Lululemon Q2 Preview: Attractive Valuation Meets Cautious Sales Outlook

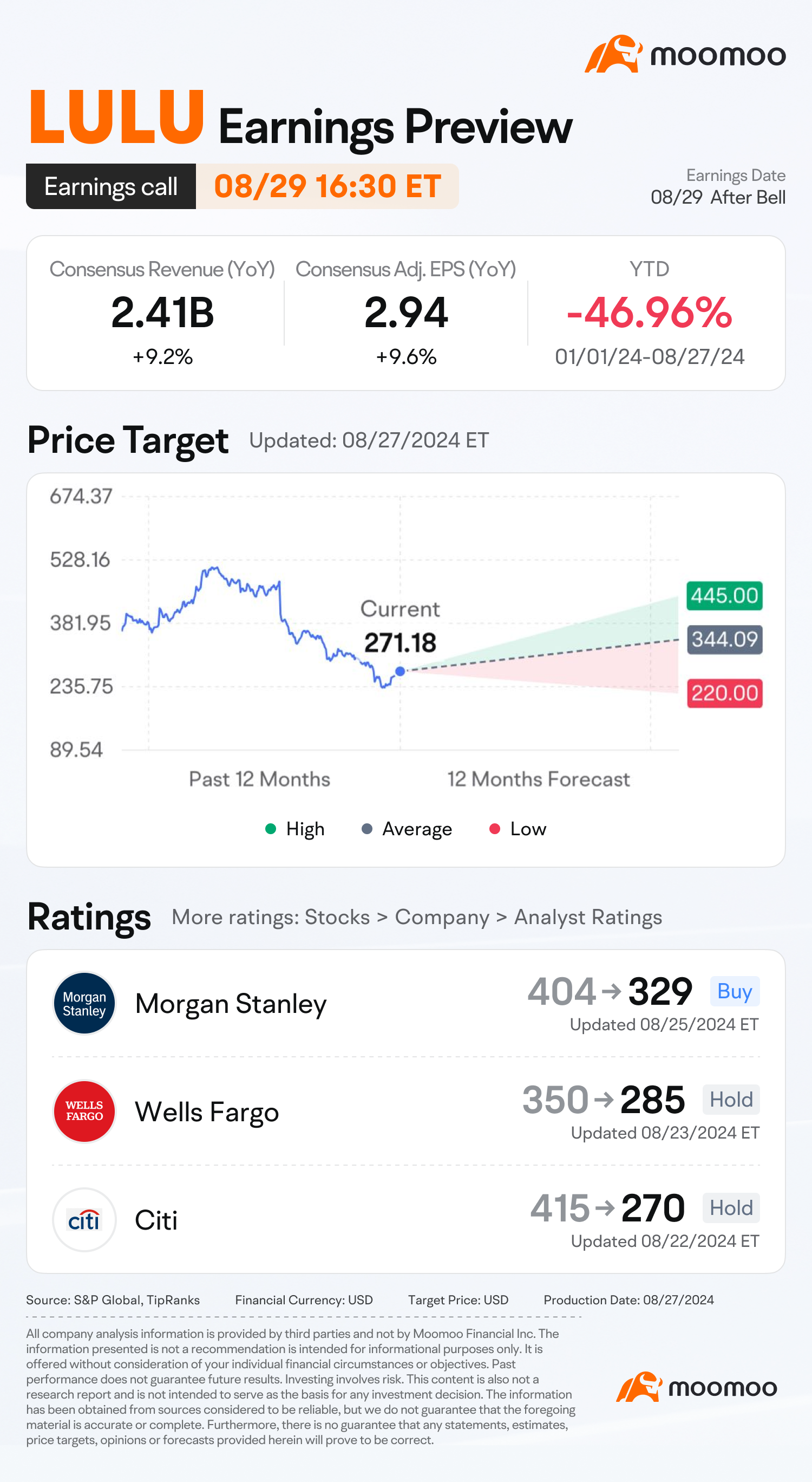

$Lululemon Athletica (LULU.US)$ is set to report the FY25Q2 earnings result on Thursday after the market closes. Analysts hold consensus estimates of a 9.2% revenue growth and a 9.6% adjusted EPS increase compared to the same period last year. Concerns about Lululemon's earnings in a slowing retail environment sent shares to their lowest levels in more than four years, declining 47% from the beginning of the year.

America's Slowing Growth and China's Key Role

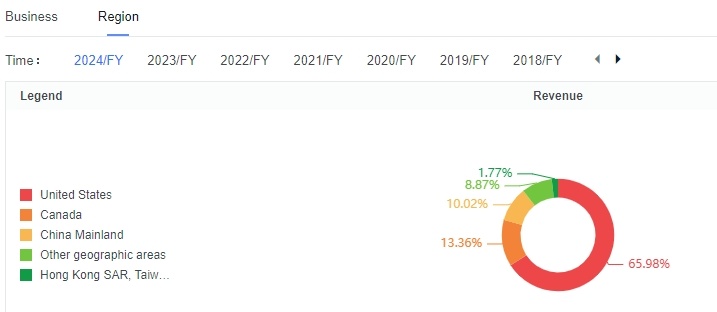

Lululemon's revenue growth in the Americas is projected to continue its slowdown, with anticipated increases of 3.3% in the US and 7.45% in Canada. This trend stems from the brand's rapid expansion in the past few years, which peaked during the pandemic as more people stayed home and participated in indoor activities, boosting demand for home workout apparel. Despite the overall retail uplift during the pandemic, where even competitors like $Nike (NKE.US)$ and $ADIDAS AG (ADDDF.US)$ saw growth, Lululemon's revenue growth in the U.S. from 2021 to 2023 was impressively high at 40.3%, 28.6%, and 11.9%, respectively. However, with the diminishing effects of the pandemic and rising inflationary pressures, consumers are becoming increasingly cautious with their spending, especially on mid-to-high-end apparel.

