WE HAVE A WIDE RANGE OF AGES & STAGES ON DECK SO LETS TAWK BOUT

RISK TOLERANCE

* The Long Game

Recognize that investing is often about long-term growth rather than short-term gains. The market can be volatile, and understanding that ups and downs are part of the journey can help you remain patient.

How much RISK can you take⁉️

When it comes to investing, risk and return may come hand-in-hand. If unwilling to take risks, one should not expect returns.

However, it could be dangerous when some only has their eye on the CAGR, ROI & returns while neglecting the risks.

So, how does one balance risk and return⁉️ This depends on how much risk you can take.

Risk tolerance varies from person to person. This is often related to 4 main factors.

• The first factor is age.

A youngin in his prime and a retired senior generally have different levels of risk tolerance.

Young people usually (think they) have a longer timeline to recover from their losses.

Therefore, they may be more risk-tolerant.

However, many elderly people live off pensions or savings, and may not have other sources of income, which can make them relatively less risk-tolerant.

A commonly cited rule of thumb makes it easier to approach the relationship between age and potentially high-risk assets, such as stocks.

According to this principle, the percentage of stocks people may consider holding is equal to 100 minus their age.

For example, a 30-year-old investor may consider allocating 70% of their idle funds to stocks, while according to this rule, that percentage for an investor aged 70 should be within 30% (this number can be more based on the person’s individual goals and risk tolerance. If their risk tolerance is high and they want to retire soon they can allocate 50-80%+ into the market and other assets with a solid history & CAGR).

However, this formula can be flexible. You can adjust it according to your situation. But, all else being equal, the principle is the older you are, the lower the proportion of your portfolio that you MAY want to consider investing in high-risk assets.

• The second factor is financial status.

For example, if someone is well-off and has no debt and he is also single, then there is a lot less financial burden on his hands. But if he is married with kids, then living expenses are high, and he might struggle to make ends meet.

There is an essential difference between his risk tolerance level in these two situations.

The former is in good financial condition. A slight loss will not affect life. Therefore, the risk tolerance is relatively strong.

The latter's financial situation is already unstable. Losing money on an investment might result in a huge burden on life.

Therefore, the risk tolerance is less.

• The third factor is individual risk appetite.

Everyone has different perspectives on risks.

Some people are conservative even when they are young and well-off. They simply do not want to take any risks, thus they are not the best candidates for high-risk investments.

Some people are more radical. Losing money will not rattle their mindsets. Thus they are willing to take high risks to gain possible high returns.

• The fourth factor is the level of investment knowledge.

The essence of risk is uncertainty. Before investing, you will not know the profits or losses it brings.

If you have done your homework in asset analysis with the right investment mindset, you may become more capable of controlling the investment risks perceived by others as huge uncertainty.

Conversely, you'll be walking a thin line if you choose to invest in financial assets that you don't know much about, especially those involving high risk.

To sum up, the investment risk that you can take depends on your age, financial situation, risk appetite, and investment knowledge. Before investing, we must know our situation, and not act on impulse.

* Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.

- Warren Buffett, Billionaire

Extra Credit:

* ETFs, Longs, Shorts 👈🏽 in that order. ETFs and Longs is the retirement and Generational Wealth. NO funny stuff in the ETFs and the Longs. Shorts is for fun and Free Cash Flow… but can occasionally also hit 2x to 10x plus, if it doesn’t go to 0. Hail Mary.

