Lululemon Q3 Earnings Preview: International Markets Expected to Drive Growth

$Lululemon Athletica (LULU.US)$ is set to release its Q3 earnings on December 5, Eastern Time, drawing significant market attention. Founded in 1998 and headquartered in Vancouver, Canada, Lululemon is a well-known fashion sportswear brand, regarded as Canada's leading professional sports brand, with strong brand recognition in yoga, fitness, and athletic wear.

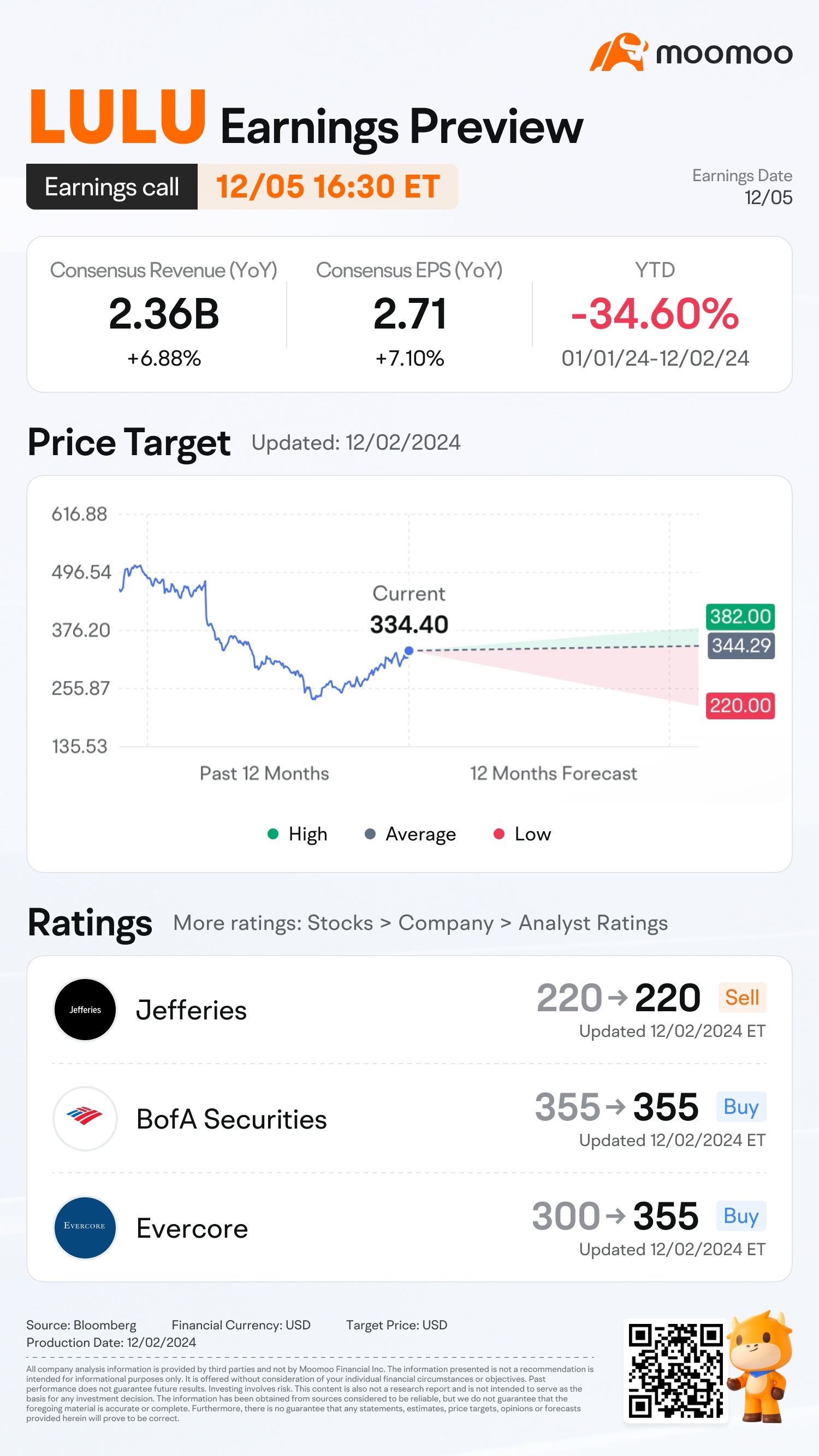

Due to disappointing Q2 performance, with noticeable slowdowns in both revenue and profit, management has lowered its full-year 2024 revenue and earnings guidance, leading to a drop in the company’s stock price, which has fallen approximately 35% year-to-date as of December 2.

As a result, the market is closely watching Lululemon’s upcoming earnings release, especially regarding the company’s future growth drivers. According to Bloomberg consensus estimates, Q3 revenue is expected to reach $2.356 billion, with a Non-GAAP diluted EPS of $2.71.

1. Market Segmentation: International Markets Continue to Drive Growth

The Americas remain the largest revenue contributor, while Mainland China is the fastest-growing market. In its Q2 2024 earnings report, released at the end of August, Lululemon reported a 7% year-over-year revenue growth to $2.4 billion, slightly below expectations. Of this total revenue, the Americas accounted for $1.7 billion (73% of total revenue), with a 1% year-over-year increase, while Mainland China and other international regions saw net revenue increases of 34% and 24%, respectively, contributing to the remaining 27% of total revenue.

