NVDA

NVIDIA

-- 110.570 AVGO

Broadcom

-- 179.450 TSLA

Tesla

-- 263.450 PLTR

Palantir

-- 80.460 MRVL

Marvell Technology

-- 72.280

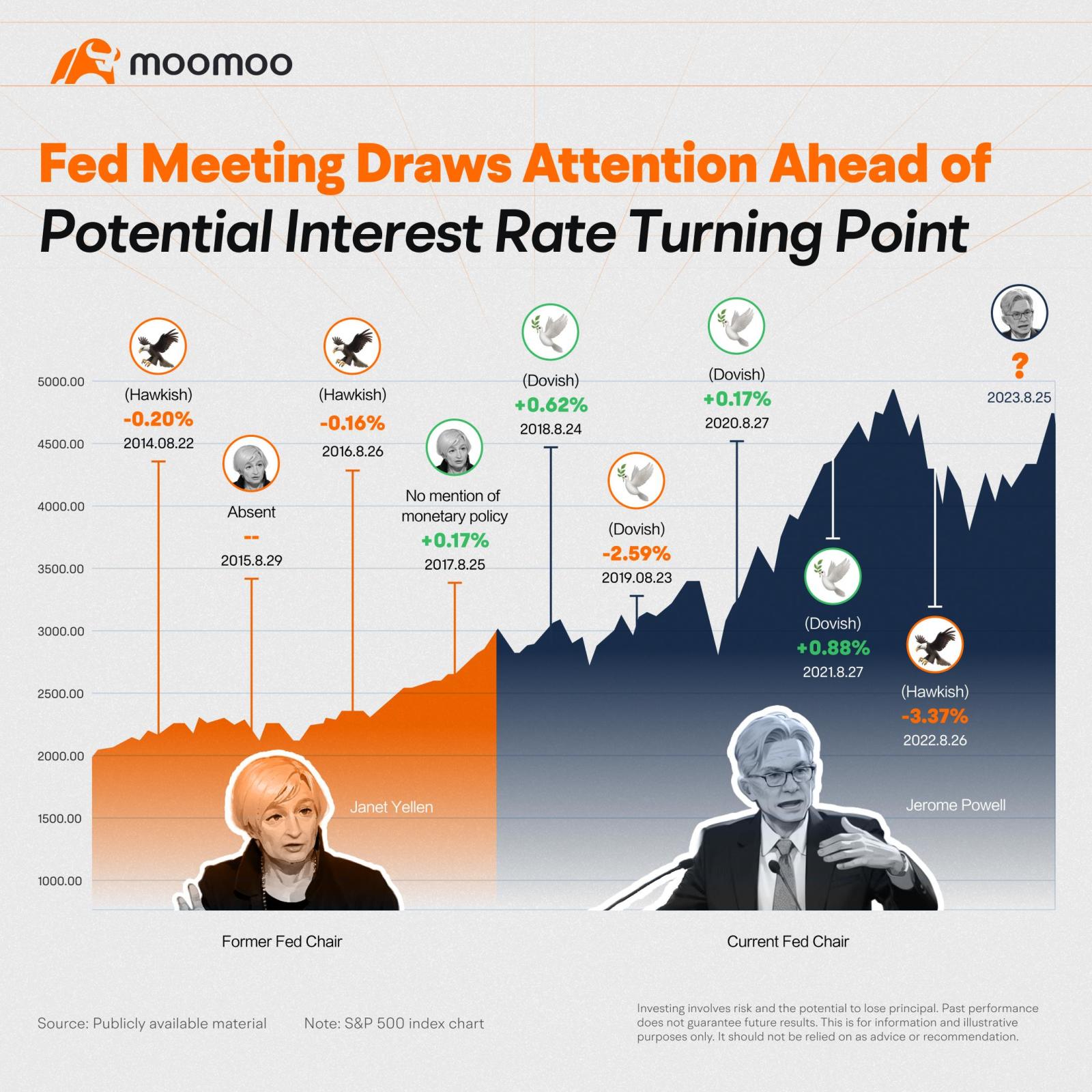

"The Fed will likely wait to be informed by these new data before changing their current posture."

“We expect Powell to strike a more balanced tone in Wyoming, hinting at the tightening cycle’s end while underscoring the need to hold interest rates higher for longer.”

"While the Fed would prefer not to short-circuit the business cycle, policymakers are probably becoming increasingly concerned about a re-acceleration in inflation, driven by strong aggregate demand. Therefore, we expect Powell to push back— implicitly or explicitly— against the degree of rate cuts that markets are pricing for next year."

ごにょにょ : Easy to understand _φ( ・_・

Teresa Lord Guide Me : Unbelievable how everything is controlled

70185181 : Laughter at the Fed playing with retail investors around the world.

lightfoot : Raising rates to control inflation is stopping growth and had no effect on inflation. The market is crazy. Fundamentals are useless. I am still predicting a CRASH this year

Mike Obama : the x factor is the new strain of covid and lockdowns. also an election year is coming.