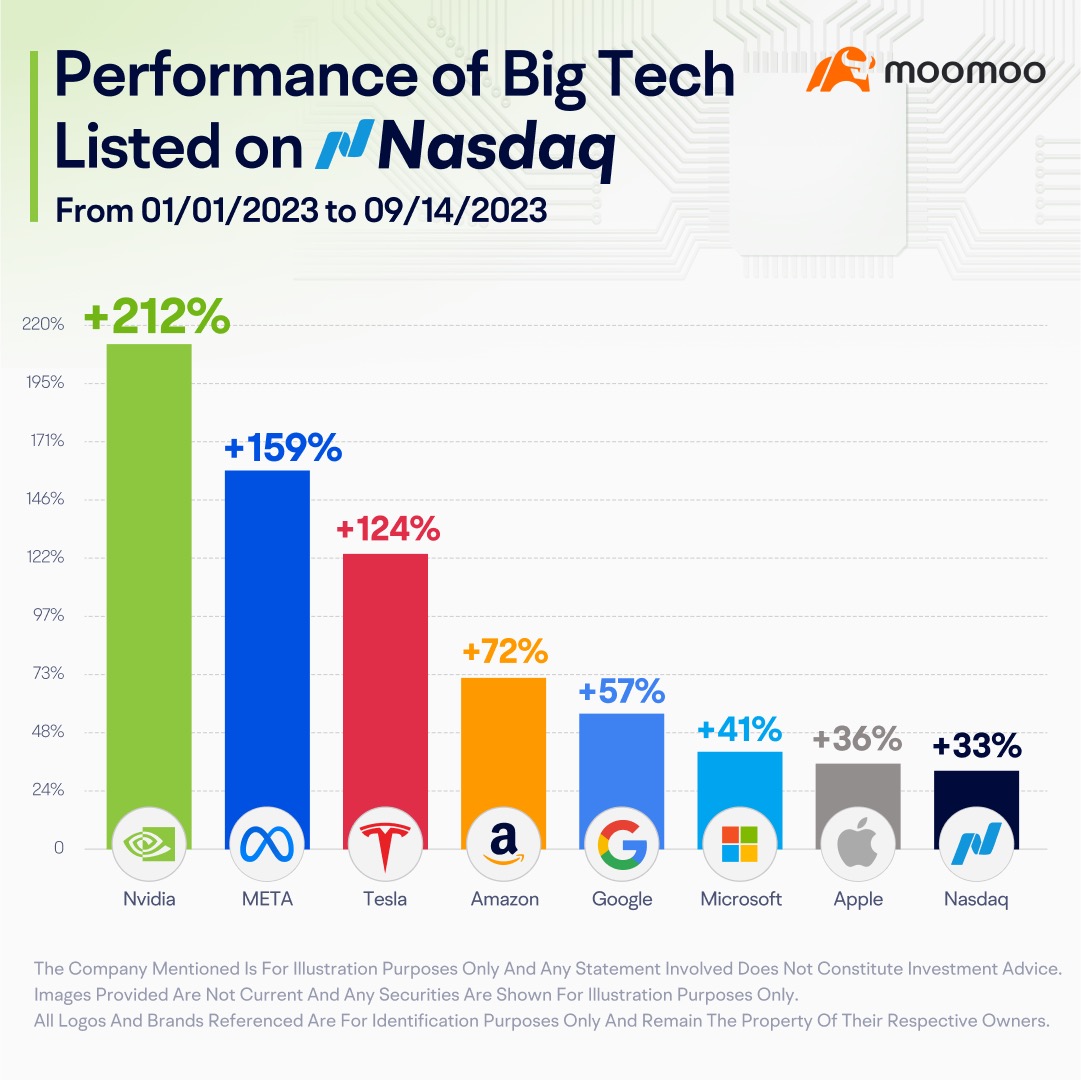

* Only invest LONG TERM in stuff that’s outperforming the market. S&P 500 📈 does 7-10% a year, my ETFs gotta yield or earn the same or MORE on an annual basis, to be worth my time.

* IF you have extremely LOW RISK tolerance consider a CD or money market.

* ONLY deal with shorts if you have the means and risk tolerance. Otherwise stick to LONG TERM STOCKS, ETFs & REAL ESTATE FOR CASH.

Let’s all

Stop 🛑 focusing on a quick buck. Hold, and go long.

Collect Assets at a Discount. DCA either way. Be patient. We Build Wealth.

The compound annual growth rate (CAGR) is the mean annual growth rate of an investment over a period longer than one year.

It's one of the most accurate ways to calculate and determine returns for individual assets, investment portfolios, and anything that can rise or fall in value over time.

= 10 to 100% CAGR or more for All of Our Assets:

Ex:

What does 10% CAGR mean?

CAGR tells you the average rate at which an investment has grown over a specified period.

10% CAGR means the 10% interest you earn every year is first added to your principal investment. And then, on the total amount, you again get 10% return.

