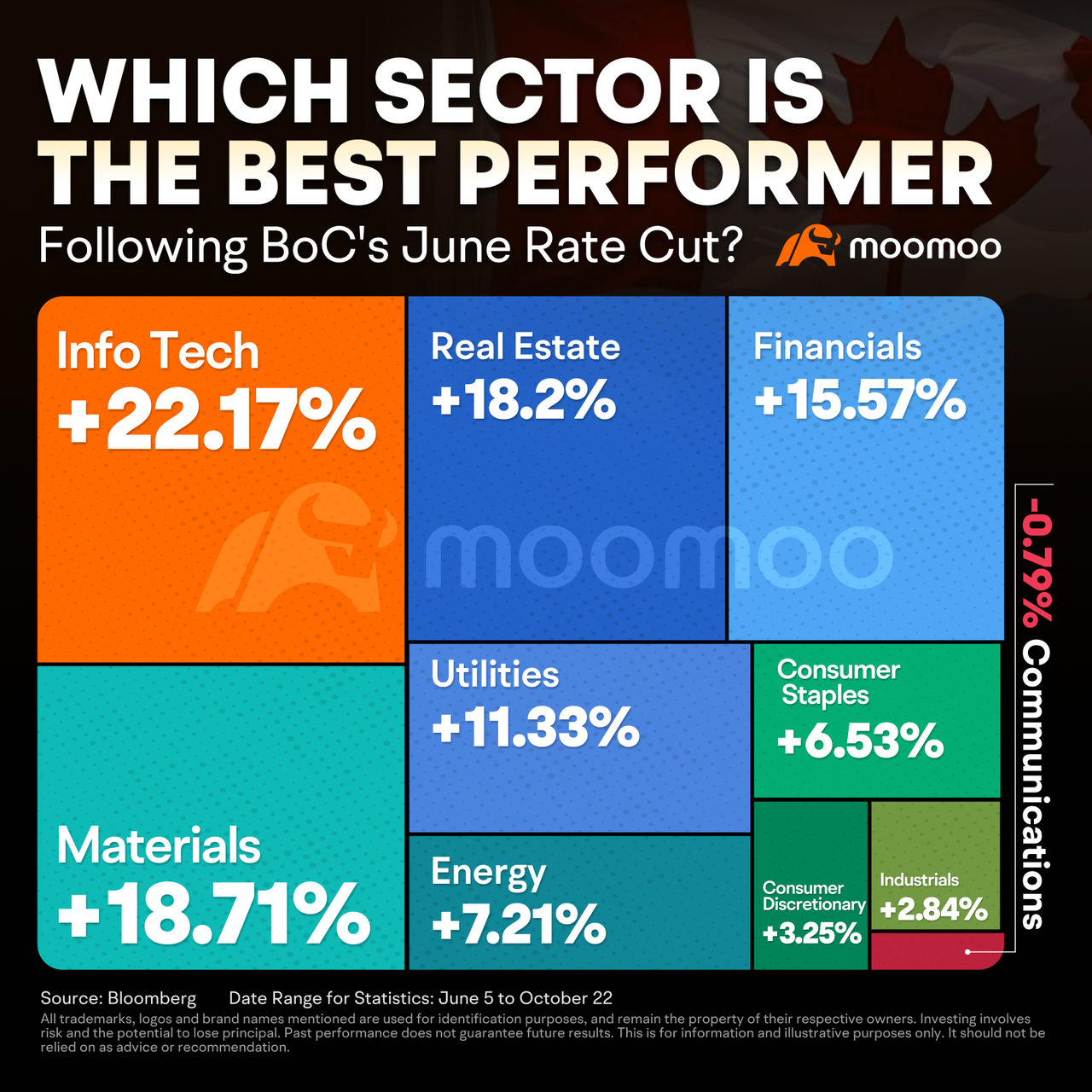

On Wednesday, the Bank of Canada reduced its key policy rate by 50 basis points to 3.75 percent. This substantial rate cut was prompted by recent inflation data, with the central bank shifting its focus from reducing inflation to maintaining its target level. This decision represents the fourth consecutive cut by the central bank since June.

102362254 : Some sectors that could gain from BoC’s rate cut are real estate, consumer discretionary, and utilities, as well as growth and dividend stocks. On the upside, borrowing for things like mortgages and loans gets cheaper, which might boost spending and investments. But on the downside, savings accounts n fixed-income investments could offer lower returns, and inflation might rise

HenryRen049 : real estate is definitely waiting for the interest rate lowering. it will incentivize the whole industries like construction, mortgage, renovation, landscaping etc

༺近战法师༻ : real estate definitely. contruction company is awaiting for lower rates to start contruction and buyers are waiting for lower moetgages rates

COCO 2024 : Agreed . The real estate industry is definitely waiting for interest rate reductions. This will stimulate construction, mortgage loans, renovations, landscaping, and the entire industry

. The real estate industry is definitely waiting for interest rate reductions. This will stimulate construction, mortgage loans, renovations, landscaping, and the entire industry

dimonoid : 1) Tech mostly

2) Lower rates will cause inflation, everything including stocks will rise, what will cause capital gains as a disadvantage

Meme_Short_Queen : REIT will be on the rise soon. Utiliiwill catch up

爱画画的玲 : Real estate will definitely benefit from low interest rates.

Fenglinshanhuo : Anything that is supported by loans for business will directly benefit, and the indirect beneficiaries will be even wider.

mr_cashcow : Bank & REITS stocks are sure to benefit from the rate cut and chain reactions from it

Living Stone : Rate cuts benefit borrowers and investors, and are not so good for lenders and savers. Some dividend paying stocks will benefit such as REITS, banks, energy and utilities because they can more easily borrow money to make purchases, expand operations and grow. Materials and gold also seem to do well in addition to the ever popular tech stocks.

For my long term investments I have mainly dividend paying stocks mostly because there are so many stocks available I chose to narrow it down to dividends for passive income. Thus the rate cut could be an advantage for me there.

On the other hand I have some savings in GICs which apparently could be a disadvantage, although I locked them in before the rate cut so I should be OK and will just reposition as they come due.

View more comments...