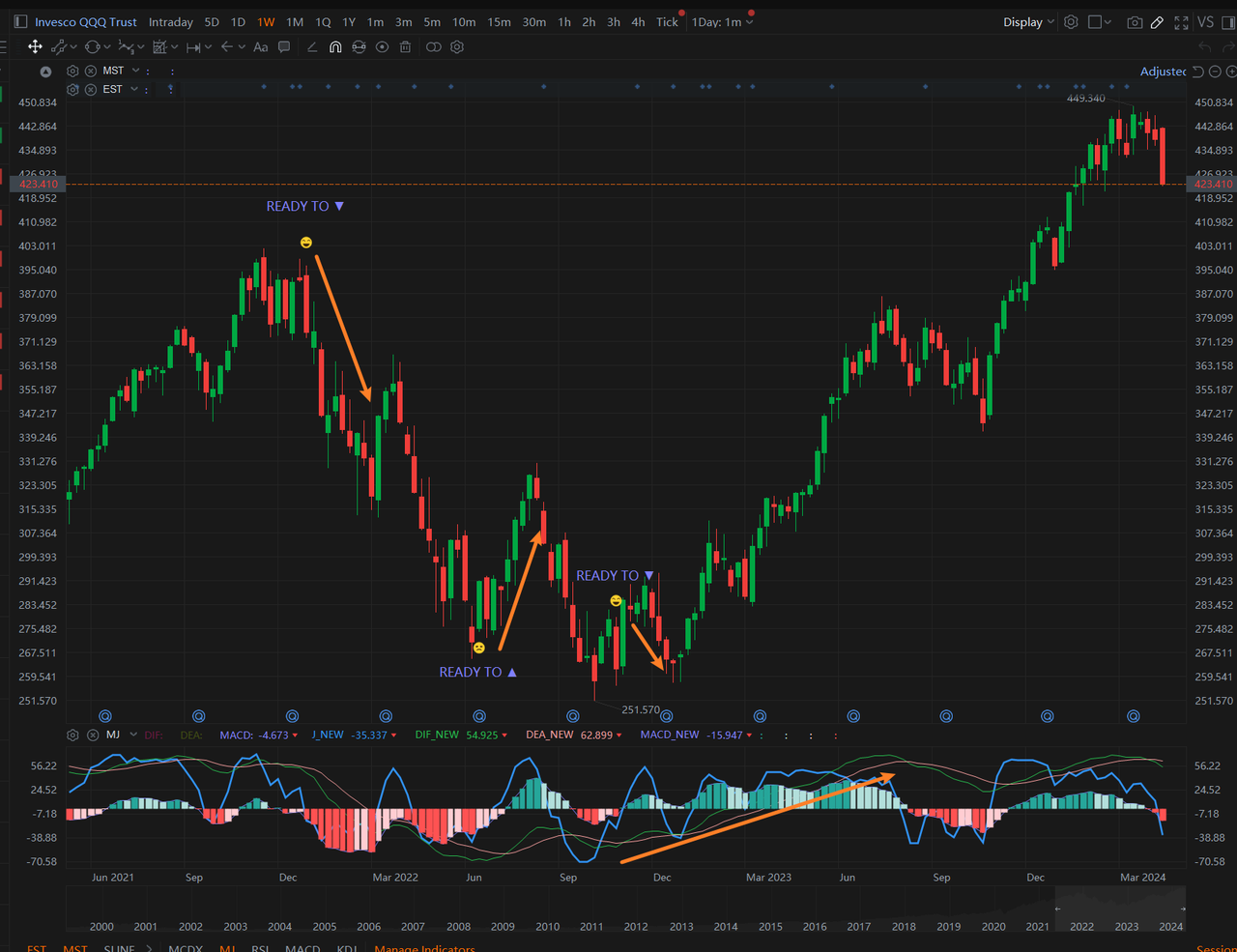

Hey Mooers!❤ Wanna know a cool way to predict market turns? Check out 🕯️ Morning Star & Evening Star candlestick patterns! They're like little signals in your charts that say, "Hey, this trend might be changing soon!"🔍These patterns are made up of three candles and they often pop up when a trend is reaching its peak or bottom. Traders use them to get a heads-up on potential market moves. 📈📉

📚 Got a few minutes? Do these quick things:

1. Read this article thoroughly! 📖 Don't skip a single word!

2. Add the indicator to your system! 🔧

3. Check out how this indicator performs on your favorite stocks! 📈 Is it a winner or a loser?

4. Snap a screenshot of your updated system & share your thoughts & doubts in the comments! 👇

1. 🌅 Morning Star(MST):

This bullish reversal pattern often emerges at the bottom of a downtrend, signaling a potential trend reversal from down to up. It comprises three candles:

🔸 A large bearish candle with a significant body.

🔸 A small-bodied candle, known as a star candle, which can be bullish or bearish and appears below the body of the first candle, indicating market uncertainty.

🔸 A large bullish candle with a substantial body that covers at least the body of the second candle and starts to erode the body of the first candle, signifying buyer control over the market.

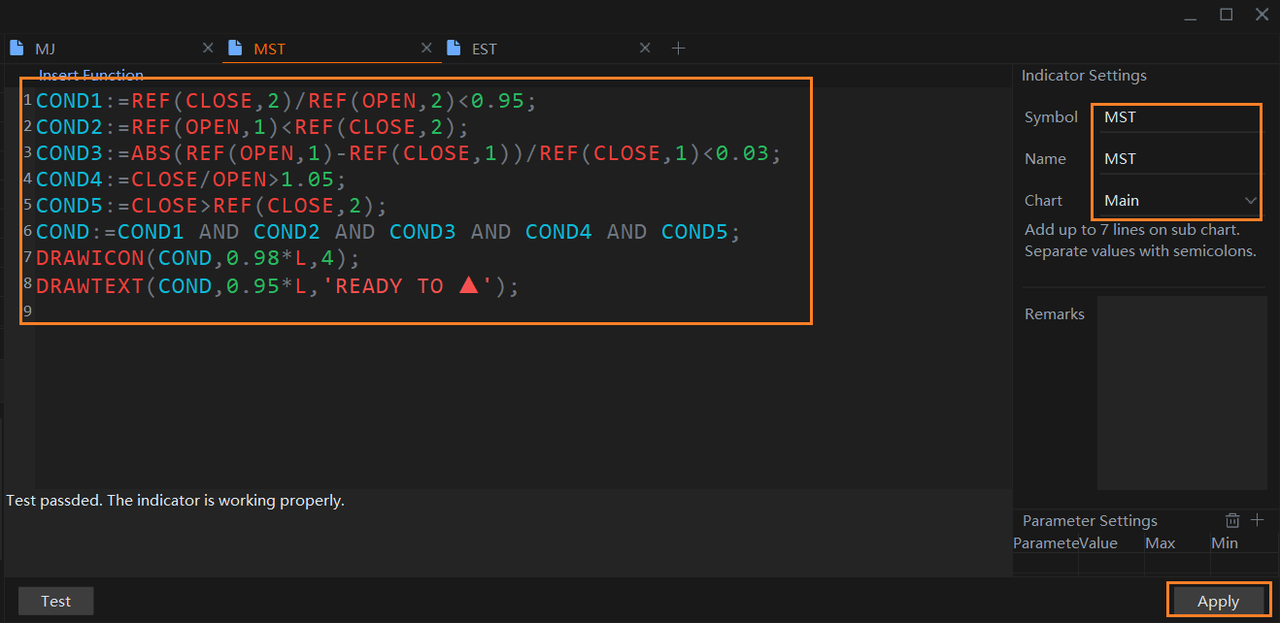

💻 Code Snippet:

COND1:=REF(CLOSE,2)/REF(OPEN,2)<0.95;

COND2:=REF(OPEN,1)<REF(CLOSE,2);

COND3:=ABS(REF(OPEN,1)-REF(CLOSE,1))/REF(CLOSE,1)<0.03;

COND4:=CLOSE/OPEN>1.05;

COND5:=CLOSE>REF(CLOSE,2);

COND:=COND1 AND COND2 AND COND3 AND COND4 AND COND5;

DRAWICON(COND,0.98*L,4);

DRAWTEXT(COND,0.95*L,'READY TO ▲');

📈📉 Code Breakdown:

🔍 COND1: REF(CLOSE,2)/REF(OPEN,2)<0.95;

Did the stock drop more than 5% from open to close two days ago? If yes, it's a bearish signal. 🐻❄️

🔍 COND2:REF(OPEN,1)<REF(CLOSE,2);

Is yesterday's open lower than the previous day's close? If so, the downtrend might continue. ⬇️

🔍 COND3: ABS(REF(OPEN,1)-REF(CLOSE,1))/REF(CLOSE,1)<0.03;

Was there price stability yesterday with less than 3% fluctuation? If true, the market was relatively calm. 🌊

🔍 COND4: CLOSE/OPEN>1.05;

Did today's close surge more than 5% from the open? If yes, it's a bullish signal! Bulls are in control. 🐂

🔍 COND5: CLOSE>REF(CLOSE,2);

Is today's close higher than two days ago? If true, prices have risen in the past two days. 📊

🔍 COND: COND1 AND COND2 AND COND3 AND COND4 AND COND5;

All the above conditions must be met! Only then will COND be true. 💯

📌 DRAWICON: DRAWICON(COND, 0.98*L, 4);

Mark the potential trend reversal! When COND is true, draw an icon at 98% of the low price.

OfficeOne : Find the exact peak

slam-dunk-1 : succeeded

Stella-K : I hope it can be used in actual transactions

mrmerk81 :

SPACELIGHT : Maybe not. I'm partial to my crystal ball.

crystal ball.

I Am 102927471 :

JoanLi : I can't read it; it's better to have buttons that can be used directly

102578497 : Good to learn more from momo

joshua_chuah316 : nice

23348496 : It seems a bit like AI intelligence, but the actual combat effectiveness has yet to be verified!

View more comments...