Traditional Investing

Buy & Hold

Big Boy Blue Chip

Long Term

#CoachDonnie

For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes discussed here

Remember the following:

🚨 DISCLAIMER 🚨

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

Coach Donnie OP : To those trading hours for dollars you’ll be free soon

you’ll be free soon

your boss and donate your job back to the economy

your boss and donate your job back to the economy

Date *

Date * Amount *

Amount *

Date:

Date:

Amount - Passive Income:

Amount - Passive Income:

Net Worth:

Net Worth:

Get ready to fire

In order to do that, knowing the following helps:

Target

Target

Target Net Worth *

• EARN More on the side (side hustles: eBay, Etsy, Lyft, Door Dash, Uber Eats)

• GIVE More (give at least 10% what you earn to God’s Children/those in need)

• KEEP Most of what you earn

• MULTIPLY what you keep by investing

Invest Daily Weekly and/or Monthly until you hit your Goals

• Example *

1. Target

In 20 years @ age 50-55 I need

2. Target

$10,000 a month - $120,000 a year, Passively

3. Target

Take the 10k x 200 ( Rule of 200 ) I need $2 million minimum in order to take care of ALL my expenses, have fun, have funds leftover, give, enjoy FREEDOM, PASS ON THE PRINCIPLE TO THE NEXT GENERATION ($2 Million) & if I want to, make millions

Everything I do has to get me to $2 million ASAP because I know I can get a 6-8% return 120k a year min / 12 and I'll have $10k a month, passively

Then you pass on the $2 million to the Next Generation

Build Wealth and Live off the Interest without having to click in

The interest will be $10k a month minimum you’ll still have $2 million principle

WE DO THIS FOR FREEDOM KINGDOM LEGACY STEWARDSHIP LOVE FAMILY NOT JUST STOCKS STUFF OR MONEY

#Freedom

#CoachDonnie

#GenerationalWealth

#WeDoThisForFreedom

Coach Donnie OP : Faith evicts Fear

Fear knocks at the door

Faith answered

Nobody was there

Coach Donnie OP : This Wealth Blueprint - or something similar - is working for a lot of people

also outlined in the first video I sent you and adjust the numbers for your specific needs

also outlined in the first video I sent you and adjust the numbers for your specific needs

DISCLAIMER

DISCLAIMER

50 - 30 - 20 split aka 50% 30% 20%

Example using $10,000:

5k goes to SPLG

3k goes to FTEC

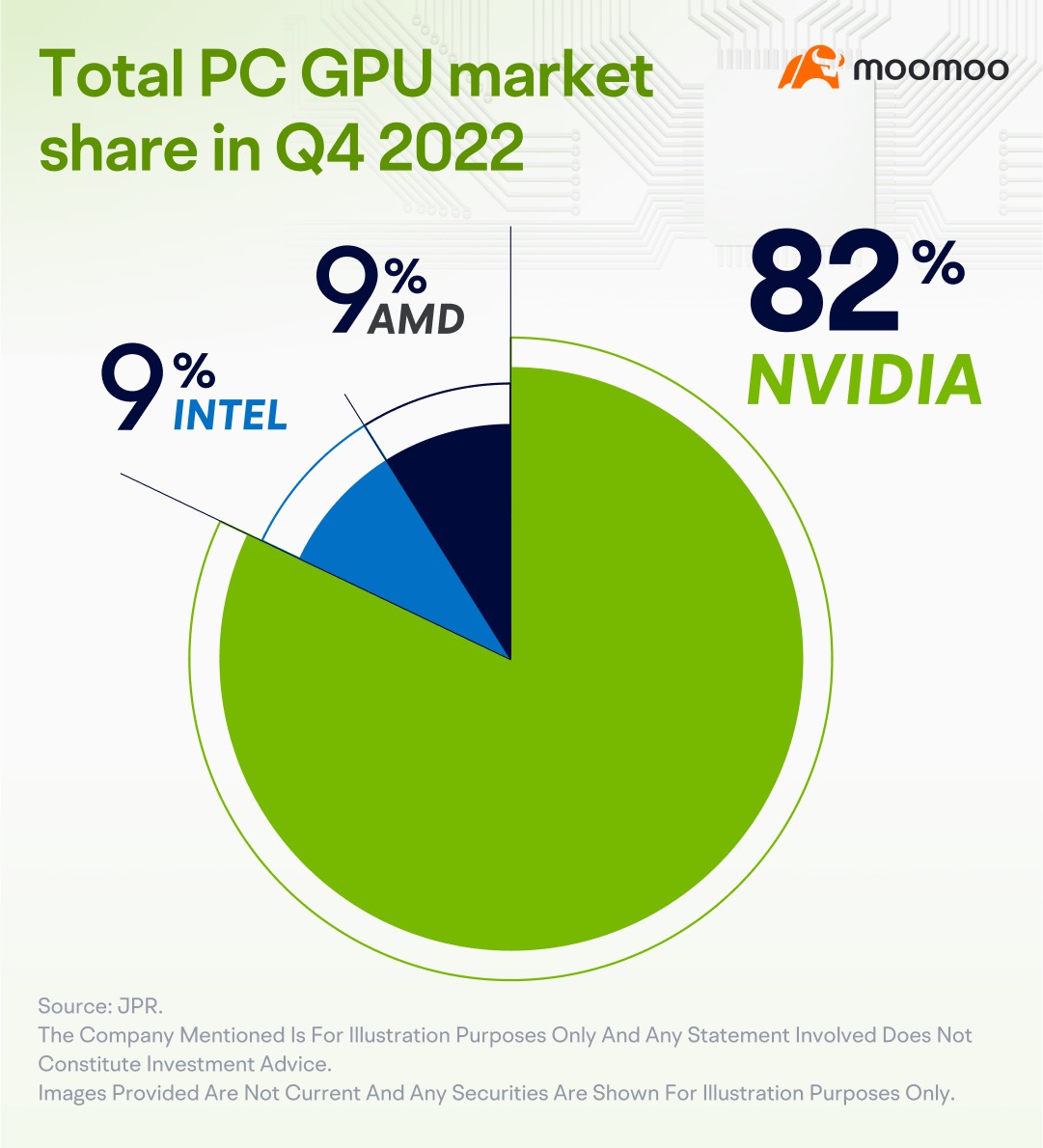

2K goes to Magnificent 7 split equally (TSLA is optional)/and or individual stocks with an amazing 10+ year history such as NVDA MSFT AMZN AAPL GOOGL META etc

You can use that framework above

And/or develop your own Wealth Transfer Blueprint

Whatever you do be sure to pick ETFs that yield 7-10% a year on a 10 year average and or stocks that yield/bring 10-100% a year on a 10 year average

#CoachDonnie

Q: Coach Donnie, are there any Guarantees with Stocks ETFs or the market overall?

• A: Yes. Nothing is guaranteed.

For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes mentioned

Remember the following:

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

Ultratech : sounds like a plan

Coach Donnie OP Ultratech : What part?

Ultratech Coach Donnie OP : I thought the whole thing was

Coach Donnie OP Ultratech : This Wealth Blueprint - or something similar - is working for a lot of people

also outlined in the first video I sent you and adjust the numbers for your specific needs

also outlined in the first video I sent you and adjust the numbers for your specific needs

DISCLAIMER

DISCLAIMER

50 - 30 - 20 split aka 50% 30% 20%

Example using $10,000:

5k goes to SPLG

3k goes to FTEC

2K goes to Magnificent 7 split equally (TSLA is optional)/and or individual stocks with an amazing 10+ year history such as NVDA MSFT AMZN AAPL GOOGL META etc

You can use that framework above

And/or develop your own Wealth Transfer Blueprint

Whatever you do be sure to pick ETFs that yield 7-10% a year on a 10 year average and or stocks that yield/bring 10-100% a year on a 10 year average

#CoachDonnie

Q: Coach Donnie, are there any Guarantees with Stocks ETFs or the market overall?

• A: Yes. Nothing is guaranteed.

For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes mentioned

Remember the following:

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

Coach Donnie OP Ultratech : The comments, the post or both?

Ultratech Coach Donnie OP : well both but mostly the post. I don't know how to read very well though but it seemed like a good plan

Coach Donnie OP Ultratech : Yes indeed , check the comment section as well

View more comments...