It's Official... We're Bullish

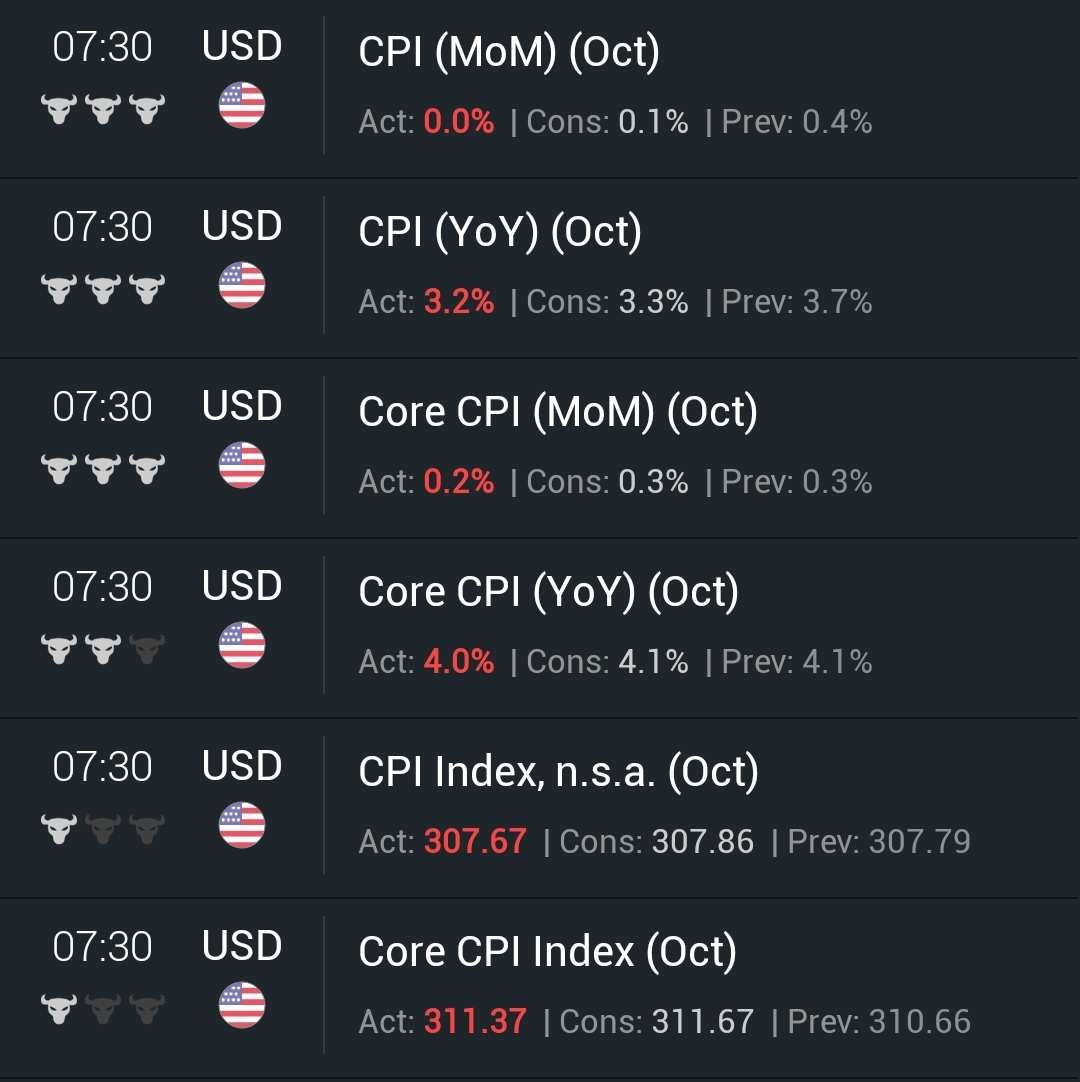

CPI Data Pushes Equity Investors Into a Buying Frenzy

The CPI reading was the final push the market needed to fall back into a bull market. Yields are tanking with the dollar. This is bullish for equities in the "bad news is good news environment," equities are ripping, and gold is tagging along. I think it is safe to say that things are looking very bullish. Short premiums are crushed across the board.

I believe that most of the market was expecting this suppressed CPI data. With the very poor leading economic data from October and the drastically falling oil prices, this could have been predicted.

Yields are Tanking

Yields are way down. The suppressed CPI reading shows that the economy is contracting, and the Federal Reserve has no need to increase interest rates any further. So the market is buying up treasuries like crazy today.

