Global Impact: Globally, these tech stocks' combined weighting in the MSCI All Country World Index surpasses the total stocks of Japan, France, China, and the U.K., underlining their global influence.

Market Concentration Risks: Concentration in a few stocks raises concerns about market resilience, especially if a downturn occurs and these heavyweight stocks decline.

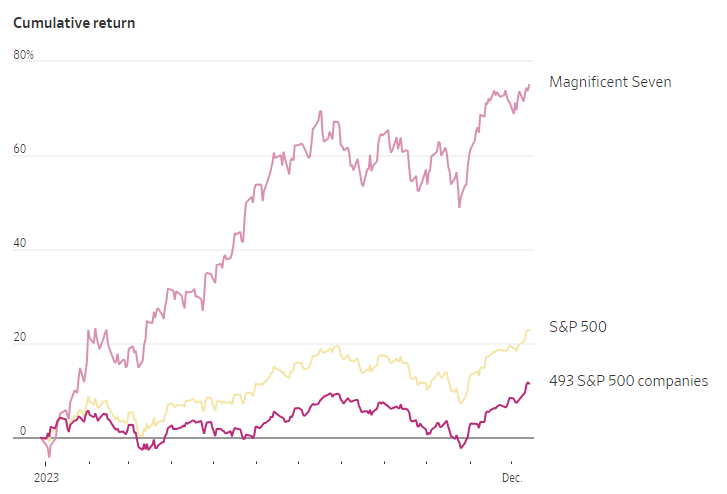

Tech Stocks Resurgence: In 2022, big tech stocks faced a decline of 40%, losing $4.7 trillion in combined market value. However, in 2023, they staged a strong comeback, driven by AI optimism and economic data suggesting easing inflation and peaking interest rates.

Earnings Growth Contribution: The Magnificent Seven not only led in stock performance but also contributed significantly to the market’s overall earnings growth. Without them, S&P 500 earnings would be on track to fall by 4%.

Blockbuster Gains: Microsoft, Apple, and Nvidia experienced substantial gains in 2023 due to AI optimism, strong economic data, and easing inflation.

Market Dynamics: While the S&P 500 is near its 2022 record, only 23% of its stocks are within 10% of their record highs, suggesting a lack of broad-based market strength.