Lululemon earnings preview: Grab rewards by guessing the opening price!

Hi, mooers!

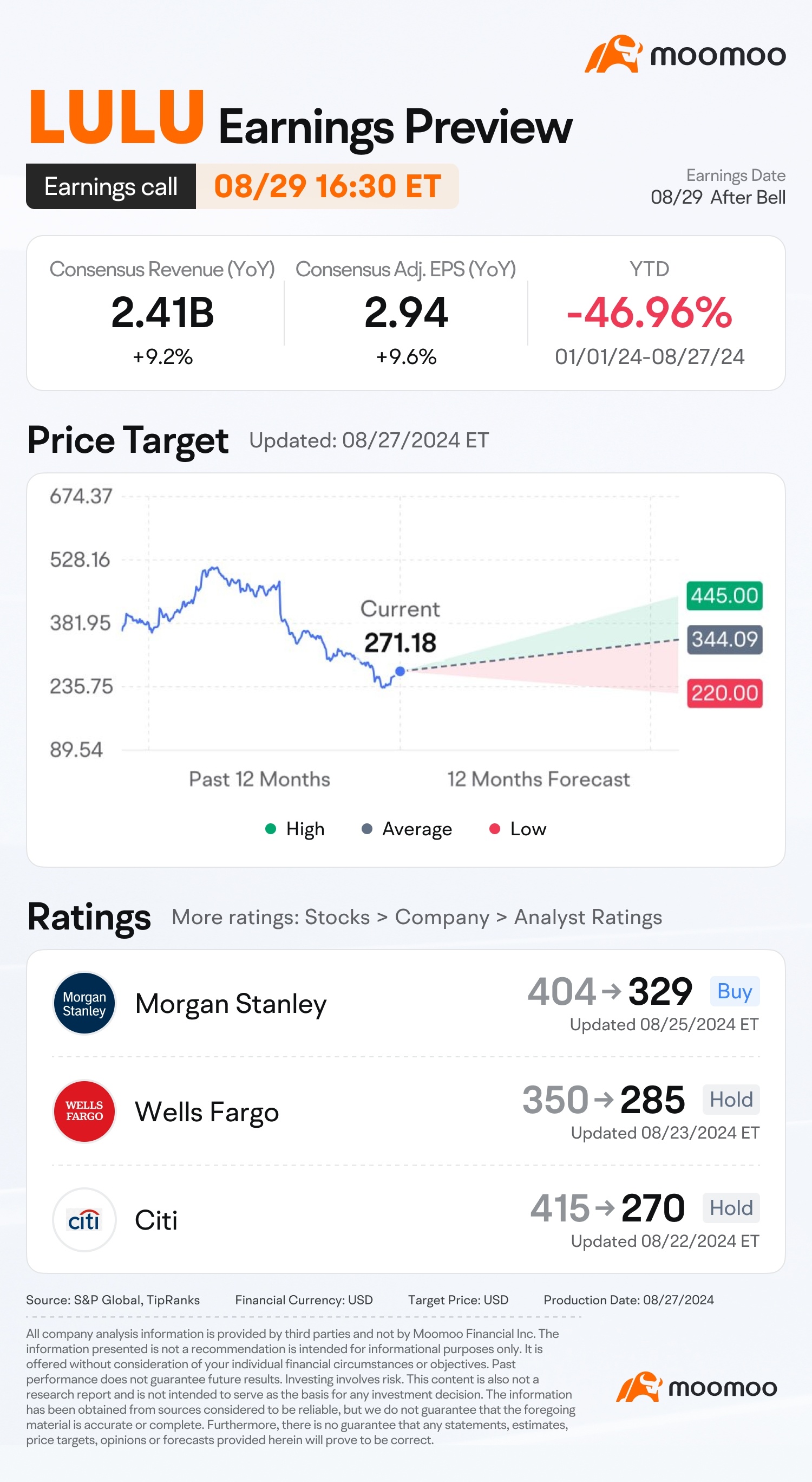

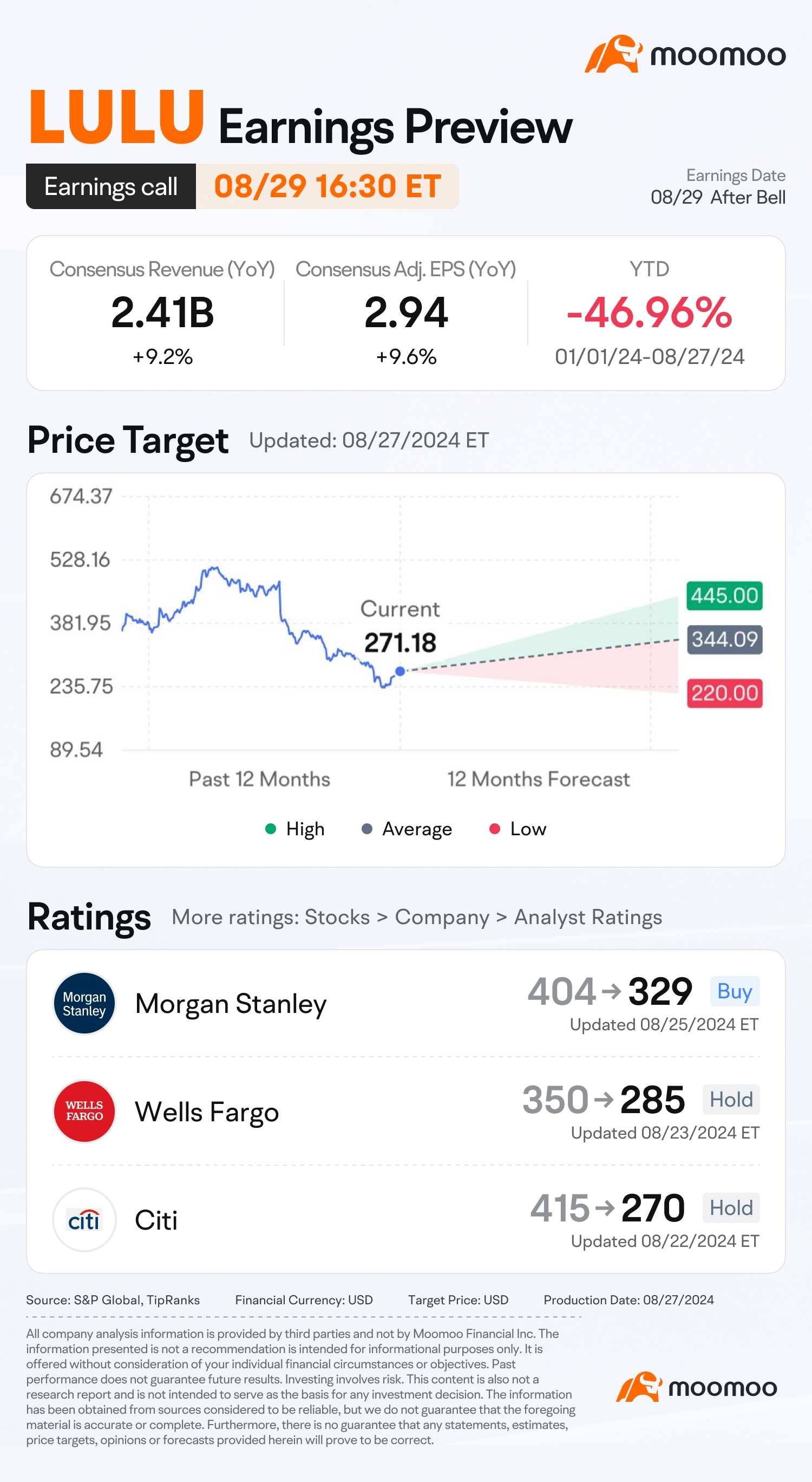

$Lululemon Athletica (LULU.US)$/ $Lululemon CDR (CAD Hedged) (LULU.CA)$ is releasing its Q2 2024 earnings on Aug 29, at 4:30 p.m. Eastern time. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

(Vote will close on 09:29 ET August 30)

Note:

Rewards will be distributed within 5-7 working days after the result's announcement.

Rewards can be used to exchange gifts at the Rewards Club (moomoo app>> Me>> Redeem Points).

The selection is based on post quality, originality, and user engagement.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102362254 : I guess $Lululemon Athletica (LULU.US)$ will open between 270-280 on 30 Aug. Lululemon consistently beat investor expectations with its earnings, averaging a 7.42% surprise over the past year and surpassing revenue estimates for nine consecutive quarters. This growth is driven by strong customer interest in its products and strong online sales. International markets, especially in China and other regions, are key drivers of this growth. Lululemon plans to increase global brand awareness to boost revenue further. Monitoring updates on international sales and online demand are important for future performance.

mr_cashcow : $Lululemon Athletica (LULU.US)$ should be pretty bullish after earnings report due to the following:

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

▲Sustained demand: Continued popularity of athleisure wear and Lululemon's strong brand loyalty

