Market Reactions to Middle East Tensions: Oil Soars as Stocks Fall

Tensions in the Middle East have intensified once again, as Iran launched hundreds of missiles at Israel in retaliation for the assassination of high-ranking Hezbollah commander Hassan Nasrallah. On Tuesday, U.S. stocks closed lower due to the escalating geopolitical tensions. The Cboe Volatility Index, known as Wall Street's "fear gauge," jumped more than 15%, reaching a session high of 20.73. Investors' appetite is off and capital flew to the bond market. This geopolitical uncertainty has driven yields on 10- and 30-year Treasuries to their lowest closing levels in over a week.

Oil Fueled As Concerns Of Iran's Oil Spplies Disruption

Oil prices surged following the recent incident, with West Texas Intermediate (WTI) for November rising over 5% to nearly $75 per barrel this week. Similarly, the Brent contract climbed more than 3%, reaching $78.56 per barrel.

Analysts in the oil market and geopolitical experts have consistently warned that an Israeli incursion into Lebanon could spark a regional war involving Iran, heightening the risk of crude supply disruptions. Israeli Prime Minister Benjamin Netanyahu asserted that Iran would face consequences for its missile attack on Israel, while Tehran cautioned that any retaliation would result in "vast destruction," raising concerns about a broader conflict. Markets expect that the impact on oil prices will largely depend on the "scope and damage" of any Iranian attack and Israel’s subsequent response.

Iran ranks as the world's ninth largest oil producer. In August, the country produced approximately 3.37 million barrels per day, accounting for about 8% of global oil supply, according to the International Energy Agency (IEA). In a worst-case scenario, the market could lose up to 3.2 million barrels per day if Israel were to launch a full attack in Iranian export facilities and shut down the Strait of Hormuz.

Iran Produce Over 3 million Barrels Per Day

Source: IEA

OPEC Lowered The Global Oil Demand

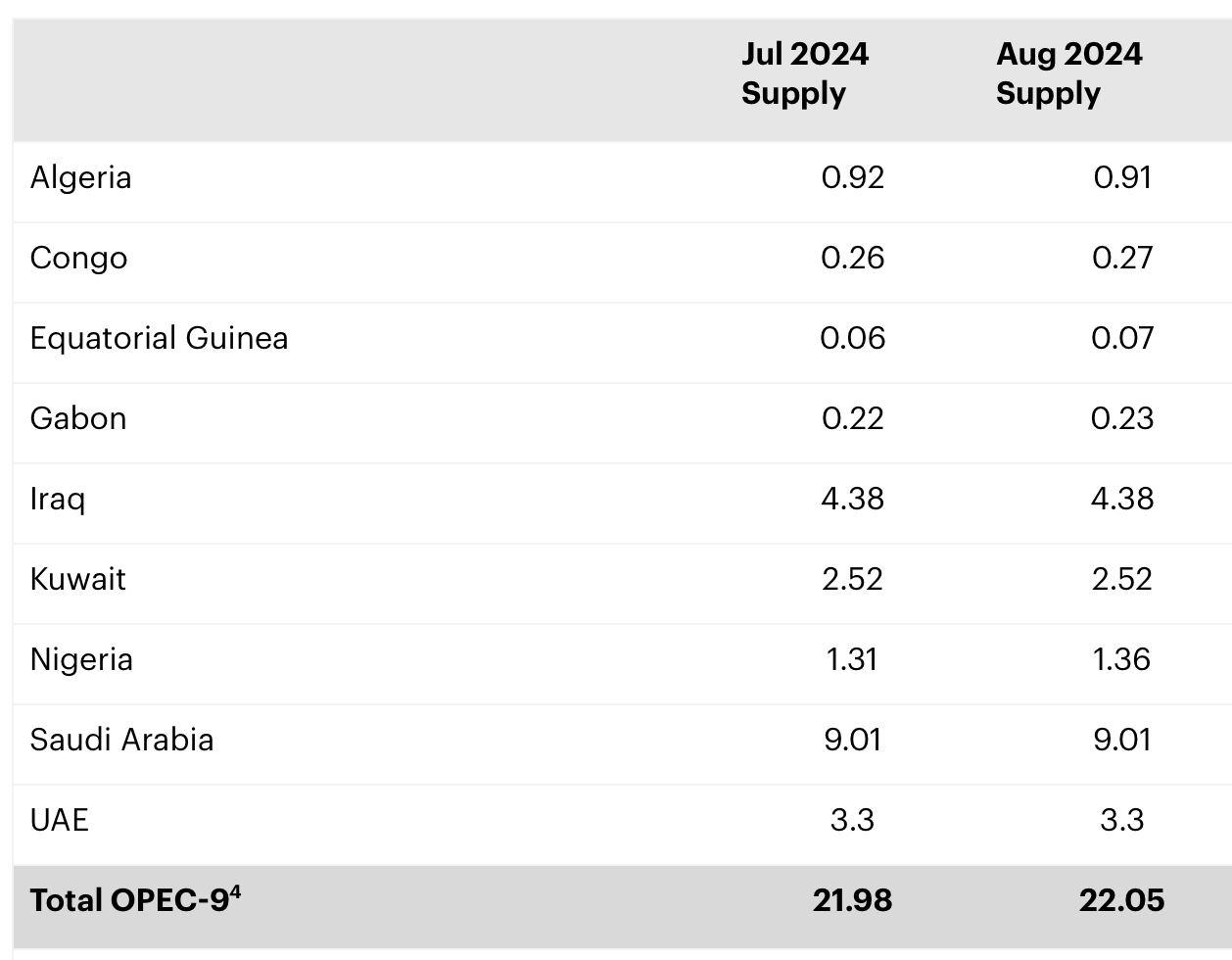

Top OPEC+ ministers met on Wednesday. They have kept oil output policy unchanged, with a plan of start raising output from December, while also emphasising the need for some members to make further cuts to compensate for overproduction.

OPEC have downgraded their forecasts for global oil demand. OPEC projects demand growth this year at just over 2 million barrels per day. The downward revisions are attributed to sluggish growth in China, where a broad-based economic slowdown and an increasing shift toward alternative fuels are negatively impacting oil consumption.

This year, even though there are many reasons that can affect oil prices—from interest rate cuts and the intensification conflict in Gaza to China's bold stimulus annoucments last week - the oil price reaction to these factors appear muted. The outlook of oil prices is still in a state of uncertainty, and markets need to observe the ongoing situation between Iran and Israel.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment