Lodging: A Guest Walks into a Hotel... A Proprietary Demand Tracker

Our Call

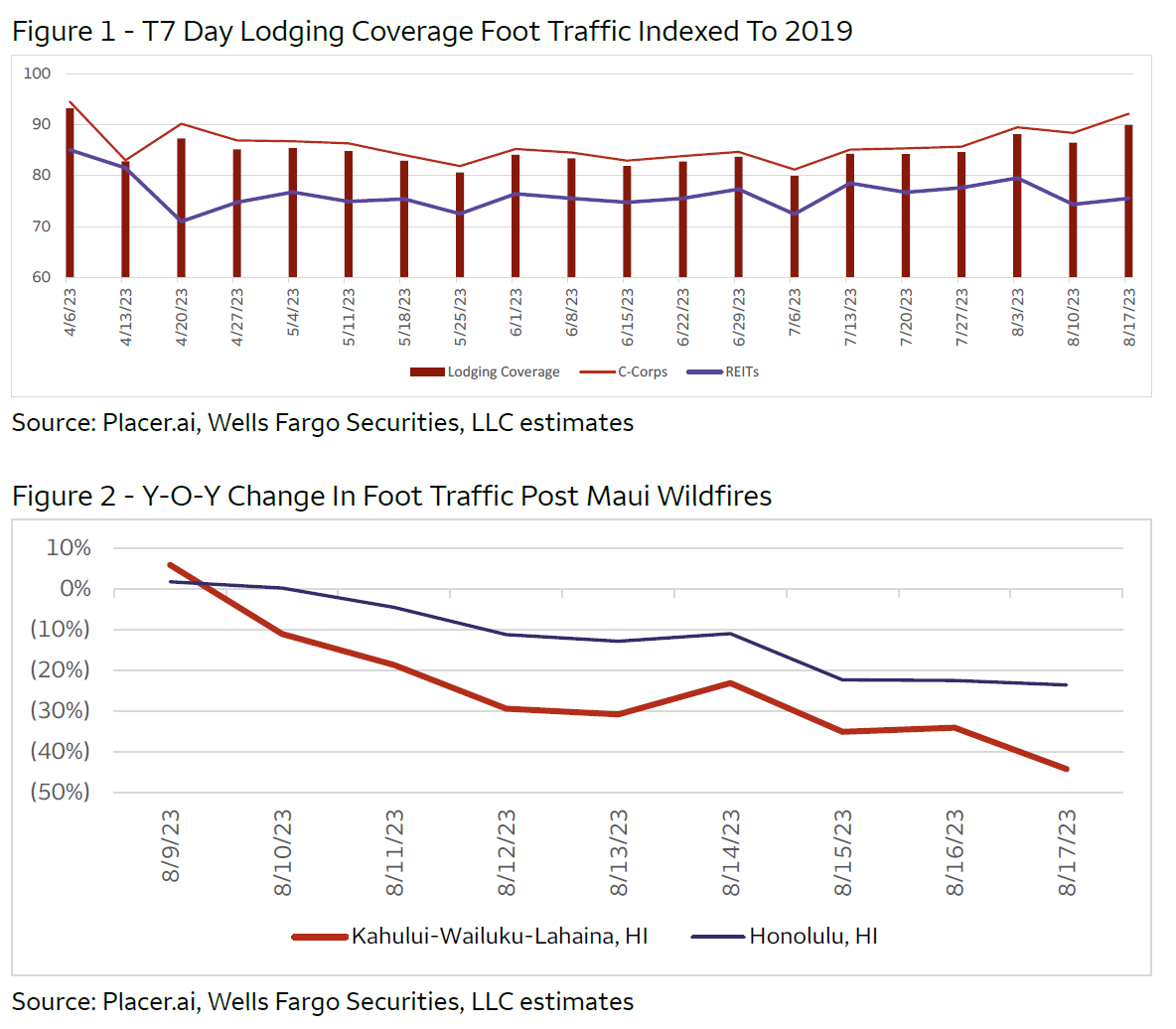

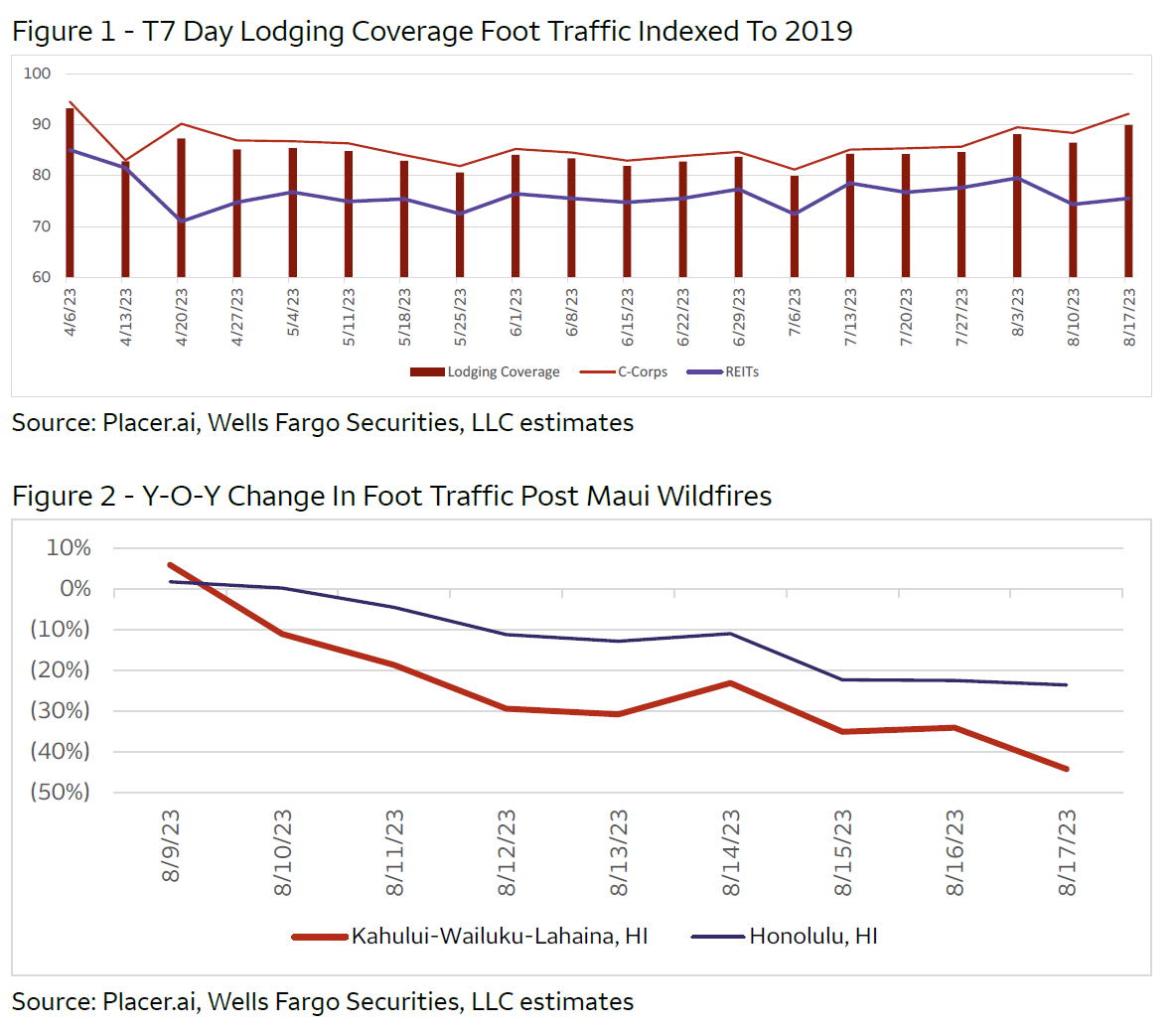

Hotel level foot traffic vs 2019 is flat/up for 85% of our coverage Q3 over Q2, led by HLT, XHR, DRH; positive read-through on demand. NT group is expected to drive occupancy gains, with a slower business transient improvement/slowing in leisure.

Q3 vs. Q2, Indexed To '19. Foot traffic for the majority of our coverage has been flat/up Q3 over Q2, led by Hilton (HLT), Xenia (XHR), DiamondRock (DRH) while Hyatt (H), Park (PK), Pebblebrook (PEB) have lagged. We noticed a selective disconnect in foot traffic/occupancy of late, which we believe is related to placer's assumptions of party size as it has impacted portfolios with greater group/leisure exposure more so than business transient. Analysis now excludes RHP (see Figure 14).

Ratings. Our Overweight-rated stocks are Apple Hospitality REIT (APLE, $14.71), DiamondRock Hospitality (DRH, $7.86), Host Hotels & Resorts (HST, $16.11), Marriott International (MAR, $202.09), and Ryman Hospitality Properties (RHP, $84.17

Methodology. "A Guest Walks Into A Hotel...", our proprietary hotel-level foot traffic tracker, provides a timely indicator of the relative health of domestic demand for the lodging C-Corps/REITs during a period of economic uncertainty. We found historically changes in traffic, measured utilizing Placer.ai's mobile analytics, and changes in occupancy are highly correlated within our coverage. Beyond occupancy, changes in foot traffic can be indicative of F&B traffic from non-hotel guests.

Lodging C-Corps: Relationship Between Occupancy And Placer Foot Traffic

For each of the lodging C-Corps, we found that Placer.ai captured foot traffic data for certain domestic chains, predominantly select-service/extended-stay, with 86-96% of those brands' domestic hotels accounted for.

Brands included are Choice's Comfort Inn & Suites, Sleep Inn, Quality Inn, Econo Lodge, and MainStay Suites, Hyatt's Hyatt House and Hyatt Place, Hilton's Embassy Suites, Hampton Inn, Hilton Garden Inn, and Homewood Suites, and Marriott's Residence Inn, Courtyard, Four Points, SpringHill Suites, TownePlace Suites, and Fairfield Inn.

Lodging REITs: Relationship Between Occupancy And Placer Foot Traffic

For each of the lodging REITs, not every property was able to be included in the analysis of Placer.ai foot traffic data, with some exclusions made due to multiple businesses at one address (a hotel on top of another business) or traffic density (a hotel located next to a transportation hub), resulting in 64-98% of rooms accounted for, or 88% on average across our coverage universe.

Below Ryman (RHP), we have included the revenue and foot traffic of its Entertainment business, Opry Entertainment Group (OEG), with the revenue and foot traffic assuming Block 21 was acquired 1/1/17

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment