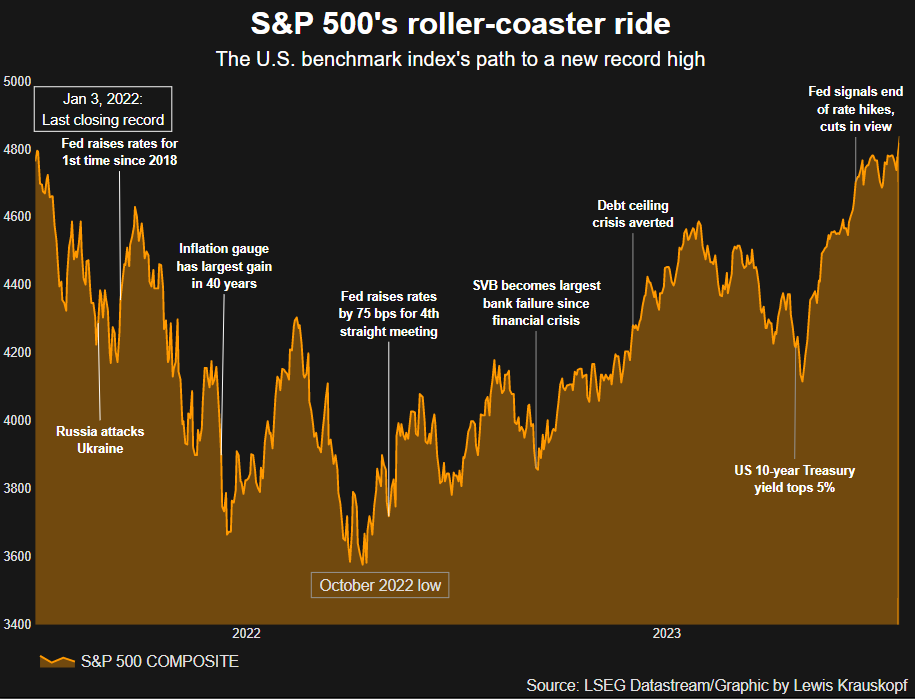

The S&P 500 plunged up to 25% from its zenith, bottoming out in October 2022. Nonetheless, a robust rally ensued in the latter part of 2023, buoyed by signs of significant inflation easing and the Fed's dovish stance, propelling the index upwards. The year concluded with the S&P 500 charting a 24% gain and has since made modest strides in an unsteady commencement to 2024.

151345481 : If Strong 7 collapses, when the market rebounds again, it will still be Strong 7 that will lead the rise in stock prices. So don't know what the analysts are worried about.