Learning from History: Is Gold or Cryptocurrency the Better Choice During a Rate Cut Cycle? | Moomoo Research

During a rate-cutting cycle, abundant liquidity often makes high-return assets more attractive. So, how will cryptocurrencies and gold perform during this unique period?

It is evident that assets reflecting liquidity tend to perform better during rate-cutting cycles. Let's compare the situations of cryptocurrencies and gold during both rate-hiking and rate-cutting cycles based on recent historical data:

1.During a Rate-Hiking Cycle

Gold, as a traditional safe-haven asset, shines brighter. With rising interest rates, market concerns about economic prospects intensify, making gold an ideal choice for investors to hedge against inflation and financial market volatility.

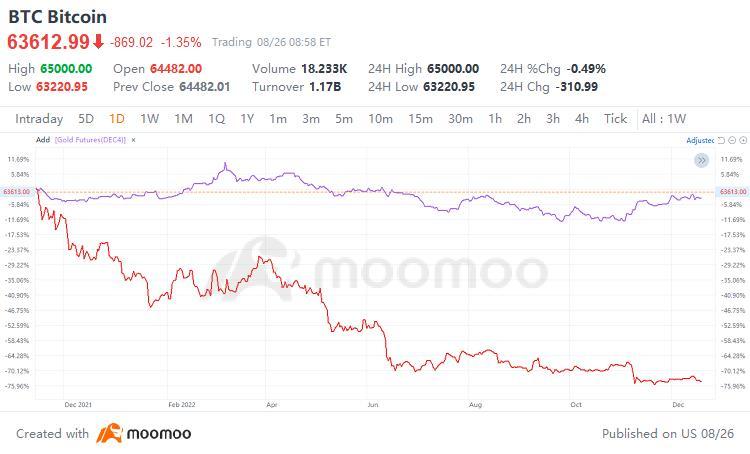

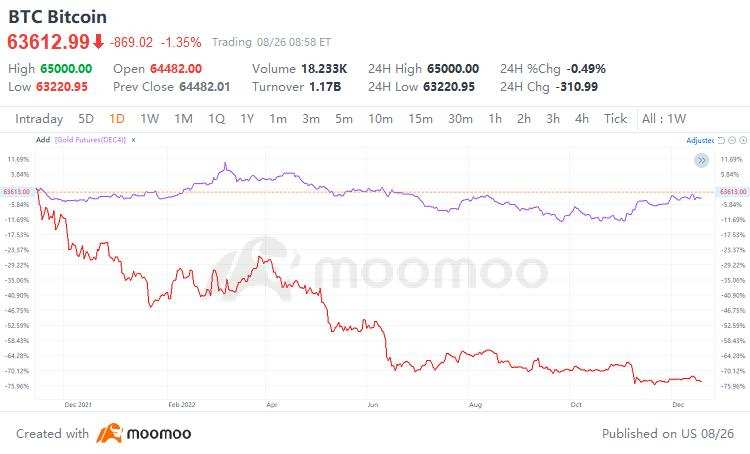

In contrast, cryptocurrencies, being more speculative, face greater selling pressure under tight monetary policies as investor risk appetite cools. For example, from the start of the last rate hike expectations to their peak, roughly from November 2021 to December 2022, Bitcoin dropped by about 70%, whereas gold's maximum decline was only around 15%.

(The red line represents BTC Bitcoin closing prices, and the purple line represents GCmain Gold Futrures(DEC4) closing prices)

2.During a Rate-Cutting Cycle

Loose monetary policy lowers the opportunity cost of holding non-yielding assets, making cryptocurrencies more attractive. A low-interest-rate environment encourages investors to seek higher returns, and the highly volatile and potentially high-yielding cryptocurrency market becomes a haven for those willing to take additional risks for excess returns.