▲Expansion initiatives: Growth in international markets, new store openings, and e-commerce investments

▲Product innovation: Introduction of new products and categories, such as outdoor and footwear

▲Digital growth: Expected increase in online sales, driven by enhanced e-commerce capabilities and digital marketing

▲Operational efficiencies: Ongoing focus on supply chain optimization, inventory management, and cost control

Potential roadblocks & speed bumps ahead:

▼Competition: Intensifying competition in the athleisure market

▼Inflation and supply chain pressures: Potential impacts on margins and inventory management

▼Global economic uncertainty: Economic downturns or recessions may affect consumer spending

Disclaimer: All the above are purely for educational purposes and are NOT financial advice, plz DYOR/DD

CNNT : @Moo Earnings top post in the comment section, or write a proper post?

爱画画的玲 : The stock market is trending downward.

71472786 : .

vim : Increasing buying power and strength in retail, although it all depends on guidance for earnings.

斯似樓阑 : Currently, DKW indicators and CM chip positions both indicate a bearish trend in the stock price, and the indicators have already signaled a put. The performance guidance actually has little to do with the stock price, it still depends on how the market perceives the expectations for performance. If the market believes it is higher than their expectations, the stock price will rise; if it is lower than the market's expectations for the company, even if the performance is good, like nvidia's financial performance, the stock price will still fall. Next$Lululemon Athletica (LULU.US)$ put