I called out treasury bonds as an investment opportunity a couple of weeks ago. Bonds have been way up since then. Like I already mentioned, I think it is still a good time to scoop up some treasury ETFs. I'm in $iShares 20+ Year Treasury Bond ETF (TLT.US)$ and $Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF.US)$

Will the Open Market Push Financial Conditions Into Accomidative Territory?

One thought that still remains in the back of my head is what will happen if yields naturally move out of restrictive territory? I'm curious to see how the Fed will respond if the open market pushes financial conditions into accommodative territory. Will the Fed feel the need to hike rates at that point?

If the economy is still contracting, then there is less likelihood of this happening. But if the economy is showing signs of strong growth, then the Fed might put the bull market on hold again.

Will Uninversion Signal a Recession?

Another aspect of yields to watch is the moment the yield curve is uninverted. In past recessions, the recession did not start until yields were actually uninverted. That is another thought to keep in the back of your mind.

Is the Dollar Rally Over

The dollar took a nosedive with yields. The lower borrowing cost stemming from lower yields decreases demand for US dollars. This is bringing the dollar down.

Many of those dollar bulls that have been riding the dollar rally are likely yield hunting as they sell the dollar in search of other profiting assets. I think they would be buying treasury bond's, gold, or equities. And in that order.

It is Finally Golds Time To Shine

Gold traders are catching a sight of relief after gold's recent sellof. The inverse correlation between the dollar and gold is back in play. Coupled with the geopolitical tensions across the world, gold should rip if the dollar is tanking.

As long as the dollar is falling, I can see gold continue to climb. Even near all-time highs, I think it is safe to grab some gold to hold.

Easy Trading in Forex Markets Today

The falling dollar is pushing up other currencies across the world. Forex traders are making easy money today. I can see this trend lasting a while.

Technically Speaking, Equities are Back in a Bull Market

VIX down, SPY up. Equities are officially back in a technical bull market. There is strong buying all across the board. With massive buybacks still in the works and many of the big name companies producing strong earnings reports during the current economic contraction, I think it is safe to say that some equities are a good buy at this point.

An important aspect of the current rally is the fact that we can see a large bredth of participation throughout most of the market. Including mid, small, and micro cap equity stock. You can see this in the IWM, IJH, and IWC ETFs.

The equal weighted equity index, EQL, has been climbing with the major indices. The only true equal weighted equity index for large cap companies, GSEW, is also participating in the rally.

All of this is an indication that most of the market is climbing with the major indices. $Alps Equal Sector Weight Etf (EQL.US)$ $Goldman Sachs Equal Weight U.S. Large Cap Equity Etf (GSEW.US)$

So, have any of you bears flipped to bullish over the past couple of weeks?

As always, I am not a financial professional, and this is not investment advice. Be careful and be patient. Dont anticipate the market. Rather, participate in the market. Don't invest money that you can't afford to lose. Give some of your investments time and know when to cut your losses.

Don't be greedy. Don't invest in anything you don't understand. Don't put all of your eggs in one basket. Don't listen to the hype. Don't fomo or panic into or out of trades. Do your own due diligence. And just follow the trends. A trend is your friend. Good luck trading.

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $iShares Russell 2000 ETF (IWM.US)$ $iShares MSCI Emerging Markets ETF (EEM.US)$ $E-mini S&P 500 Futures(DEC4) (ESmain.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $E-mini Dow Futures(DEC4) (YMmain.US)$ $VIX Index Futures(DEC4) (VXmain.US)$ $Crude Oil Futures(JAN5) (CLmain.US)$ $FTSE Bursa Malaysia Mid 70 Index (.FBM70.MY)$ $FTSE Bursa Malaysia Top 100 Index (.FBM100.MY)$ $Hang Seng Index (800000.HK)$ $Hang Seng TECH Index (800700.HK)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

razo2 : I think better keep eyes on data. Friday MM will not want to pay out the bulls.

SpyderCall OP razo2 : Of course those tricky MMs don't want to pay anybody. Especially on mid month expirations. Usually there is a little volatility around those expiration dates.

It is possible we might see a bit more volatility today, Wednesday, or Friday. Wednesday is the official monthly expiration but sometimes the rollover can happen before or after, like on a Friday.

But it is a possibility that investors might have already rotated their contracts. After a crazy rally like we have seen, it makes me think a lot of capital has already moved around. So then the volatility might be just like any normal day.

102905741 : stok data in market

102905741 : stok data in market..