$Latham Group (SWIM.US)$ Risk Level: 3/10 (Low Risk) With ...

Risk Level: 3/10 (Low Risk)

With a risk score of 3, Latham Group Inc. presents a low risk to traders seeking to add this stock to their portfolio. The company's financial health, underpinned by its ability to generate a gross profit margin and its recent positive news catalysts, contributes to its lower risk profile. Despite a high P/E ratio, indicating future growth expectations, the stock's recent price behavior aligns with its fundamentals, suggesting stable volatility. Reduced sector interest might slightly increase risk perception; however, the company's innovative market position counters this concern. Overall, stable support levels and a robust equity base further mitigate risk, making this stock a feasible addition to a diverse investment portfolio.

With a risk score of 3, Latham Group Inc. presents a low risk to traders seeking to add this stock to their portfolio. The company's financial health, underpinned by its ability to generate a gross profit margin and its recent positive news catalysts, contributes to its lower risk profile. Despite a high P/E ratio, indicating future growth expectations, the stock's recent price behavior aligns with its fundamentals, suggesting stable volatility. Reduced sector interest might slightly increase risk perception; however, the company's innovative market position counters this concern. Overall, stable support levels and a robust equity base further mitigate risk, making this stock a feasible addition to a diverse investment portfolio.

Key Attributes worksheet

Catalyst ( Yes), Breakout ( Yes), Good company (Yes), Valid float ( Yes), Dollar break ( Yes), Near 52 week high ( Yes), Recent earnings ( No), Hot sector ( No)

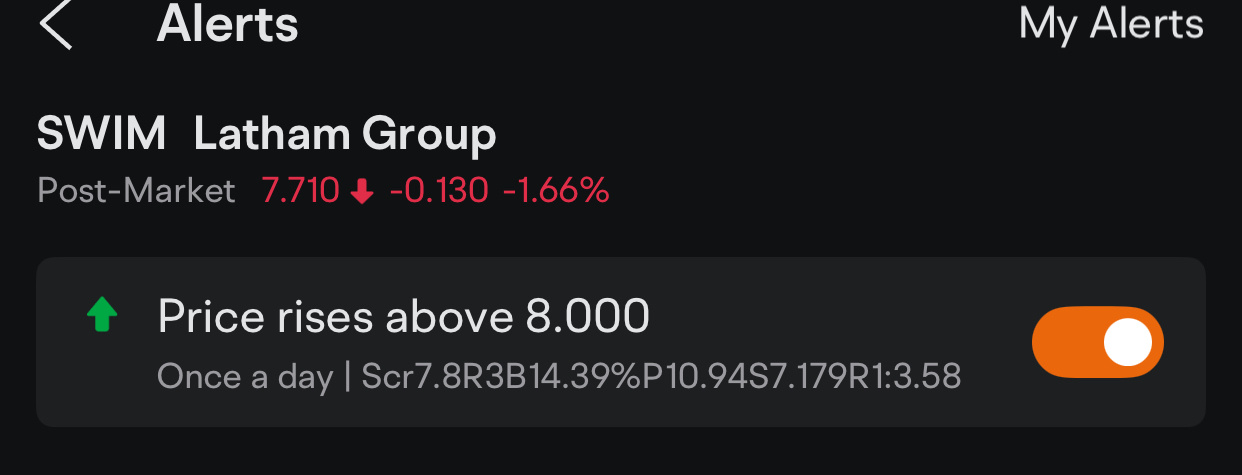

Upswing viability score: 7.8

Sentiment: Trade

Levels

Support Level: 7.25, derived from recent consolidation phases and chart data indicating established price stability.

Resistance Level: 7.92, set slightly below the recent 52-week high and supported by technical price movements in the provided chart data.

Entry Point: 8.00, reflecting a current position aligned with the stock's recent upward trend and proximity to the resistance level.

Support Level: 7.25, derived from recent consolidation phases and chart data indicating established price stability.

Resistance Level: 7.92, set slightly below the recent 52-week high and supported by technical price movements in the provided chart data.

Entry Point: 8.00, reflecting a current position aligned with the stock's recent upward trend and proximity to the resistance level.

Trading Strategy

My trading strategy for Latham Group Inc. entails a cautious yet opportunistic approach given the stock's current strength and potential upside. Allocating 14.39% of my $10,000 portfolio, I aim to purchase 179 shares with an entry price of $8.00, capitalizing on its alignment with key levels and a strong technical setup. The exit target is strategically placed at $10.94 to optimize gains while considering recent highs, with a stop-loss set at $7.179 to limit potential losses. This setup offers a risk-reward ratio of 1:3.58, balancing risk management with the potential for substantial profit based on observed trends and sentiment.

Position Size: 179 shares

Allocation: 14.39% of equity

Entry Price: $8.00

Exit Price: $10.94

Stop-Loss Price: $7.179

Risk/Reward Ratio: 1:3.58

My trading strategy for Latham Group Inc. entails a cautious yet opportunistic approach given the stock's current strength and potential upside. Allocating 14.39% of my $10,000 portfolio, I aim to purchase 179 shares with an entry price of $8.00, capitalizing on its alignment with key levels and a strong technical setup. The exit target is strategically placed at $10.94 to optimize gains while considering recent highs, with a stop-loss set at $7.179 to limit potential losses. This setup offers a risk-reward ratio of 1:3.58, balancing risk management with the potential for substantial profit based on observed trends and sentiment.

Position Size: 179 shares

Allocation: 14.39% of equity

Entry Price: $8.00

Exit Price: $10.94

Stop-Loss Price: $7.179

Risk/Reward Ratio: 1:3.58

Conclusion

In summary, Latham Group Inc. presents a viable trading opportunity for swing traders, supported by a solid stock score and positive technical and fundamental indicators. The company seems poised for potential gains, benefiting from positive sentiment and strong price movements. Although the sector's lack of heat might detract from its allure, other pivotal factors suggest an upside possibility. Consequently, traders should consider engaging with SWIM under the provided trading strategy, while ensuring sound risk management practices. This evaluation informs a trading decision conducive to potential capital appreciation.

In summary, Latham Group Inc. presents a viable trading opportunity for swing traders, supported by a solid stock score and positive technical and fundamental indicators. The company seems poised for potential gains, benefiting from positive sentiment and strong price movements. Although the sector's lack of heat might detract from its allure, other pivotal factors suggest an upside possibility. Consequently, traders should consider engaging with SWIM under the provided trading strategy, while ensuring sound risk management practices. This evaluation informs a trading decision conducive to potential capital appreciation.

Final Verdict: Trade

Based on the analysis, Latham Group Inc., SWIM, is a suitable candidate for a swing trade investment. The compilation of positive financial health, supportive technical indicators, and favorable news sentiment suggests an optimistic outlook for traders. Therefore, pursuing a trade with this stock aligns well with strategic investment objectives focused on growth.

Based on the analysis, Latham Group Inc., SWIM, is a suitable candidate for a swing trade investment. The compilation of positive financial health, supportive technical indicators, and favorable news sentiment suggests an optimistic outlook for traders. Therefore, pursuing a trade with this stock aligns well with strategic investment objectives focused on growth.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment