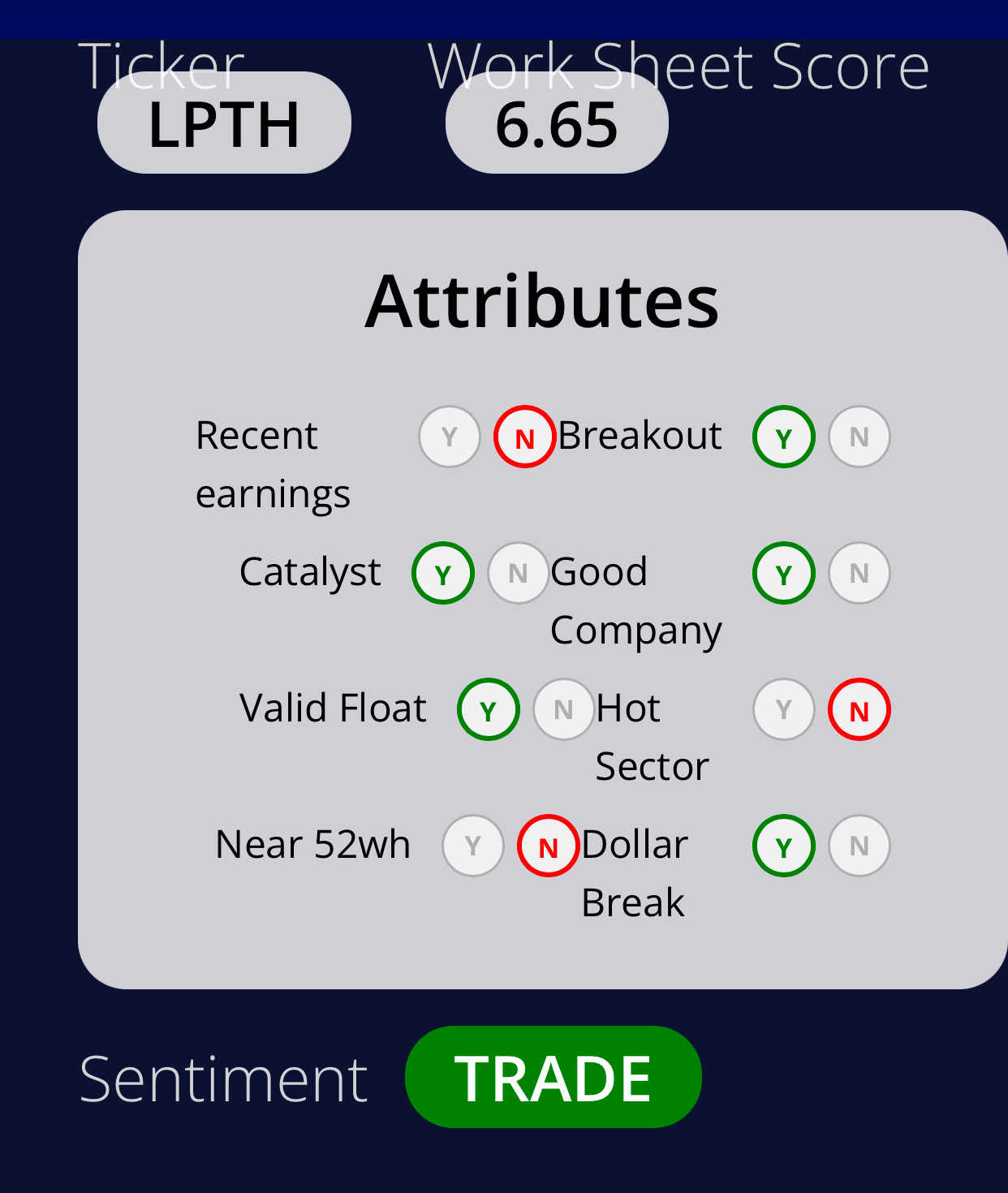

Trading Strategy

Given the completion of the analysis for LPTH, a long position is recommended for swing trading. Based on a capital of $10,000, an allocation of $1,131 (11.31% of equity) is suitable, translating into a purchase of approximately 545 shares at an entry price of $1.75. A profitable exit price is anticipated at $3.805, with a cautious stop-loss set at $1.123 to manage downside risk effectively. The calculated risk/reward ratio is an attractive 1:3.28, suggesting a favorable opportunity under current market conditions.

Equity for Trading: $10,000

Position Bias: Long

Position Size (Shares): 545

Allocation (% of Equity): 11.31%

Entry Price: $1.75

Profitable Exit Price: $3.805

Stop-Loss Price: $1.123

Risk/Reward Ratio: 1:3.28