Market Falls Thursday, Producer Inflation Grows, and Tech Pulls Back From Records | LiveStock

Happy Thursday, December 12th. The market fell on Thursday after tech stocks hit all-time highs Wednesday, and inflation in the prices companies pay rose more than expected. Here are the stories you might have missed affecting stocks today:

$Warner Bros Discovery (WBD.US)$ climbed 13%, the highest on the S&P 500 by percentage gain after the firm said Thursday it decided to cut its cable TV business from its streaming and studio operations into two segments, possibly planning for a sale of the declining segment under a more deal friend Trump administration. In August, the firm cut its TV assets by $9 billion over uncertainty.

$Adobe (ADBE.US)$ fell 12%, the lowest percentage decliner on the S&P 500 after the Photoshop company posted earnings that beat but offered first-quarter guidance below expectations, with revenue of $5.63-$5.68B compared to conses for $5.7B.

$Ciena (CIEN.US)$ stock was trading higher after the optical networking equipment company missed earnings for the quarter but issued upbeat guidance Thursday morning. For its fiscal fourth quarter ended Nov. 2, the firm pulled in adjusted earnings of 54 cents, missing estimates for 65 cents. For the current quarter, they see revenue of $1.01B-$1.09B, above estimates for $1B.

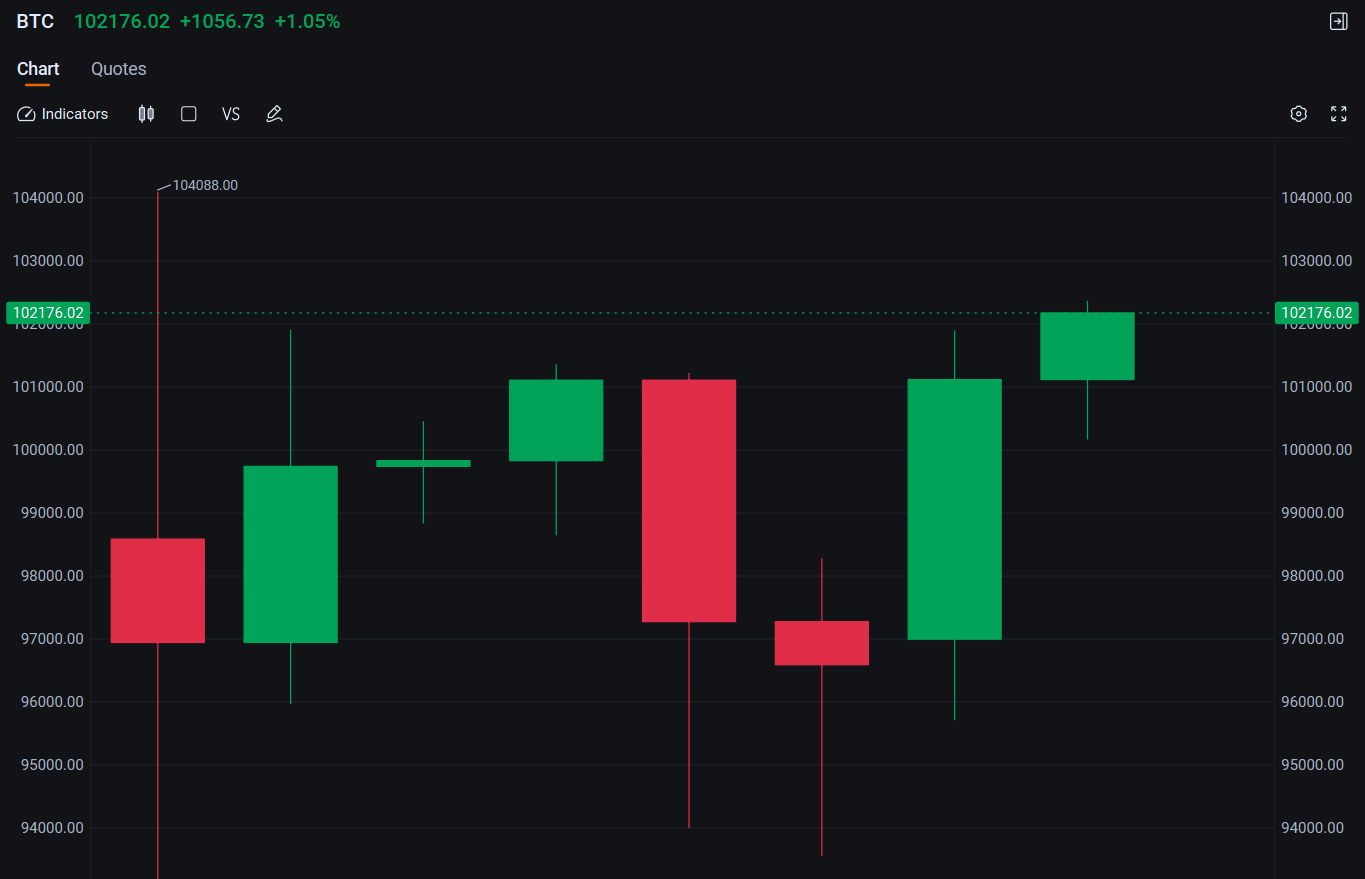

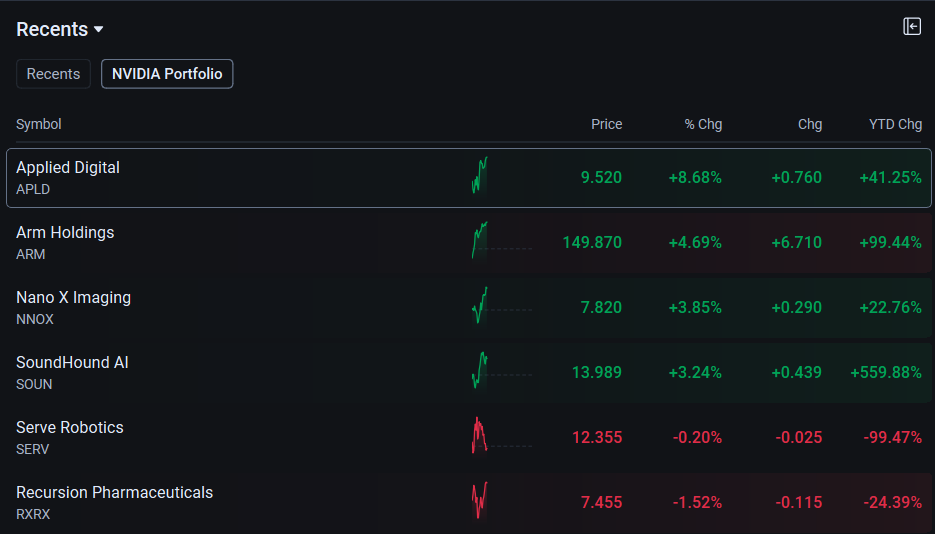

Within industry themes tracked by moomoo, $Bitcoin (BTC.CC)$ a climb over $102k led to a rise in some Bitcoin stocks. Nvidia portfolio companies also climbed higher.

Elsewhere in the economy, $Crude Oil Futures(FEB5) (CLmain.US)$ remained at $69. Gold and silver fell, and treasuries that were not the 2year climbed

Overall, the market was falling after the Nasdaq hit a record over 20k. Past 11:17 am ET the $S&P 500 Index (.SPX.US)$ traded +0.10%, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.01%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 0.12%.

Thursday's macro in numbers showed PPI Wholesale inflation number rose to 3% in October, above estimates of 2.6%. Core PPI, excluding food and gas, climbed 3.4% year over year, above estimates and closer to Wednesday's CPI core numbers of 3.3% that consumers felt.

Yesterday, I met with new moomoo clients at the New York AI Summit Conference! It was great to talk to customers face to face, and learn how they were investing and what features they wanted at moomoo-- there are so many fun things on the roadmap next year!

Want to keep up to date with the market and all its feelings-driven swings, all in under three minutes? Click here to follow the Live Stock Podcast topic. Comment below or in the hot topic for a chance to appear on the podcast! I want to talk about what you are investing in!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Alen Kok : okay

Silverbat : If inflation keeps rising, interest will move higher

Marie Thermidor : Thanks Kevin Travers. You’re rock

BOTAKZERO : i just new on trading apps, i not too much for understand about trading