Figure:Q2 2024 Company's Net Revenue Year-over-Year Growth by Region

The company anticipates reaching $12.5 billion in revenue by 2026, with international market expansion being a key growth lever. As part of its “Power of Three ×2” growth strategy, international revenue is expected to double from 2021 levels. For Q3, Lululemon’s international business is expected to continue its strong growth, driven by several factors: 1) Continued expansion in Mainland China, with more stores opening and further enhancement of e-commerce channels. 2) Ongoing product innovation to increase product appeal. 3) Brand marketing activities aimed at expanding its reach within communities. 4) Accelerated penetration in Southeast Asia and Europe, with the Paris store benefiting from the upcoming Olympic Games.

In contrast to international markets, growth in the Americas is relatively sluggish. In Q2, comparable sales in the Americas declined by 3%, while comparable sales in Mainland China grew by 21%, and other regions saw a 17% increase. With the U.S. and Canadian consumer markets remaining weak, the Americas market is expected to face continued growth challenges in Q3.

Figure:Q2 2024 Company's Comparable Sales Year-over-Year Growth by Region

Lululemon still has significant growth potential in international markets. Though it gained more market share than any other brand in the industry, it currently holds just 1% of the $650 billion global premium athletic-wear market and has a retail presence in over 25 countries.

2. Channel Performance: Physical Store Revenue Growth Outpaces E-commerce

In addition to international market expansion, Lululemon’s “Power of Three ×2” growth strategy leverages investment in physical stores and digital growth to enhance customer experience. In Q2, the company opened 10 new stores, bringing the global store count to 721, with 1 new store in the U.S., 5 in Mainland China, and 4 in other Asia-Pacific markets. Meanwhile, total sales from the store channel grew 11% year-over-year, with store areas expanding by 14%.

Figure:Q2 2024 Number of Stores Open at the End of the Quarter

When broken down by channel, revenue growth from physical stores outpaced that from e-commerce. While physical stores continue to drive growth, the company expects that further improvement of its e-commerce platform will boost digital channel revenue. In Q2, physical store revenue grew 11% year-over-year, while digital channel revenue grew by only 2%. Lululemon plans to increase engagement and conversion rates across both channels through its membership program, which currently boasts about 20 million members. This initiative aims to increase purchase frequency, order value, and customer loyalty.

3. Product Category Focus: Innovation in Women's Apparel and Growth in Men's Sales

The third growth pillar of Lululemon's “Power of Three ×2” plan is accelerating product innovation, with a goal of doubling men's apparel revenue by 2026. Although Lululemon still lags behind key competitors like Nike and Adidas in the men's activewear segment, the launch of new products is helping to build brand credibility. New lines such as Zeroed In, Steady State, ShowZero, and Soft Jersey, along with the expansion of men's footwear and the Pace Breaker collection into jackets and pants, will further strengthen the brand's market position. Additionally, the launch of the men’s leisurewear line in collaboration with DK Metcalf and Odell Beckham Jr. is expected to raise brand awareness.

In terms of women's innovation, Lululemon continues to make strides, as women's apparel remains the company’s largest market, contributing over 62% of overall revenue growth. By offering more color options and smaller sizes, Lululemon aims to attract younger customers. The reintroduction of the Breezethrough fabric also presents additional opportunities. During the Q2 earnings call, management revealed plans to introduce a new high-performance fabric in the Wunder Under collection and release an upgraded version of the Chargefeel footwear line.

4. Profit Margin Under Pressure

Lululemon expects its gross margin to decline by 20 basis points in 2024 due to lower sales and higher shipping costs, with price reductions expected to remain consistent with the previous year. Investments in the distribution network, including new facilities in Los Angeles and expansions in Columbus, Ohio, and Toronto, may also put pressure on margins. The company is particularly focused on inventory management to maintain healthier stock levels. In 2023, inventory decreased by 9% compared to the previous year, while sales grew by about 1%. With easier year-over-year comparisons, inventory levels are expected to rise in the second half of the year.

In Q2, gross margin increased by 80 basis points, primarily driven by lower product costs, which boosted product profitability. However, this growth was partially offset by higher occupancy and depreciation costs, increased distribution expenses, and foreign exchange headwinds, while price reductions remained in line with the previous year.

Management expects diluted EPS of $2.72 for Q3 and $14.05 for fiscal year 2024. Additionally, management provided further guidance for the 2024 fiscal year, forecasting a 20-basis-point decline in gross margin and a 10-20 basis point decrease in operating margin, with sales, general, and administrative expenses expected to remain in line with last year.

5. Summary

Lululemon is set to release its Q3 earnings report on December 5, with the market closely watching its future growth prospects. Following weaker-than-expected Q2 performance, the company has lowered its full-year revenue and earnings guidance, resulting in a 35% drop in its stock price year-to-date.

In terms of market performance, international markets remain the primary growth driver, particularly strong performances in Mainland China and other Asian markets. Despite growth challenges in the Americas, Lululemon still has significant global expansion potential. When it comes to channels, physical store revenue growth outpaced e-commerce, and store expansion remains a key growth driver. The company is also boosting sales by increasing membership program engagement, further enhancing both online and offline sales.

On the product innovation front, men’s and women’s apparel continue to be core growth areas, with new collections and partnerships with prominent athletes enhancing brand awareness. However, the company faces margin pressures, especially with sales declines and rising shipping costs, and expects gross margin to decrease in 2024. Despite this, Lululemon is optimizing inventory management and continuing to invest in its distribution network to address these challenges.

Overall, the company shows strong growth potential through international expansion, product innovation, and channel diversification, but short-term concerns over slower revenue growth and margin pressure remain.

Source: Moomoo, Bloomberg, Company's filings

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104088143 : Good

73279472 : i