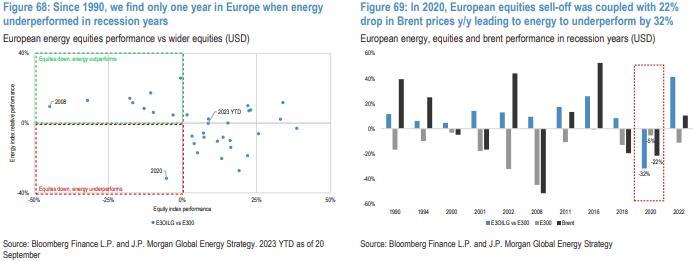

In addition, energy is a preferred sector relative to the broader equities market, should the recession viewpoint materialize. JP Morgan's recent study of energy indices' relative performance since 1990 shows that during "recession years," energy generally outperforms the more comprehensive equity index. For instance, in Europe, energy underperformed only once (-32%) out of 11 such years, while in the US, energy underperformed only three times (-1% in 1990, -23% in 2015, and -14% in 2018). Negative equities performance was often coupled with a sharp decline in Brent prices, except in 1990, where it wasn't the case.

Mikyahl : Biden caused oil to go from $30 a barrel to 100-130 a barrel when he stopped the pipe line flow between Canada