🎁 Maple Market Challenge 5: How would you rank the Magnificent 7 Stocks?

Hi, mooers!

![]() Welcome back to Maple Market Challenge! We'll throw a couple of easy questions about Canadian/US stocks each week. Think over what's happening with the markets, different sectors, and news that might make waves.

Welcome back to Maple Market Challenge! We'll throw a couple of easy questions about Canadian/US stocks each week. Think over what's happening with the markets, different sectors, and news that might make waves. ![]() All you need to do is pick an answer or drop us a line with your thoughts. It's that simple! Then, come back the next day for the answer and to see if you've earned 20 points for being right.

All you need to do is pick an answer or drop us a line with your thoughts. It's that simple! Then, come back the next day for the answer and to see if you've earned 20 points for being right.![]() Learn more about Maple Market Challenge>>

Learn more about Maple Market Challenge>>

![]() Now, brace yourselves for today's quiz!

Now, brace yourselves for today's quiz!

Mag 7 stocks Q2 earnings are in full swing! $Amazon(AMZN.US)$ is scheduled to release earnings after the market closes on August 1. EBIT is expected to increase 17% in Q2 and 10% in Q3, driven by enhanced profitability in North America and the rapid expansion of Amazon Web Services:

Check this out to find the correct answer.

![]() Bonus question: Share your thoughts and earn extra points!

Bonus question: Share your thoughts and earn extra points! ![]()

