All contents such as comments and links posted or shared by users of the community are the opinion of the respective authors only and do not reflect the opinions, views, or positions of Moomoo Financial Inc., Moomoo Technologies, any affiliates, or any employees of MFI, MTI or its affiliates. Please consult with a qualified financial professional for your personal financial planning and tax situations.

Moo Options Explorer OP : Thanks for their sharing! @doctorpot1, @AkLi, @CasualInvestor, @Invest with 8268, @TnjAU, @sky9191, @Cow Moo-ney, @WolfRun, @Alvinnnnnnngenius, @DipHuntah_808![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

CasualInvestor :

Space Dust :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

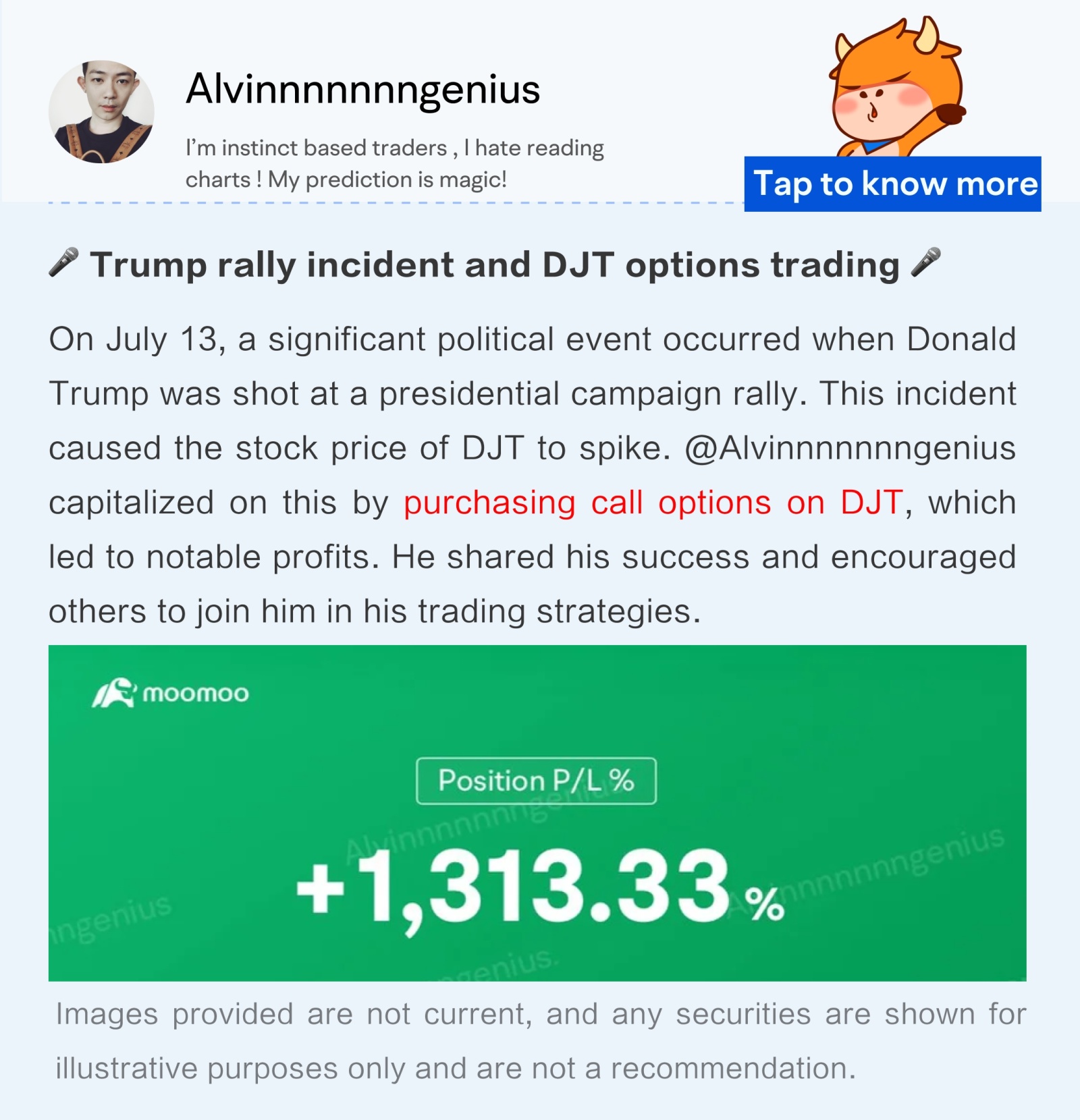

priority is to learn options, did I see over 1,000% gain..

priority is to learn options, did I see over 1,000% gain..

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

..

..

. Some could rapidly change their lives better than college debt.

. Some could rapidly change their lives better than college debt.

and instead of a degree

and instead of a degree  100k

100k

worth nothing since every schmoe

worth nothing since every schmoe ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) in every country is fighting

in every country is fighting ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) to stand in that line.

to stand in that line.

I wish this was taught in school

what if kids got student loan money

webguybob : right!

Laine Ford : hi

Laine Ford : like that stock here

squirrel in my pants : I have been buying call options for $Tesla (TSLA.US)$ and $NVIDIA (NVDA.US)$ recently, but every time I buy, the price drops, and every time I sell, the price rises. How can I be sure that I am buying in the right direction?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

溫馨提示 : Nvda and dell earnings next week (why talking tsla 2 Q lol )

xiaomitu : FOMO, HOLD, FMOC

葡萄山 : Market trends

View more comments...