On the other hand, China is emerging as a significant growth driver for Lululemon, with sales growth expected to exceed 45%. The upcoming earnings report will likely evaluate whether the strong performance in international markets can counterbalance the decreasing demand in the crucial North American markets.

Intensified Competition and Strategic Challenges

Lululemon faces intensified competition and pricing challenges, particularly from brands like Alo Yoga, which has significantly penetrated Lululemon’s market share in leggings by targeting a younger demographic that prioritizes comfort and durability. Vuori presents another formidable challenge, especially in the men's segment, where Lululemon reported a 15% increase in Q1, surpassing the 10% growth in women’s merchandise. Both competitors have strategically positioned their stores close to Lululemon’s, intensifying market rivalry.

Leadership transitions in the Product Officer category could also impact future innovation efforts, especially in the back half of the year. The highly publicized failure of the Breezethrough leggings drew negative attention at a critical time for Lululemon’s growth trajectory. Following customer complaints about the design, Lululemon pulled its latest Breezethrough leggings from the market in July, which led to a 9% drop in its stock price. This incident likely benefitted Lululemon’s competitors, potentially drawing away significant customer segments.

During the upcoming Q2 earnings call, attention will focus on Lululemon’s progress with its "Power of Three x2" strategy and updates on its Breezethrough fabric, which has faced several challenges recently. The "Power of Three x2" strategy is Lululemon’s ambitious plan to double its 2021 revenue from $6.25 billion to $12.5 billion by 2026, supported by innovations in production, enhancements in customer experience, and market expansion.

Attractive Valuation And Shareholder Value

After experiencing a substantial drop of nearly 50% since the beginning of the year, Lululemon's valuation now appears significantly more attractive. Its current price-to-earnings (P/E) ratio stands at just 20.3, placing it in the 2nd percentile compared to its five-year average, according to moomoo. As a premium athletic apparel brand that consistently delivers double-digit compound annual growth in revenue and EPS, and maintains higher profit margins, Lululemon is now valued lower than peers such as Nike and Puma, whose growth rates have largely stagnated.

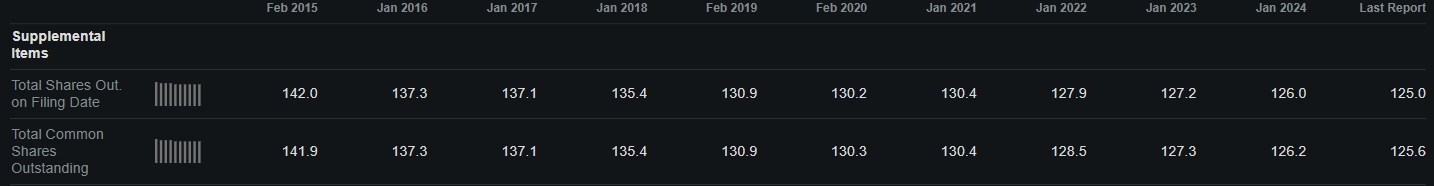

At the same time, The company has demonstrated a strong commitment to enhancing shareholder value, allocating hundreds of millions annually to share repurchases. Since early 2021, Lululemon has reinvested more than $2 billion in buying back shares. As of June 5, it has repurchased over $500 million in shares this year alone, with $1.7 billion remaining in its repurchase authorization. Over the last decade, these efforts have reduced the company’s share count by more than 12%, reinforcing Lululemon's focus on returning value to its shareholders. This buyback strategy, particularly the recent program announced last quarter, has significantly lifted investor confidence.

Analysts have been reassessing their outlook on Lululemon as the company approaches its third-quarter earnings release. Morgan Stanley analyst Alex Straton lowered the firm's price target on Lululemon to $329 from $404 and kept an Overweight rating on the shares. Straton highlighted that he sees room for a Q2 EPS beat and fiscal year guidance raise.

While not an inspiring result in aggregate, it suggests US trends have not necessarily gotten worse (quarter on quarter)," Morgan Stanley said. The firm expects China could represent revenue upside for Lululemon rather than a headwind. "Altogether, while (second-quarter) top-line results may not change the broader narrative, we think they can come in better than consensus forecasts."

On the other hand, Wells Fargo analyst Ike Boruchow lowered the firm's price target on Lululemon to $285 from $350 and kept an Equal Weight rating on the shares. The firm remains cautious on growing concerns including domestic merchandising issues and accelerating competition.

Source: Bloomberg, the Fly, Seeking Alpha

Lululemon 2024 Q2 业绩电话会

Aug 29 15:30

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Laine Ford : maybe money stock

Laine Ford : maybe money stock