Jobs Are Too Hot Market Flatter, Eyes on Kitty | Herd on Wall Street

Morning mooers! It is Friday, June 7th, the market is lower after jobs data came in too high from the month of May.

My name is Kevin Travers, here are stories from the herd on Wall Street today.

Videogame retailer$GameStop fell 20% in early trading Friday after the firm reported a first-quarter loss of 12 cents a share on revenue of $881.8 million Friday morning. Investors are waiting for a livestream from Keith Gill, also known as investor Roaring Kitty, is scheduled to go live on Friday at noon ET on YouTube. The company also announced it would sell an additional 75M of shares today. I'll be watching on the moomoo community where you can find a stream.

$Vail Resorts fell 13% after a bad skiing season, hotter temperatures and worse snow hurt the ski companies bottom line in its quarterly results.

The highest gainers and decliners on the indexes were not moving more than 5% Friday morning. The highest on the S&P was$Air Products & Chemicals, an energy company that signed a deal to supply Europe with 70,000 tons of Green Hydrogen in 2030.

The largest decliner on the S&P was$Gen Digital, down 5% after multiple analyst downgrades following a cut form Morgan Stanely overnight.

By industries tracked by moomoo, 'Digital Currency' frims climbed 2.8%, lead by$CleanSpark up 9%, and$Cipher Mining up 8%.

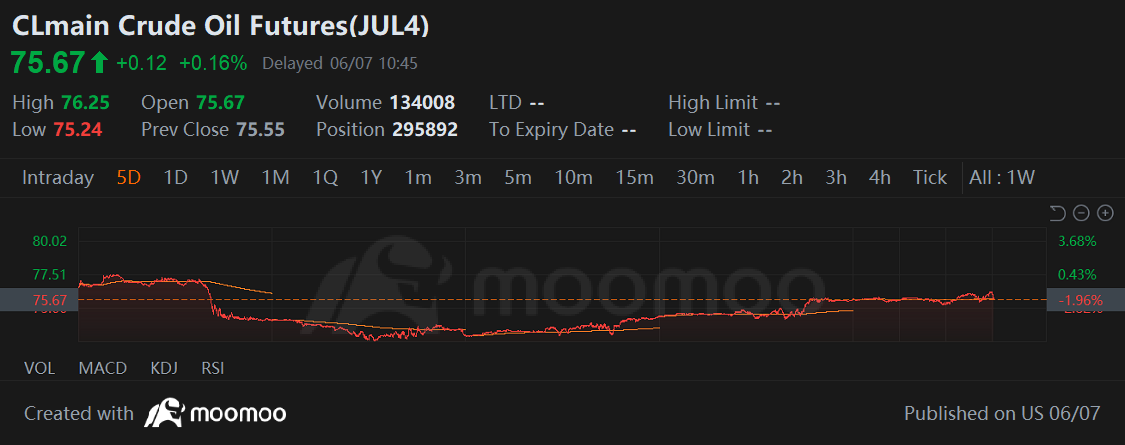

$Crude Oil Futures(JUL4) climbed back up 0.74%.

Gold and silver fell, with the Gold spot down 2% and silver falling more than 5% after strong employment numbers dashed hopes for rate cuts.

As a general recap, the market was in decline after hitting highs, and the indexes were climbing following Jobs data that was much higher than expected.

Just after 10:50 AM EST, the $S&P 500 Index jumped to +0.16%, the $Dow Jones Industrial Average climbed 0.31%, and the $Nasdaq Composite Index traded flat.

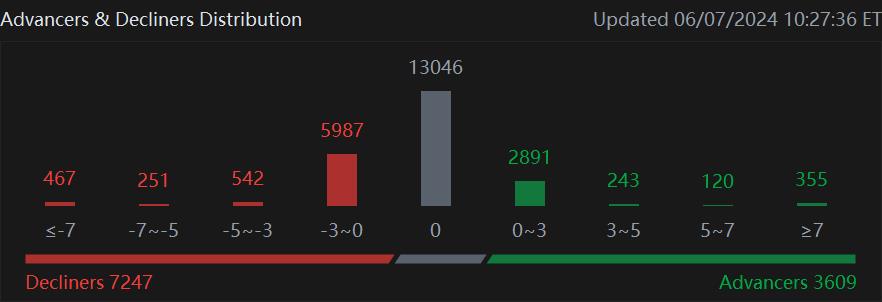

By direction, 3500 equities climbed, while 7200 fell.

In Macro, non-farm payroll data, the favorite of Fed rates and inflation watchers alike, came in higher than expected.

Total nonfarm U.S. jobs grew by 272,000 jobs in May, compared to 182K expected, according to the Labor Department reported on Friday. That's about 100k more than the economy added in April. The unemployment rate climbed to 4% for the first time in more than two years, over Aprils 3.9%.

Thursday, initial jobless-benefit claims climbed to a four-week high of 229,000 last week. Wednesday, ISM Non-Manufacturing PMI climbed higher. S&P PMI came out as expected. Sifting through this employment data, investors are looking for signs the job market will fall and push the Fed to lower interest rates.

The $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ was 4.84, and the $U.S. 10-Year Treasury Notes Yield was 4.42.

Yesterday, user Trtosaveabit said they were watching Chipotle, facing a 50-1 stock split

Mooers, what are you watching today? Comment below and I may feature your comment tomorrow!

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Stock_Drift :

Kevin Travers OP Stock_Drift : hahaha this is great

Stock_Drift Kevin Travers OP : He’s live on you tube right meow

Kevin Travers OP Stock_Drift : I’m watching on moomoo too!

Kevin Travers OP Stock_Drift : https://www.moomoo.com/live/2304092

UrMomsBoyfriend : Stock traded lower while he was on, seems to me like a boiler room!

70942084 : Terrible

Kevin Travers OP UrMomsBoyfriend : I felt the same thing, like it was a big specticle distraction of some sort, he did not say much on the stream

105370276 : hallo

Kevin Travers OP DeepFuckinValue : Original name