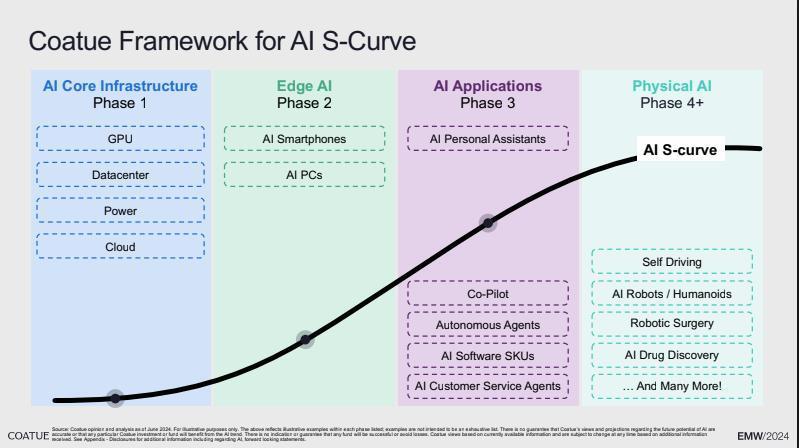

Challenges extend beyond valuations. Growth in cloud giants' capital expenditure is slowing, and NVIDIA's demand for chips is stabilizing, suggesting that infrastructure development may be reaching maturity. Although NVIDIA continues to benefit from robust GPU demand, analysts caution that the growth of cloud investment may not sustain its current pace. Meanwhile, enthusiasm for generative AI appears to be cooling. For instance, companies' mentions of AI in earnings reports have leveled off, signaling a more cautious and rational market sentiment.