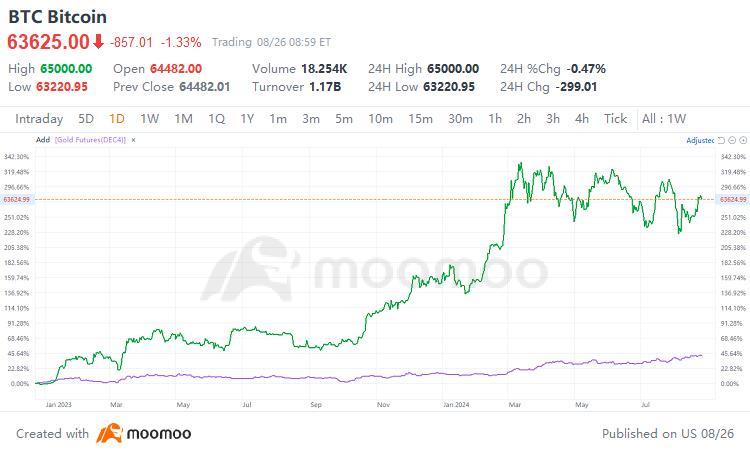

In this context, while gold remains stable, its relatively conservative returns cannot compare to the explosive growth of cryptocurrencies. For instance, from the peak of the current rate hike expectations to the sustained expectation of rate cuts, roughly from January 2023 to August 2024, Bitcoin's maximum increase could reach 320%, far surpassing gold's approximately 35% rise.

In this context, while gold remains stable, its relatively conservative returns cannot compare to the explosive growth of cryptocurrencies. For instance, from the peak of the current rate hike expectations to the sustained expectation of rate cuts, roughly from January 2023 to August 2024, Bitcoin's maximum increase could reach 320%, far surpassing gold's approximately 35% rise.

(The green line represents BTC Bitcoin closing prices, and the purple line represents GCmain Gold Futrures(DEC4) closing prices)

We believe the above periods are in a rate-cutting cycle mainly due to global economic slowdown and reduced inflationary pressures. Central banks worldwide aim to stimulate economic growth by lowering interest rates to encourage consumption and investment. Rate cuts can reduce borrowing costs, increasing the willingness of businesses and individuals to borrow, thereby promoting economic activity.

Moreover, at the recent Jackson Hole central bank meeting, the Federal Reserve Chairman emphasized, "Now is the time for policy adjustments. The path forward is clear, and the timing and pace of rate cuts will depend on incoming data, evolving outlooks, and the balance of risks." This statement further raises the likelihood of a rate cut in September.

Additionally, as commodity prices decline, easing inflation pressures, rate cuts become a viable policy option.

Therefore, in a rate-cutting cycle, enhanced liquidity makes cryptocurrencies more attractive compared to gold. In a low-interest-rate environment, investors seeking high returns are more inclined to accept the high volatility of cryptocurrencies.

While gold remains stable, the potential of cryptocurrencies in this period cannot be ignored. However, while maintaining enthusiasm for digital currencies, we must also be wary of the sustainability of cryptographic technologies to prevent the risk of a fundamental breakdown.

Thus, in an era of monetary easing, the brave chase the digital dream, while the wise seek the true "golden key" amidst volatility.

We believe the above periods are in a rate-cutting cycle mainly due to global economic slowdown and reduced inflationary pressures. Central banks worldwide aim to stimulate economic growth by lowering interest rates to encourage consumption and investment. Rate cuts can reduce borrowing costs, increasing the willingness of businesses and individuals to borrow, thereby promoting economic activity.

Moreover, at the recent Jackson Hole central bank meeting, the Federal Reserve Chairman emphasized, "Now is the time for policy adjustments. The path forward is clear, and the timing and pace of rate cuts will depend on incoming data, evolving outlooks, and the balance of risks." This statement further raises the likelihood of a rate cut in September.

Additionally, as commodity prices decline, easing inflation pressures, rate cuts become a viable policy option.

Therefore, in a rate-cutting cycle, enhanced liquidity makes cryptocurrencies more attractive compared to gold. In a low-interest-rate environment, investors seeking high returns are more inclined to accept the high volatility of cryptocurrencies.

While gold remains stable, the potential of cryptocurrencies in this period cannot be ignored. However, while maintaining enthusiasm for digital currencies, we must also be wary of the sustainability of cryptographic technologies to prevent the risk of a fundamental breakdown.

Thus, in an era of monetary easing, the brave chase the digital dream, while the wise seek the true "golden key" amidst volatility.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

sick4cash : how high gold going waiting