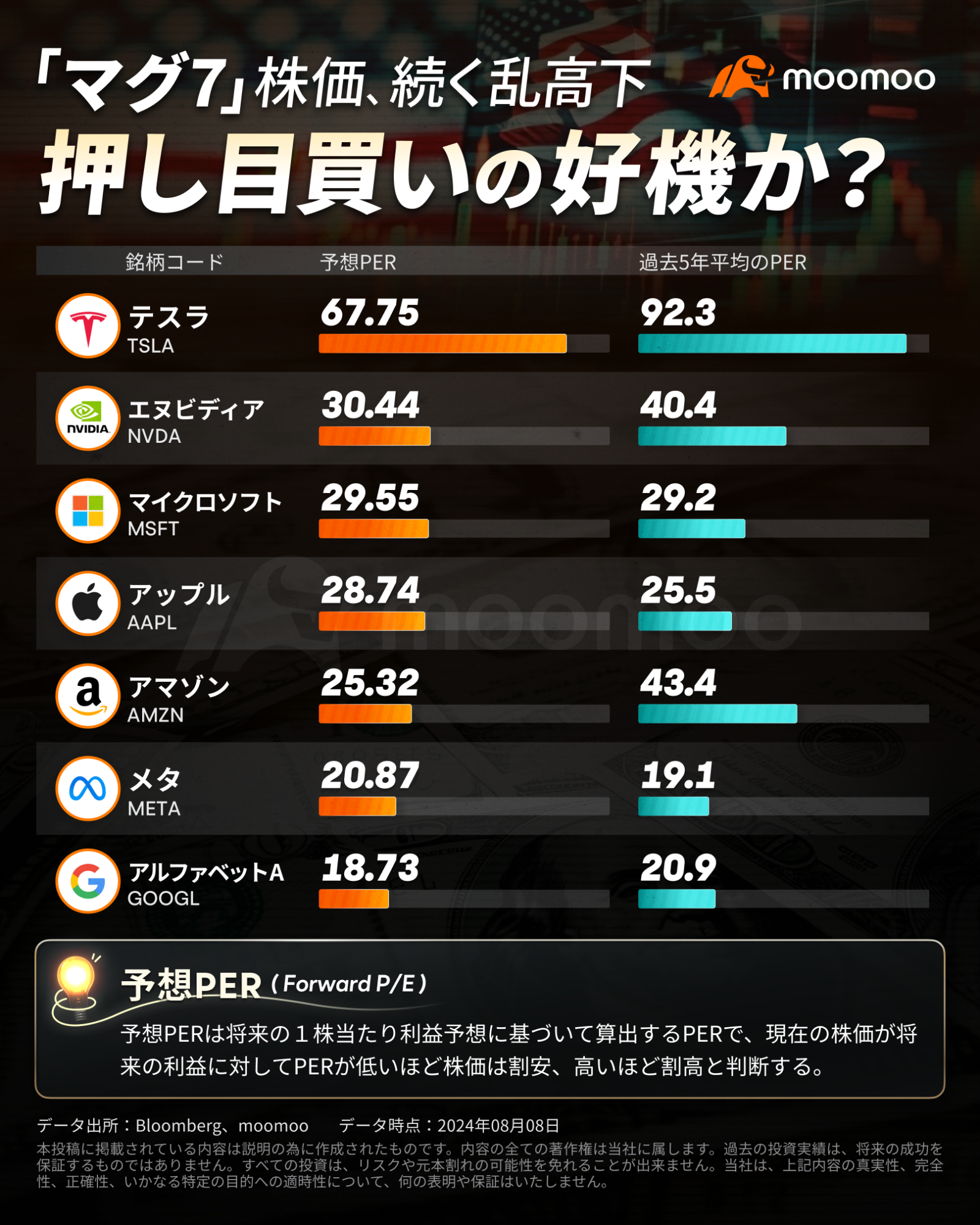

On the 7th, Man Group, the world's largest listed hedge fund management company, stated that the evaluation of 'MAG 7' is not 'too high' and it would be relatively reasonable to achieve a justifiable return.

Investment analyst AJ Bell, Mr. Dan Coatsworth pointed out that the expectations for the so-called 'US Mega 7' may have been too high.

182076928鬼平 : Saying it's going down means shopping

Thank you very much

182076928鬼平 : I want to see reviews from other analysts

182076928鬼平 : The situation in the Middle East became chaotic due to the assassination of top Hamas executives, and it should be calculated that another crash is possible!

Toshi03 : This is just my personal impression, but I think the M7 was expected too much. I think M7 companies will continue to increase their performance in the future, but I feel that stock prices will not rise.