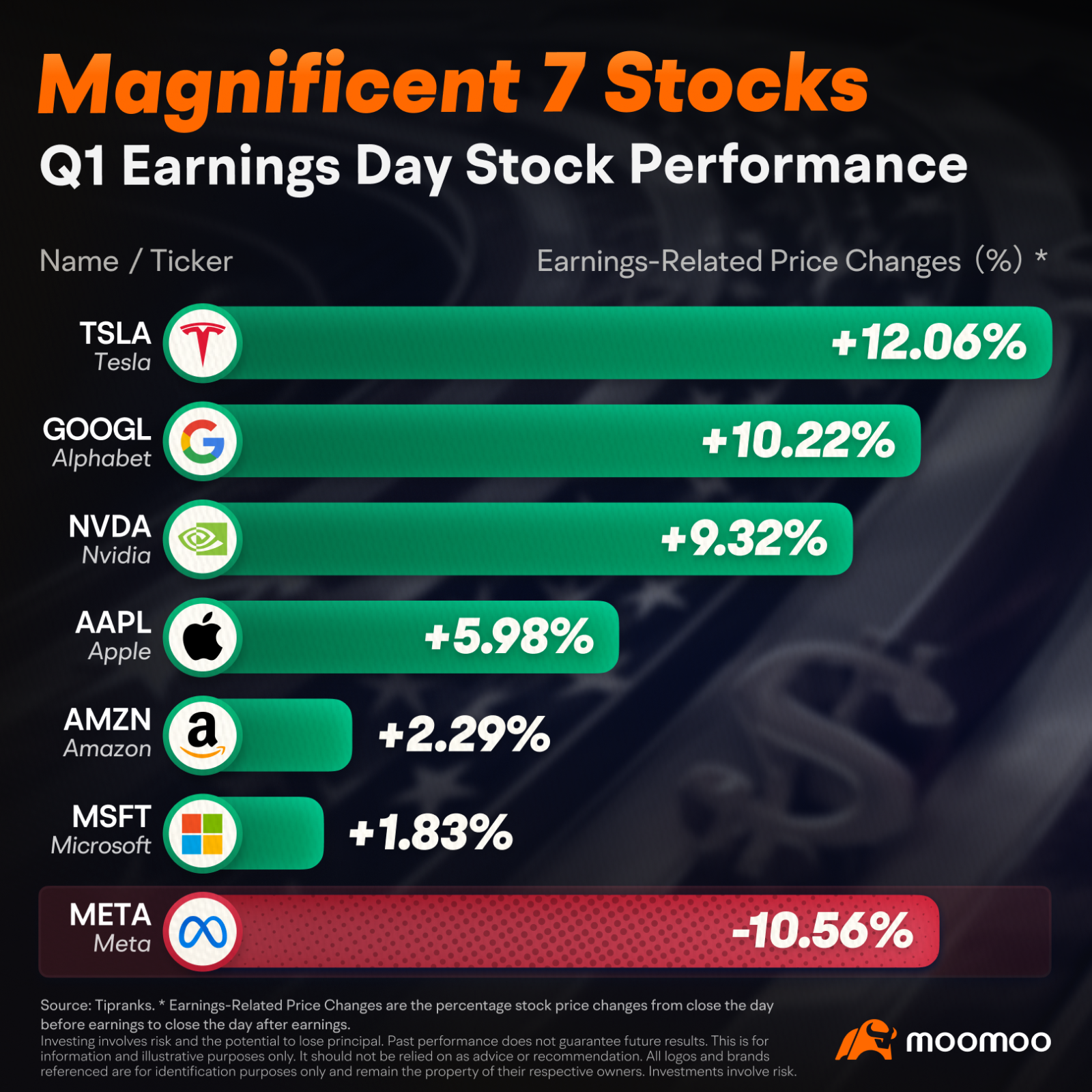

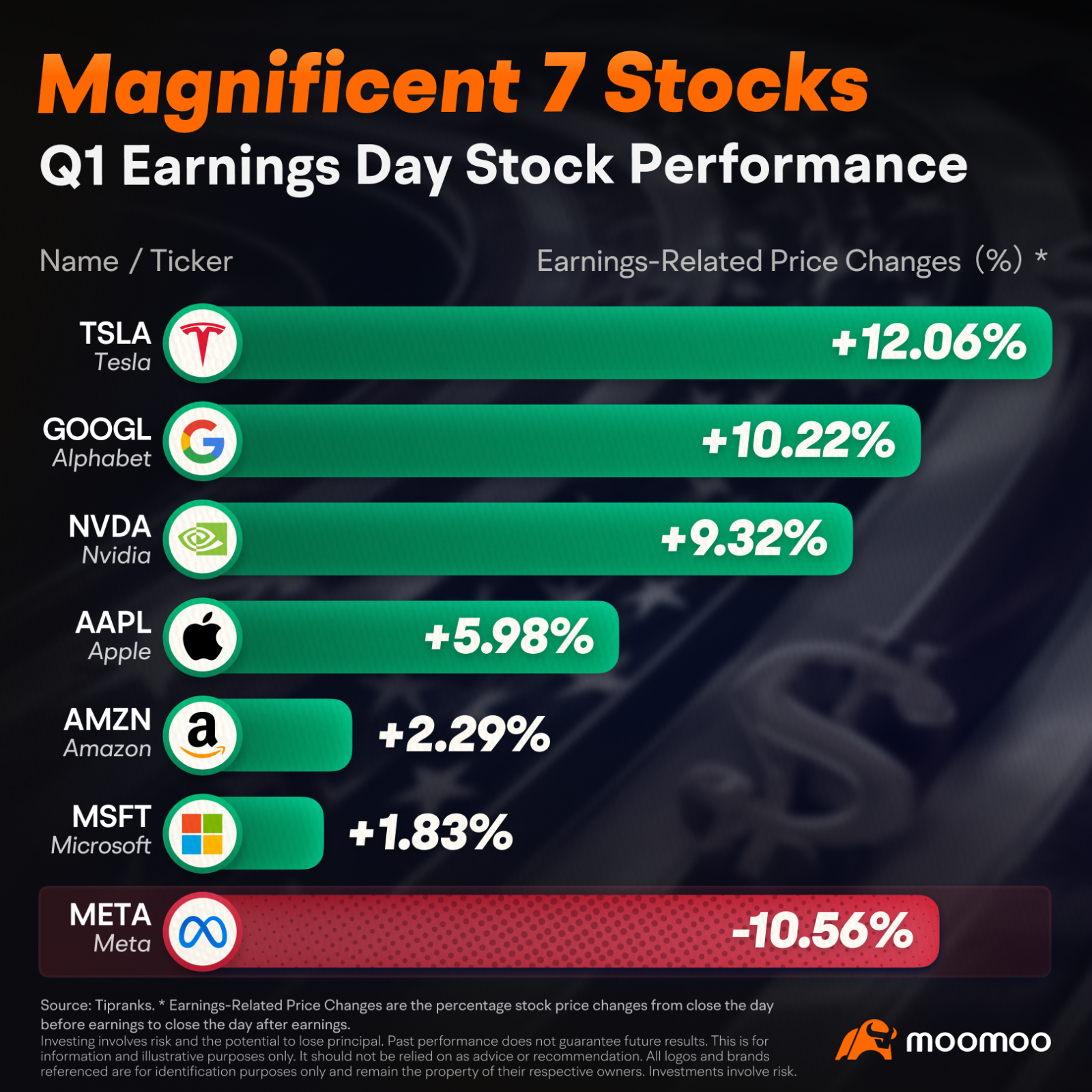

How did the Magnificent 7 perform in Q1?

The Magnificent 7 collectively account for 29.1% of the $S&P 500 Index (.SPX.US)$ and 40.5% of the $NASDAQ 100 Index (.NDX.US)$ as of the end of April 2024. Their stock price movements are likely to influence the overall market direction. Here’s a closer look at their Q1 2024 performance:

How did the Magnificent 7 perform in Q1?

The Magnificent 7 collectively account for 29.1% of the $S&P 500 Index (.SPX.US)$ and 40.5% of the $NASDAQ 100 Index (.NDX.US)$ as of the end of April 2024. Their stock price movements are likely to influence the overall market direction. Here’s a closer look at their Q1 2024 performance:

$Microsoft (MSFT.US)$, standing as the most valuable American company as of May 28, 2024, boasts a market capitalization of $3.2 trillion. Despite its substantial size, the corporation is experiencing ongoing expansion. In Q1, its total revenue reached $61.86 billion, indicating a 17% increase compared to the previous year, while net income surged to $21.94 billion, marking a 20% rise. This growth was predominantly fueled by its cloud division, witnessing a 21% uptick in Intelligent Cloud revenue to $26.7 billion, along with a 31% increase in revenue from Azure and other cloud services.

Looking ahead to Q2, will Microsoft (MSFT) maintain its position at the helm? Who will perform best? Share your rankings and insights in the comment area to earn 50 points!

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

mr_cashcow : The correct ans is cloud computing due to increase growth in web services![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) That said I did enjoy more of their Amazon prime videos such as season 4 of the boys with homelander

That said I did enjoy more of their Amazon prime videos such as season 4 of the boys with homelander![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Yeah the big boys are fighting each other for market dominance but I think each have their own uses and applications. I doubt $Microsoft (MSFT.US)$ will lose their lead unless there is any surprises from the other competitors

