James Hardie Industries: Slumping Housing Market Prompts Cautious Outlook

Company Overview

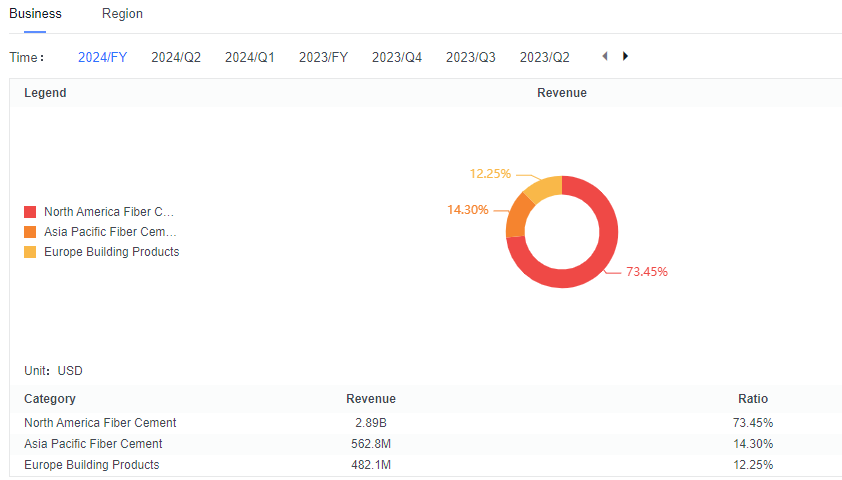

$James Hardie Industries PLC (JHX.AU)$ is a global leader in the manufacturing of high-performance fiber cement and fiber gypsum building materials, holding a dominant position particularly in the North American market. Since its establishment in 1888, the company has focused on providing durable and design-flexible building solutions, widely used in residential exteriors, fencing, and other structures, continuously driving innovation and progress in the construction industry. The majority of its revenue, approximately 73%, comes from the North American region. The remaining revenue is derived from Australia, New Zealand, the Philippines, and Europe.

Operational Results and Guidance

1.Recent Performance Below Expectations

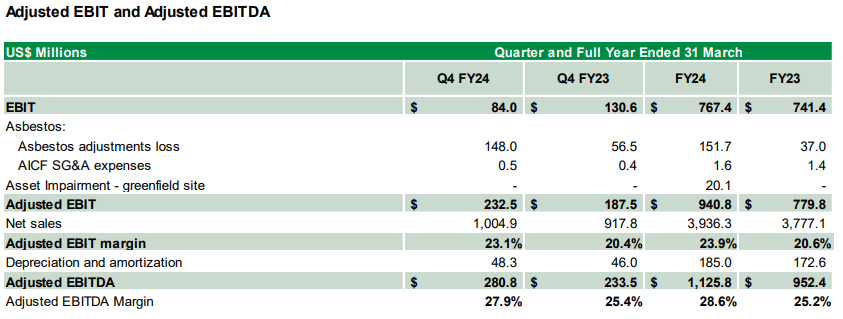

James Hardie Industries reported global net sales of $1.005 billion for the fourth quarter of FY24 (ending March 31), representing a 9% increase compared to the same period last year. Adjusted earnings per share (EPS) were $0.40, with growth primarily driven by increased sales volumes and higher average selling prices in the North American, Asia-Pacific, and European markets. Both revenue and profit fell short of market expectations of $1.009 billion in revenue and an EPS of $0.42.

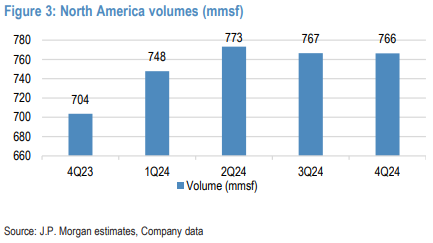

2.Uncertain U.S. Housing Market Outlook, Delayed Rate Cuts Worsen Prospects

The company's outlook is weaker than expected, primarily due to anticipated declines in sales volumes in the North American region. For the first quarter of FY2025, the group projects NPAT (Net Profit After Tax) to be between $155 million and $175 million, with sales volumes expected to range between 745 million and 775 million square feet, and an EBIT margin estimated at 30%-32%. In comparison, JPMorgan had previously estimated an NPAT of $175 million, sales volumes of 803 million square feet, and an EBIT margin of 30%.

The impact of high interest rates on the real estate market is multifaceted. Rising interest rates directly lead to higher mortgage interest costs, increasing the total payment amount for homebuyers. This weakens their purchasing power, reduces their willingness to buy, or forces them to seek cheaper properties. Due to the increased cost of loans, some potential homebuyers may postpone their purchasing plans and opt for renting or other forms of housing arrangements instead, leading to a decrease in real estate market demand. The reduced demand further affects the speed and volume of home sales.

Since the earnings release in February, expectations for interest rate cuts have been repeatedly delayed. Although rate cuts are still expected to provide a boost to the market in the second half of the year, the outlook for growth has become more conservative based on the current situation, leading to an overall pessimistic sales forecast.

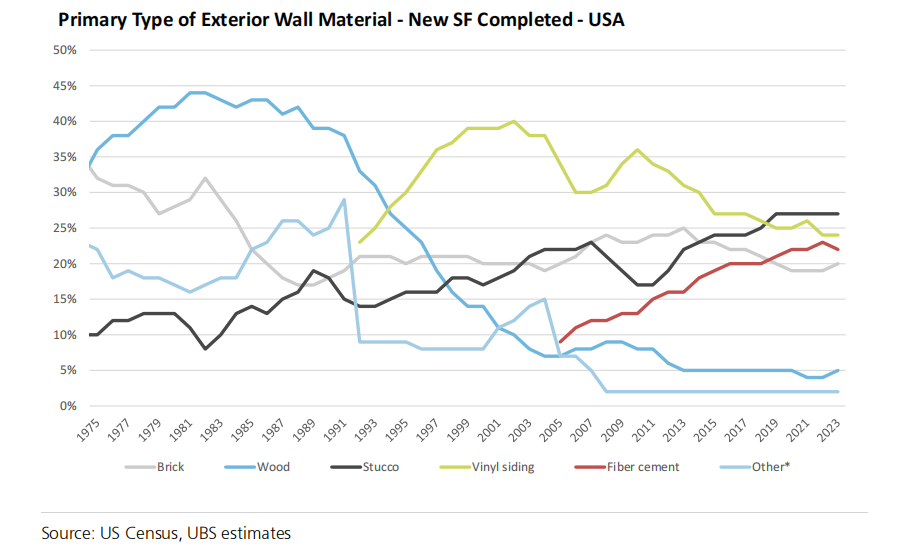

3.Increased Competition, Declining Market Share for Fiber Cement Materials

The latest census data shows that the market share of fiber cement materials in U.S. single-family homes (SF) has decreased from 23% to 22%, marking the first decline on record. This is primarily due to the growing demand for brick in the southern region, where brick holds a dominant market share of 31% and has seen year-over-year growth, eroding the share of fiber cement. Brick remains the clear preference in the southern region and continues to gain market share in both the total number of completed homes and homes sold.

Summary Investment Thesis

The company's stock price has dropped over 13% since the earnings report was released on May 21 and continues to fluctuate at low levels. In the short term, given the pessimistic market conditions, it appears unlikely that there will be sufficient upward momentum. Additionally, the company has no plans for dividends in the near future, providing little support in terms of shareholder returns.

Although from a medium to long-term perspective, the company has the potential to achieve profit growth with the recovery of the U.S. real estate market, it faces several challenges in the short term. These include weaker-than-expected performance of the U.S. housing market, a decline in the overall market share of fiber cement materials, and rising key raw material costs. Investors should remain cautious.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment