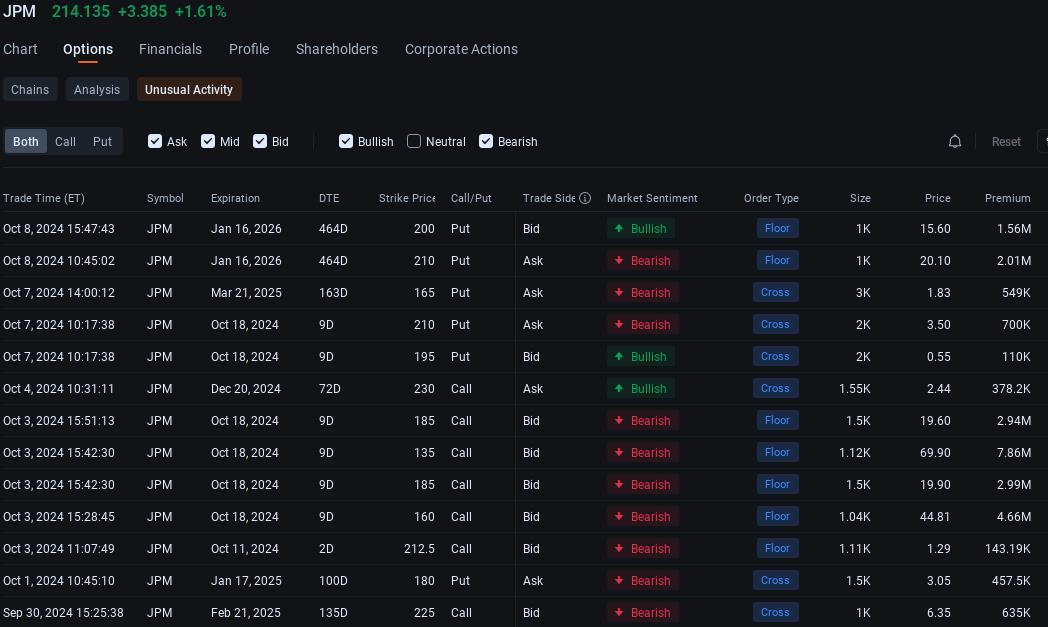

The transactions were posted just days before the investment bank is expected to post earnings. On average, the company is expected to report Friday that earnings for the third quarter fell 7% to $4.01 a share, from according to analyst estimates compiled by Bloomberg as of Wednesday morning.

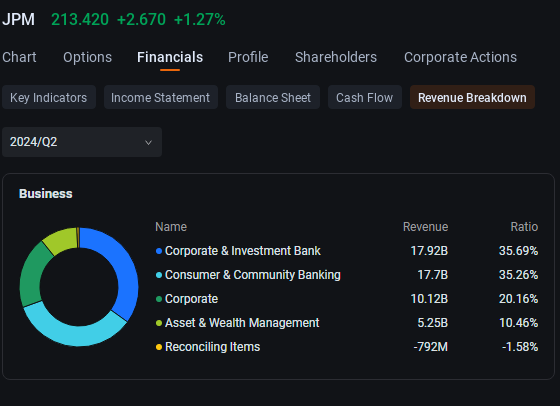

JPMorgan's full year net interest income may attract market attention after Chief Operating Officer Dan Pinto said in early September that Wall Street consensus of about $90 billion was too high, according to Bloomberg Intelligence analyst Ravi Chelluri. The bank's "net interest income views are core to its profit outlook for 2025," Chelluri wrote in a note dated Oct. 7.

72614465 : $Coinbase (COIN.US)$ $Coinbase (COIN.US)$ 5

TomatoData : .

Cypher : “…$4.01 a share, from according to analyst estimates…” I believe some information is missing between “from” and “according”.

@Luzi Ann Santos

Laine Ford : I like but no follow

Dan’l : Luzi Ann Santos is remarkably thorough, buUut… as for me? I’d still be guessing, in re $JPMorgan (JPM.US)$.

safri_moomoor : on