Looking to Get into NVIDIA But Options Are Too Pricey? Here's How to Open a Position with Lower Cost

$NVIDIA (NVDA.US)$ 's options trajectory has been under intense scrutiny lately, with the past month alone witnessing it occupying a quarter of the options market.

Apart from those bullish on NVIDIA throughout this year, many Mooers here also believe that NVIDIA's downtrend isn't over yet: fundamentally, as its size increases, sustaining high-profit growth becomes challenging, insufficient to support its high valuation. Technically, the pullback hasn't concluded yet, with trading volume remaining flat; RSI indicates neutrality.

Many Mooers are keen on both bullish and bearish plays on NVIDIA through options. However, the cost of opening a position in NVIDIA options is too high. ![]()

![]()

![]()

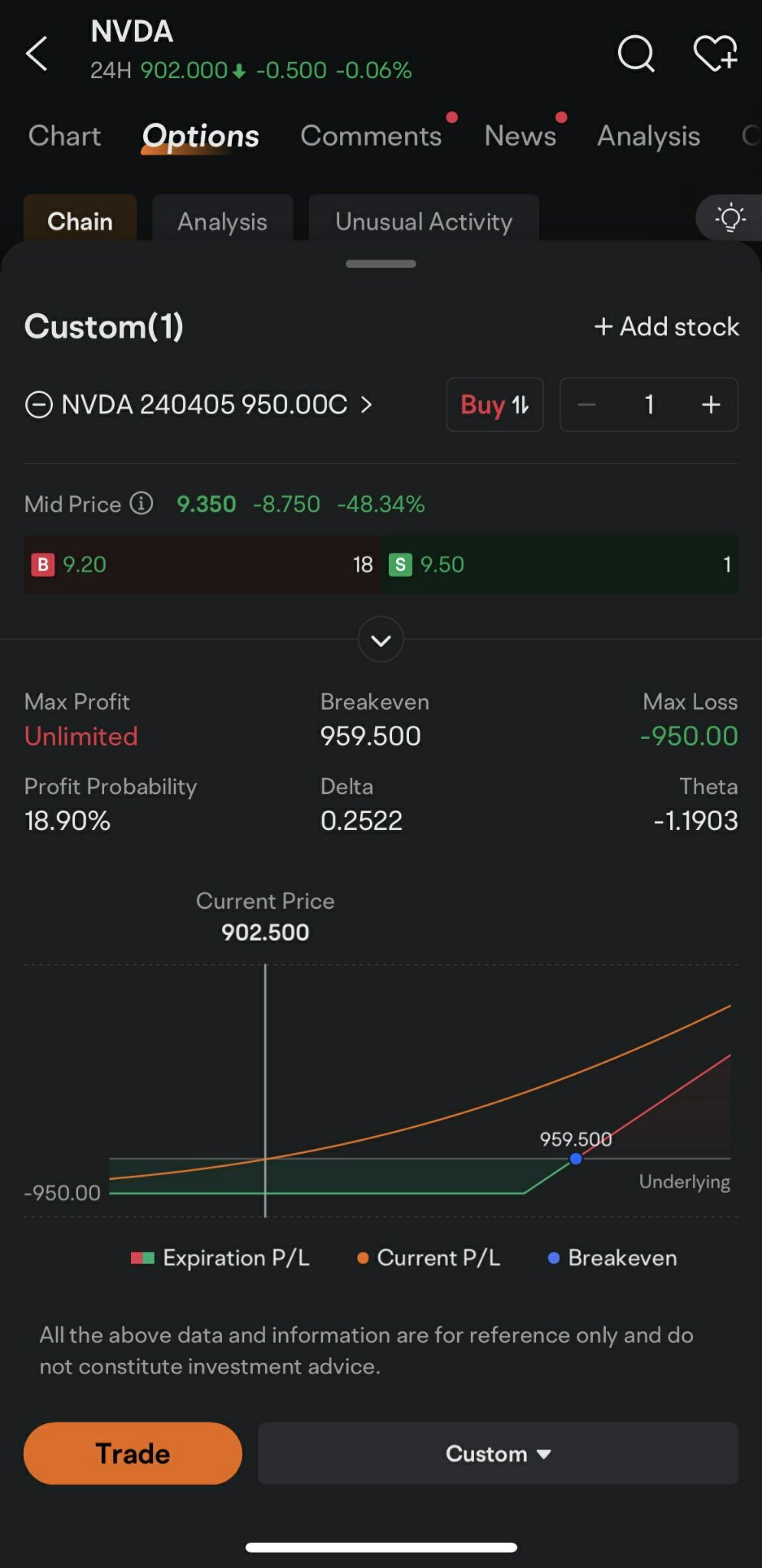

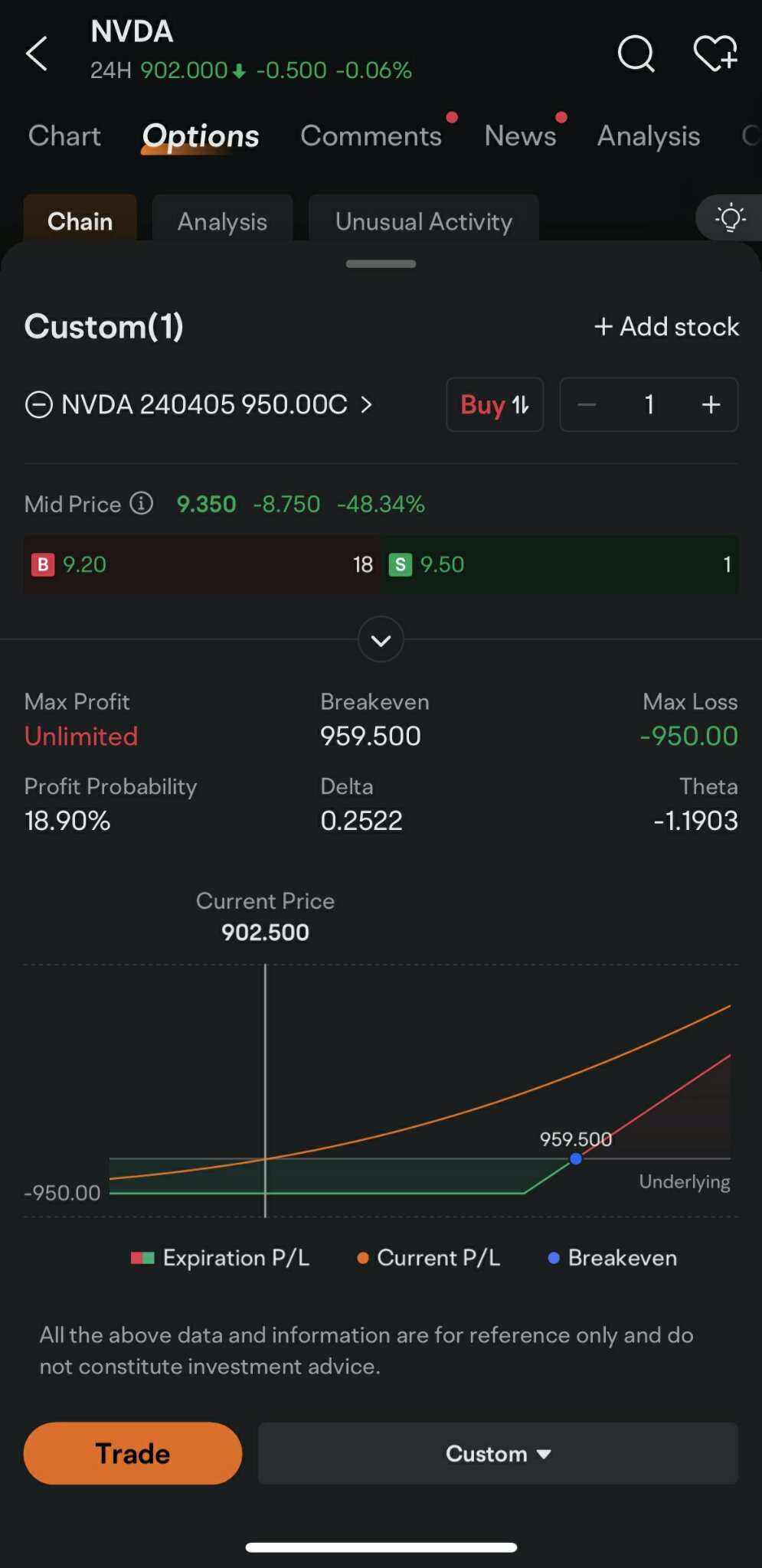

For instance, as of the close on March 14th at 879, opening a call with a strike price of 950 expiring in mid-April costs $3,135. Opening a put with a strike price of 850 expiring in mid-April costs $3,710.

