NVDA

NVIDIA

-- 107.424 TSLA

Tesla

-- 258.790 PLTR

Palantir

-- 84.010 AMZN

Amazon

-- 189.795 GOOG

Alphabet-C

-- 156.060

We have had multiple former Fed governors suggest that September is appropriate for a cut,” Tyler and his team wrote in a note to clients on Tuesday. “With this in mind, we remain tactically bullish, but with slightly less conviction.”

Clement Lemons : okkk

Loi73 :

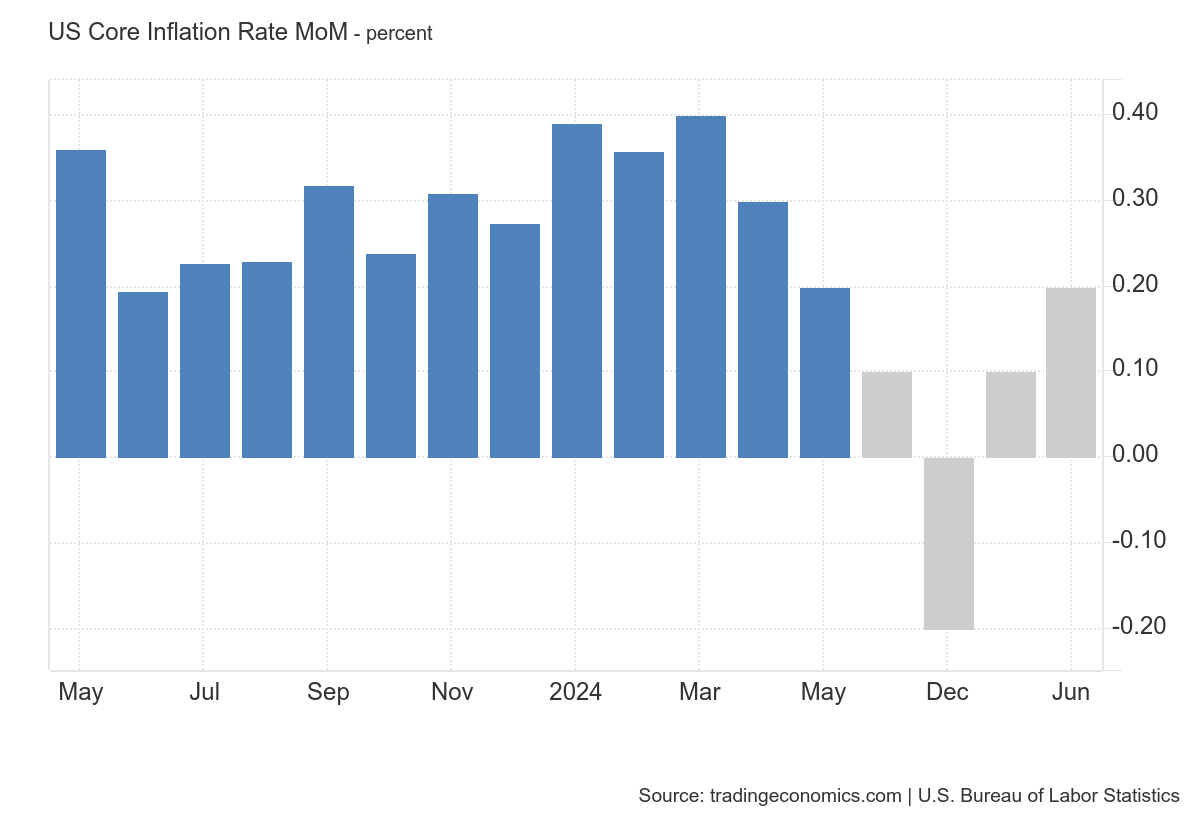

74664349 : The drop in CPI on May 15 and June 12 doesn't seem to have any effect on the stock market in the next day or two. Can Okami answer