How I Trade Using Moving Averages (MA) and Donchian Channels (DC)

In my trading strategy, I rely heavily on Moving Averages (MA) and Donchian Channels (DC) to make informed decisions. Here’s how I utilize these indicators:

Moving Averages (MA)

Moving Averages help smooth out price data to identify trends. I use three types of MAs:

- MA20 (20-day moving average): Indicates short-term trends.

- MA60 (60-day moving average): Indicates medium-term trends.

- MA250 (250-day moving average): Indicates long-term trends.

Trading Strategy Using MA:

1. Bullish Signal:

- When the MA20 crosses above the MA60 and MA250, it signals a potential uptrend.

- When the stock price is above all three MAs, it confirms strong upward momentum.

2. Bearish Signal:

- When the MA20 crosses below the MA60 and MA250, it signals a potential downtrend.

- When the stock price is below all three MAs, it confirms strong downward momentum.

Donchian Channels (DC)

Donchian Channels help identify breakout levels and consist of three lines:

- Upper Band: The highest high over a certain period.

- Lower Band: The lowest low over a certain period.

- Middle Line: The average of the upper and lower bands.

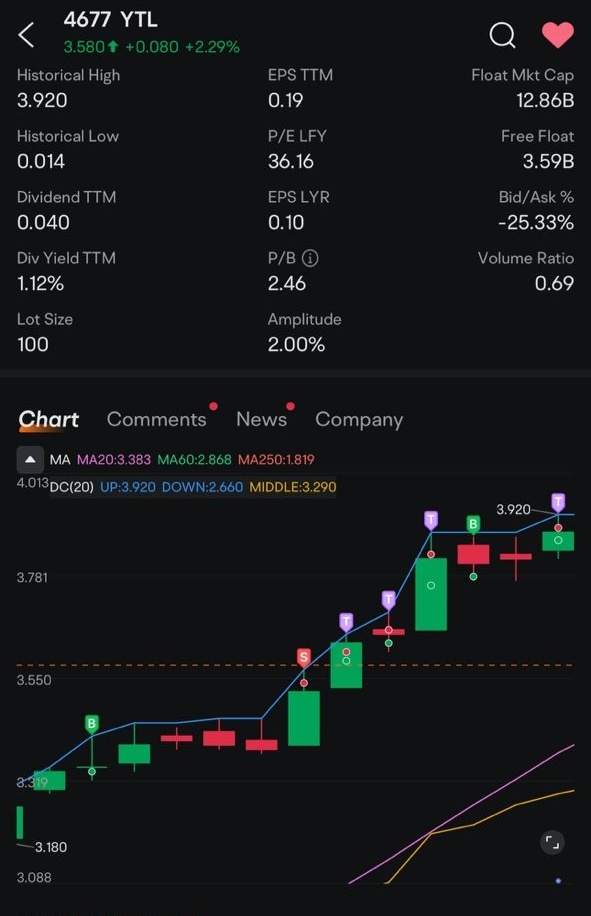

For the chart in question, the parameters are:

- Upper Band (UP): 3.920

- Lower Band (DOWN): 2.660

- Middle Line (MIDDLE): 3.290

Trading Strategy Using DC:

1. Breakout Strategy:

- Buy when the stock price breaks above the upper band (3.920), indicating an upward breakout.

- Sell when the stock price breaks below the lower band (2.660), indicating a downward breakout.

2. Range Trading:

- Buy when the stock price approaches the lower band (2.660) and shows support.

- Sell when the stock price approaches the upper band (3.920) and shows resistance.

Combining MA and DC for Trading:

1. Confirmation of Trend:

- Use MA to identify the overall trend direction. For instance, if the stock price is above the MA20, MA60, and MA250, it confirms an uptrend.

- Use DC to identify entry and exit points within the trend. In an uptrend, buy signals are more reliable when the price breaks above the upper band of the DC.

2. Avoiding False Signals:

- If the price fluctuates within the bands of the DC without a clear breakout, the MAs can help avoid false signals by indicating whether the trend is strong or weak.

Example:

From the chart, the stock is in an uptrend as indicated by the price being above all three MAs. The recent high is 3.920, coinciding with the upper band of the DC, suggesting resistance. A potential buy signal occurred when the price broke above the middle line of the DC and stayed above it.

Conclusion:

By using Moving Averages to identify trends and Donchian Channels to find entry and exit points, I make more informed trading decisions. This combination helps me confirm trends, identify breakouts, and avoid false signals, ultimately improving my trading outcomes.

Hase Investment King : Thanks for sharing![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

mr_cashcow : Nice, well done! Thanks for sharing![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Alef Santiago : how do I get it to show DC? I have the three ma showing now

104572083 : Thanks for sharing

JulW21 : Great sharing!

_aobm_ Alef Santiago : Go to Indicators > More > search "DC" > > Back to Main Chart > select "DC".. Done

> Back to Main Chart > select "DC".. Done ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Hase Investment King :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Hase Investment King : Ytl up and down

AnnYeo God of Money OP Alef Santiago : just click on the indicator > then select more > type dc

Hase Investment King : Buy or sell![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...