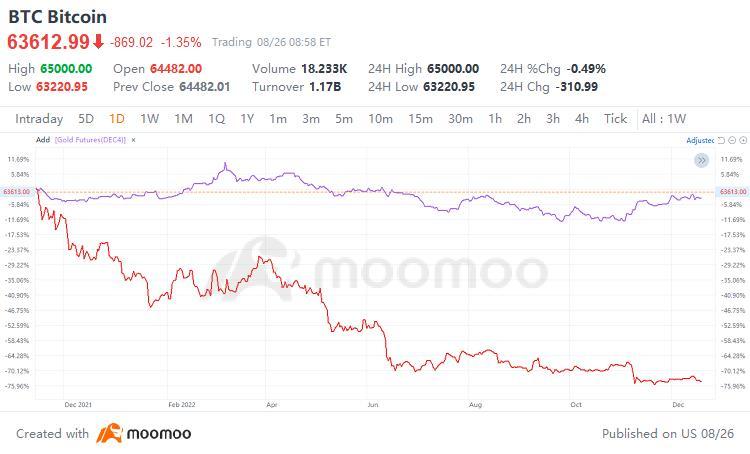

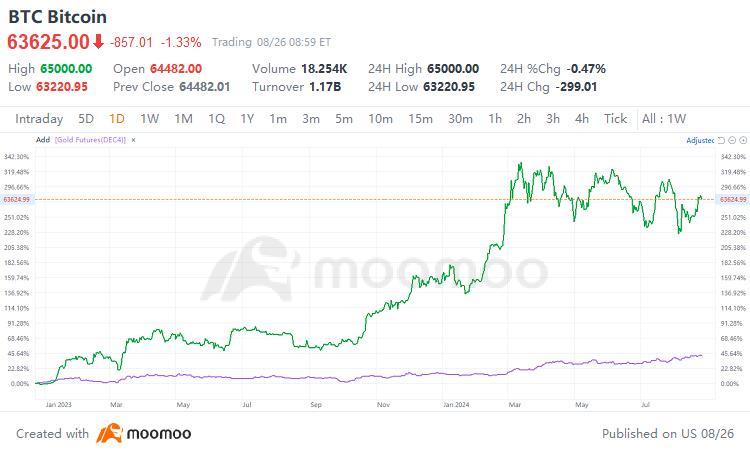

(The green line represents BTC Bitcoin closing prices, and the purple line represents GCmain Gold Futrures(DEC4) closing prices)

We believe the above periods are in a rate-cutting cycle mainly due to global economic slowdown and reduced inflationary pressures. Central banks worldwide aim to stimulate economic growth by lowering interest rates to encourage consumption and investment. Rate cuts can reduce borrowing costs, increasing the willingness of businesses and individuals to borrow, thereby promoting economic activity.

Moreover, at the recent Jackson Hole central bank meeting, the Federal Reserve Chairman emphasized, "Now is the time for policy adjustments. The path forward is clear, and the timing and pace of rate cuts will depend on incoming data, evolving outlooks, and the balance of risks." This statement further raises the likelihood of a rate cut in September.

Additionally, as commodity prices decline, easing inflation pressures, rate cuts become a viable policy option.

Therefore, in a rate-cutting cycle, enhanced liquidity makes cryptocurrencies more attractive compared to gold. In a low-interest-rate environment, investors seeking high returns are more inclined to accept the high volatility of cryptocurrencies.

While gold remains stable, the potential of cryptocurrencies in this period cannot be ignored. However, while maintaining enthusiasm for digital currencies, we must also be wary of the sustainability of cryptographic technologies to prevent the risk of a fundamental breakdown.

Thus, in an era of monetary easing, the brave chase the digital dream, while the wise seek the true "golden key" amidst volatility.

sick4cash : how high gold going waiting