Jensen Huang's Billion-Dollar Cash-Out: The Delicate Balance Between Stock Price and Trust

1. Concerns Behind the Soaring Stock Price

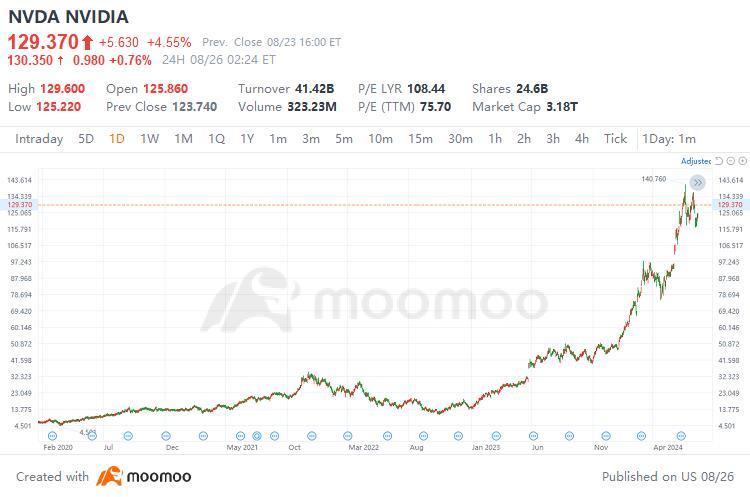

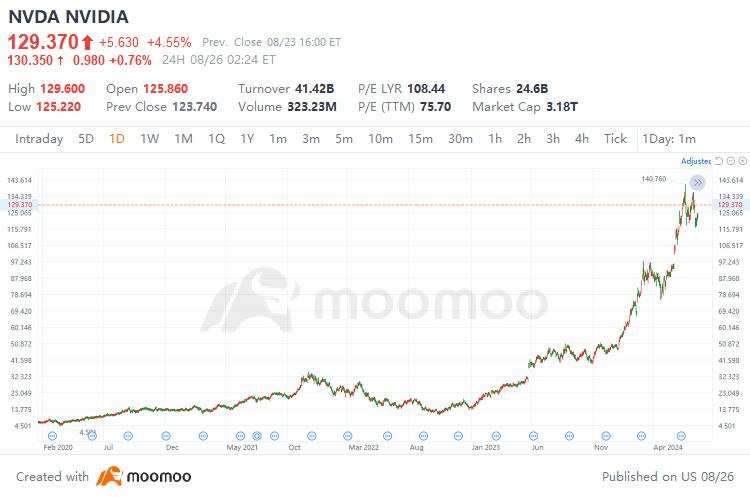

Five years ago, Jensen Huang's net worth was $3.73 billion. With Nvidia's stock price surging in recent years, especially since the beginning of this year, the CEO's net worth has approached $92 billion. Behind this numerical leap lies a staggering rise in stock price and the ensuing scrutiny.

Five years ago, Jensen Huang's net worth was $3.73 billion. With Nvidia's stock price surging in recent years, especially since the beginning of this year, the CEO's net worth has approached $92 billion. Behind this numerical leap lies a staggering rise in stock price and the ensuing scrutiny.

2. The Delicate Relationship Between Stock Price and Cash-Out

The market's enthusiasm for Nvidia partly stems from optimism about its technological prospects. However, Huang has been cashing out almost daily, selling about $14 million worth of stock per day. This behavior raises questions: Why choose to sell now rather than hold for the long term? Is this selling indicative of a lack of confidence in the company's future, or is it a reassessment of personal asset allocation?

The market's enthusiasm for Nvidia partly stems from optimism about its technological prospects. However, Huang has been cashing out almost daily, selling about $14 million worth of stock per day. This behavior raises questions: Why choose to sell now rather than hold for the long term? Is this selling indicative of a lack of confidence in the company's future, or is it a reassessment of personal asset allocation?

3. Rule 10b5-1: The Art and Strategy of Cashing Out

Huang sells his shares under a Rule 10b5-1 plan, which allows executives to trade according to a predetermined schedule, thus avoiding insider trading risks. Nonetheless, choosing to sell after a significant stock price increase inevitably stirs market unease and skepticism. Market governance expert Nell Minow bluntly stated that executives should demonstrate confidence in their company's stock rather than rush to cash out.

Huang sells his shares under a Rule 10b5-1 plan, which allows executives to trade according to a predetermined schedule, thus avoiding insider trading risks. Nonetheless, choosing to sell after a significant stock price increase inevitably stirs market unease and skepticism. Market governance expert Nell Minow bluntly stated that executives should demonstrate confidence in their company's stock rather than rush to cash out.

4. Nvidia's Future and Market Reaction

Overall, Huang's ongoing cash-outs present a dual challenge to Nvidia's stock price and market confidence. The company needs to showcase its long-term value and growth potential to investors while also reviewing and adjusting its internal governance and executive incentive mechanisms to address market concerns.

Overall, Huang's ongoing cash-outs present a dual challenge to Nvidia's stock price and market confidence. The company needs to showcase its long-term value and growth potential to investors while also reviewing and adjusting its internal governance and executive incentive mechanisms to address market concerns.

Amid Nvidia's stock price fluctuations, we observe the market's complex emotions regarding the future of tech giants. Huang's cash-out behavior may just be a part of personal asset allocation, but its deeper implications are worth pondering for every investor. After all, in the capital markets, confidence is often more precious than gold.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Simon 5183 : Has it been soaring in recent years? It has undergone 6 stock splits because the stock price was too high, which shows that it has always been in a soaring state!

Daring Lu Simon 5183 : Let crash.

Simon 5183 Daring Lu : Which institutions have the financial capability to short NVDA? I'd like to hear about it. Even Soros doesn't have that kind of clout!