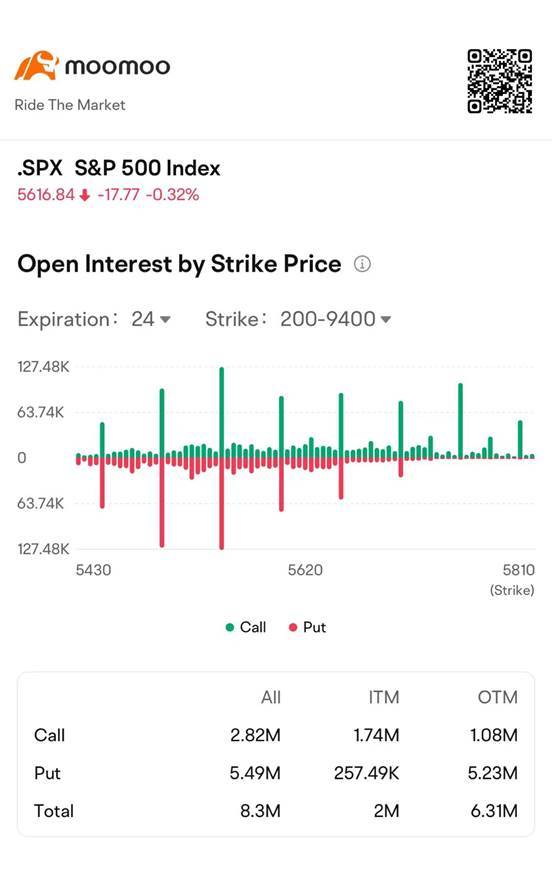

For options expiring within September, open interest is heavily concentrated at strike prices of 5500, 5550, 5600, 5650, and 5700. These "option walls" are significant because they represent levels where large volumes of options contracts are outstanding, indicating potential areas of strong support or resistance.

102125929 : news here.. thanks