102362254 : Q1: Cloud computing.

Amazon streamlined operations with cost cuts and layoffs, boosting profitability.

Bonus: Yes. In Q2, Microsoft is still strong in cloud with Azure. Innovation, partnerships, and a solid customer base matter, but they face competition from AWS and Google Cloud.

Ace74374147 : Amazon

lan Zhang4 : amzn

lan Zhang4 : Amazon cloud computing

Meme_Short_Queen : Microsoft is already down after hours due to deceleration in Azure growth, I think the AI hype has peaked, the bloodbath is now commencing!

༺近战法师༻ : cloud computing

bonus question

microsoft will not lose its market share, at least not in the long tern. MSFT is a giant player and will be the first to transform the ai play into cashflow due to the ai applications of their ecosystem suite of products. Compared to unknown apps not yet available in the marketplace, MSFT has a much higher chance of succeeding

COCO 2024 : Amazon cloud computing

Moomoo CA OP :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) E-commerce and advertising had a strong showing in Q1, which investors will be keen to see continue this quarter. Only 6% of mooers chose the correct answer, did you? For the mooers who got the right answer, you’ll receive 20 points soon!

E-commerce and advertising had a strong showing in Q1, which investors will be keen to see continue this quarter. Only 6% of mooers chose the correct answer, did you? For the mooers who got the right answer, you’ll receive 20 points soon! ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Thanks y’all for participating and see you soon!

Thanks y’all for participating and see you soon! ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ChengHoe : Microsoft is gradually improving its cloud service supply capabilities to meet strong market demand, indicating that there may be more growth opportunities in the future. many investment in firm maintains a buy rating on Microsoft and raises its target price to $460