NVDA

NVIDIA

-- 104.420 TSLA

Tesla

-- 247.070 PLTR

Palantir

-- 82.630 AMZN

Amazon

-- 185.444 GOOG

Alphabet-C

-- 153.620

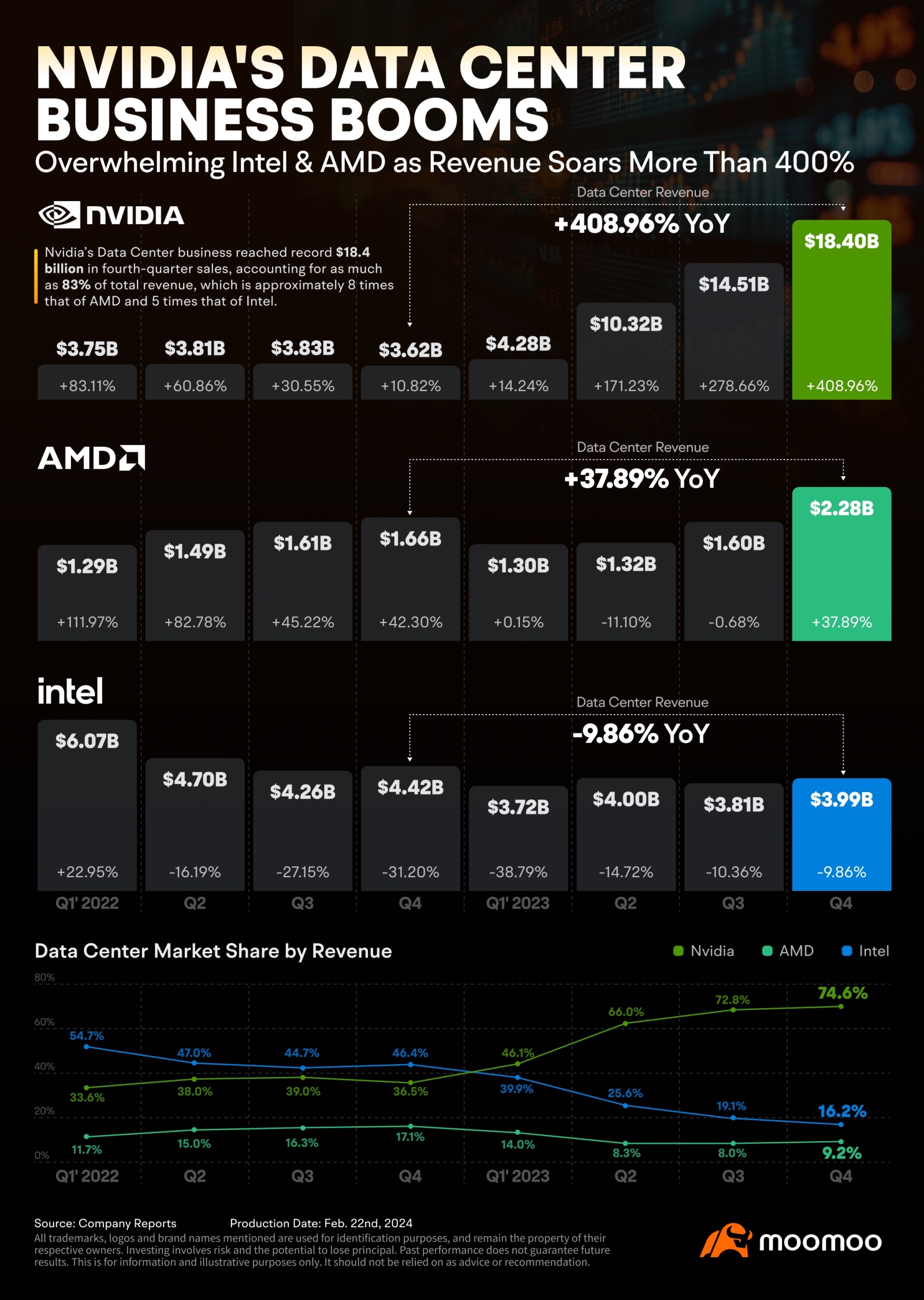

We estimate in the past year approximately 40% of data center revenue was for AI inference," Colette Kress, Nvidia's Chief Financial Officer (CFO) reported.

Growth was strong across all regions except for China, where our data center revenue declined significantly following the US government export control regulations imposed in October," Colette Kress, Nvidia's CFO said.

We understood what the restrictions are, reconfigured our products in a way that is not software hackable in any way, and that took some time so we reset our product offering to China. Now we're sampling to customers in China."

Fundamentally, the conditions are excellent for continued growth in 2025 and beyond. The demand for the company's GPUs will remain high due to generative AI and an industry-wide shift away from central processors to the accelerators that Nvidia makes."

Money Thrill : Hold and perhaps buy before next earnings? The same with #$Super Micro Computer (SMCI.US)$ ?

safri_moomoor : analytically