The high cost of opening NVIDIA options positions is influenced by both high implied volatility (IV) and the high value of the underlying stock:

1. High Implied Volatility (IV): Market expectations for increased future price volatility of NVIDIA raise the possibility of increased option value at expiration.

2. High Value of the Underlying Stock: The high stock price of NVIDIA itself increases the intrinsic value and total cost of buying call options. The high stock value also means that each price movement involved in the option contract may involve substantial funds.

The core idea of reducing the cost of opening options positions is to reduce potential profits.![]()

How to understand this? Let's take a bullish perspective as an example.

The meaning of this option is that I believe NVIDIA can rise above 950 by the expiration date in April 5th.

But the profit and loss breakeven point on the expiration date shown in the profit analysis chart is 959.5? The extra 9.5 multiplied by 100 is approximately the opening cost of this option. Because 1 option corresponds to 100 shares. And the max loss of 950 is calculated in this way, the max loss of buying an option is all loss!

So what does "the core idea of reducing the cost of opening options positions is to reduce potential profits" mean? The analysis is not written with unlimited potential profits because there is no limit to the rise in stock prices; the crazier the stock rises, the greater the difference between the stock and the option, the greater the intrinsic value of the option, and the profit is unlimited.

But the reality is, how can NVIDIA rise to the sky in a short time?

For example, I believe it can rise, but not above 1500, then I can sell a call with a strike price of 1500.

When you only short this call with a strike price of 1500, it means you bet NVIDIA won't rise above 1500, and if you win, you get the premium.

But when you are long a call with a strike price of 950 and short a call with a strike price of 1500 at the same time, it means you give up the differential income of NVIDIA rising above 1500, and this premium reduces your opening combination.

This is called a spread strategy.

Let's continue to look at the profit distribution chart of Long Call 950 and Short Call 1500.

The max loss, corresponding to the opening cost, has changed from 950 to 947. The difference in the middle is the income received from Short Call, which corresponds to the first half of "reducing the opening cost".

The max profit has changed from unlimited to 54053, which corresponds to the latter half of "reducing potential profits".

Okay, now someone jumps out and says, it's still expensive.

Options are a zero-sum game market, where returns and risks are completely equal. The max loss of buying options is all loss, and the risk can be equated to the cost (max loss).

Want to continue reducing costs? Of course you can, then continue to give up potential profits.

Just now we gave up the differential income of NVIDIA rising above 1500. Now we choose to give up the differential income of NVIDIA rising above 1200, so let's change the strike price of Short Call from 1500 to 1200. The profit chart is as follows:

At this point, the max loss becomes 928.

At the same time, because you gave up the differential income of rising above 1200, the max profit also decreases further, becoming 24072.

Let me explain further why this opening cost further decreases:

When we buy a call option, the higher the strike price, the lower the probability that the stock will rise to this price by the expiration date, the lower your probability of profit, and the greater the probability of a complete loss. Therefore, the farther the strike price is from the money, the cheaper it is. Similarly, the lower the strike price you buy, the lower the strike price, the greater the probability of breaking even, the more expensive it is.

The explanation above is from the buyer's perspective. So when we Short a Call with a lower price, the higher the premium we receive.

In fact, the process of continuously reducing the opening cost is the process of reducing leverage. You can calculate the profit and loss ratio yourself.

If you want to reduce the opening cost of bearish NVIDIA options, the same logic applies. However, understanding in-the-money and out-of-the-money is reversed. Based on the current price of 901, above 901 is the "in-the-money" for bearish options.

The above is the vertical spread strategy. As for the so-called ratio spread strategy, compared with the vertical spread, it means making Short Call more.

The ratio spread strategy is an options strategy where the quantity bought and sold is different, the execution prices are different but have the same expiration date.

When we make the original Long Call 950, Short Call 1500 vertical spread combination short Call one more time, it becomes a ratio spread.

This time, the opening cost becomes 938. This is because I received two premiums for being short twice, both of which were used to reduce my opening cost. But the potential risk has also increased because Short Call has been added one more time, if it rises above 2040, the strategy will still lose money.

At the same time, if the stock price falls on the expiration date at 1500, the max profit will be obtained, but it is generally unlikely to be so coincidental. In normal trading, if you can make three or four times the profit, it is already exaggerated.

Comments are welcome.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Maniac Fool : Quite clear explanation

whqqq OP Maniac Fool : thanks![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)