Looking at Taiwan Semiconductor's third-quarter performance and annual outlook, as the current leader in computing power, Taiwan Semiconductor's performance is still very impressive. In the current and foreseeable future, Taiwan Semiconductor will maintain a relative advantage over other competitors.

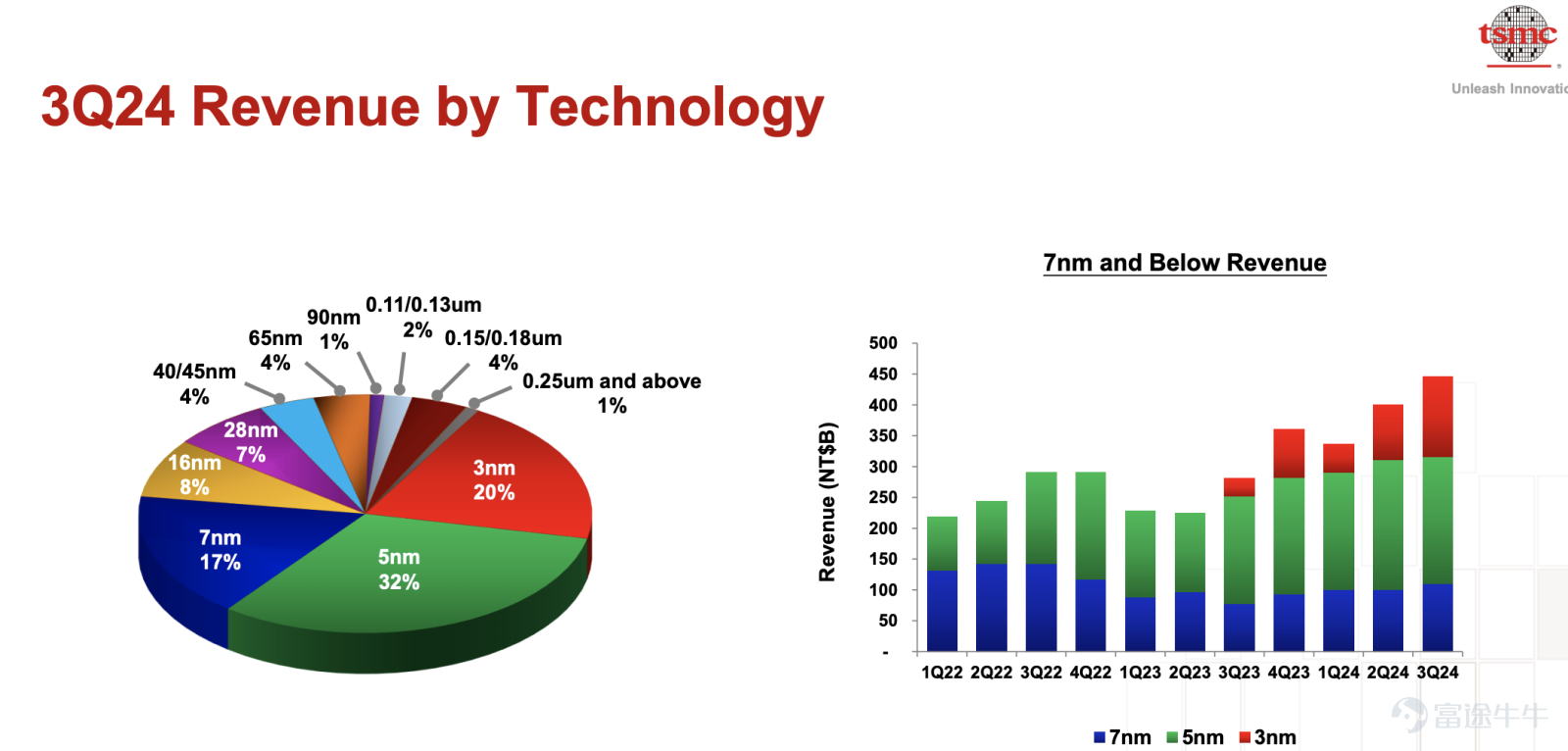

Firstly, in terms of revenue technology, the 3nm and 5nm processes account for over 50% of the company's revenue, which are also the highest-profit margin businesses for Taiwan Semiconductor, mainly used for manufacturing CPUs, GPUs, smart phones, and other products. From the current overall market situation, high-performance GPUs are likely to be the main growth drivers, which also means that AI companies represented by NVIDIA will continue to maintain high prosperity.

Secondly, looking downstream, the PC and smart phone markets are gradually maturing and stabilizing. GPUs, as representatives of high-performance computing, are maintaining a high growth trend. Based on the communication between the company and the market, this trend is expected to continue.

Thirdly, benefiting from Taiwan Semiconductor's high-gross-margin operating model, the company's asset structure will be further optimized. Coupled with a favorable downstream environment and strong negotiating power, the company's cash flow situation remains healthy.

Fourthly, as the industry leader, Taiwan Semiconductor is continuously widening the technological gap with followers like Samsung, while also expanding in scale. Additionally, with the impact of building factories in Arizona, Japan, and other places, the company's capital expenditure will remain high. In theory, this is a bullish signal for companies like AMSL, LAM, AMAT, TEL, as at least for the foreseeable future, their orders are secure.

Fifth, AI, still AI. Whether it's advanced 3nm, 5nm process products, or CoWos advanced packaging, Taiwan Semiconductor is undoubtedly a key participant in the AI field. Therefore, the company's performance exceeding market expectations also reflects Taiwan Semiconductor's unique competitive position and advantages.

Finally, perhaps it is the company's bullish view on advanced packaging and the AI field. After Taiwan Semiconductor acquired the Kingkey factory, it now has a larger clean room area, especially in glass-based advanced packaging, the company's advanced packaging capabilities will be greatly enhanced. The hundreds of K processing capabilities mentioned by HTI Jeff are not unfounded.

Overall, Taiwan Semiconductor's performance conference not only provides optimistic expectations for the chip processing industry, but also plays a certain guiding role for the downstream future. After the company's market cap surpassed one trillion, it has formed strong support.