Figure 7: Financial position of KHPT Holdings Berhad

Financial overview, industry market, and personal opinion

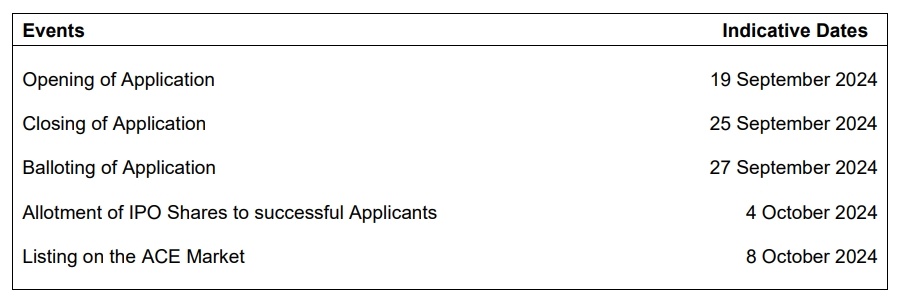

-Based on the financial position of KHPT Holdings, the liabilities to equity ratio is about 1:1, while almost half of the liabilities were from the trade payables from FY2021 to FPE2024. Interestingly, the best PAT of KHPT Holdings was recorded in FY2022, with RM8.79 million.

-According to the TIV (total industry volume) by brands in 2023, the market shares of Proton and Perodua have occupied more than 50%, with figures of 18.88% and 41.30% respectively. Meanwhile, KHPT Holdings has been providing automotive parts to its major customers, which are from Proton and Perodua.

-KHPT Holdings and Crest Group have the same closing date for the retail section, so the fund allocation might not be sufficient for both desired tiers. Analyse properly before making the decision.

Jshen Ng OP : Congrats to all shareholders![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) $KHB (0322.MY)$

$KHB (0322.MY)$