Market review + hold positions (28/10-01/11 2024)

Review of last week👉🏻Market review + current holdings (21/10-25/10 2024)

Market behavior this week:

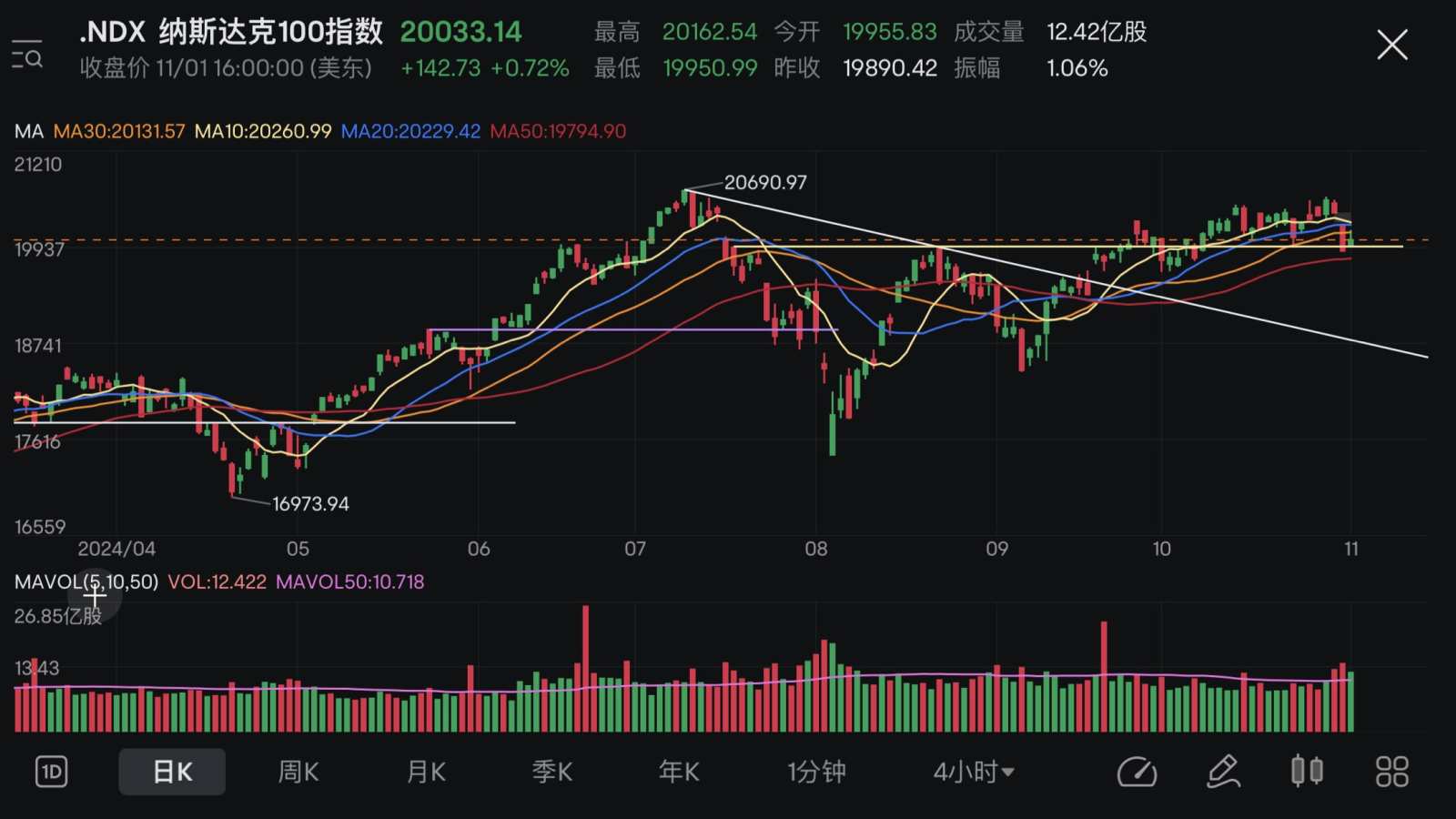

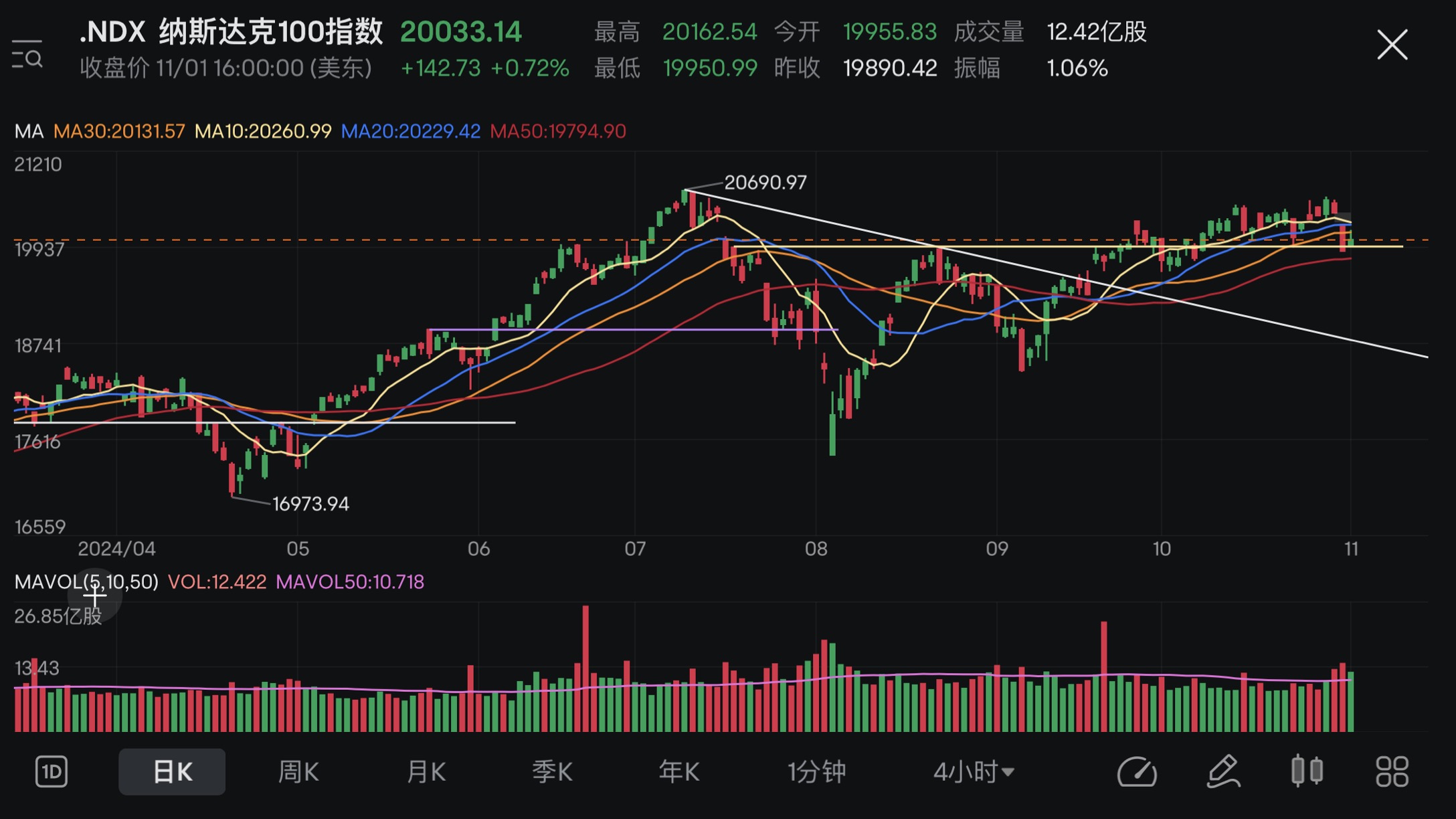

$NASDAQ 100 Index (.NDX.US)$ Tuesday absorbs funds, Wednesday and Thursday distribute;

$S&P 500 Index (.SPX.US)$ Distributions will be made on Tuesday, Wednesday, and Thursday;

$Russell 2000 Index (.RUT.US)$ Accumulation on Monday, distributions on Thursday.

RUT ended up above NDX and SPX.

NDX and SPX experienced a sharp drop in trading volume on Thursday, breaking through three moving averages. Currently testing the 50-day moving average position; RUT is relatively better, with Thursday's low still slightly higher than last Wednesday's low; Traders do not need to search for potential support levels as they are generated by the combined buying power of the market's large capital players; However, the previous day's close price of SPX, especially compared to September 19, is still worthy of reference. Whether the price can close above that level determines the effectiveness of September 19 and recent days.

Weekly charts:

All three indices are currently testing the 10-week moving average. The volatility of NDX and SPX has increased, while the volatility of RUT has decreased compared to the previous week; Most market participants are concerned about major upcoming events in the short term. Traders should not predict unknown events or develop emotional biases. All actions should be based on price feedback, maintaining the long-term consistency of their trading systems.

Breadth:

Although still in the green, the gap is narrowing further. Based on previous data, the SPX price will reach a cyclical bottom at the same time as breadth (August 5th, September 6th).

Weekly notes:

In this week's list of stocks traded internally, the RS of NVDA, PBI, and UPST has slightly downgraded.

Market sentiment:

The AAII sentiment has not changed much compared to last week. The significant drop on Thursday was mainly led by a large number of financial reports. Although there was a slight recovery starting on Friday, there was still selling pressure in the latter half of Friday.

The fear index has returned to a neutral level, with most major branches currently at a fear level.

Current positions:

Among them, CART, BITU, NN, and SOUN were mentioned yesterday.

$NVIDIA (NVDA.US)$ The RS decreased by 1 point this week. If it falls below the 20MA on Thursday, it indicates that its adjustment is not yet complete. We need to see the next adjustment staying above the 50MA to retain this position. Currently, the hard stop loss has been slightly raised again to maintain the rule of riding.

$NuScale Power (SMR.US)$ A profit protection has been done once, and the hard stop loss has been significantly increased, maintaining the rule of riding for free.

$Pitney Bowes (PBI.US)$ The RS decreased by 1 point this week, still no progress. The stop loss remains unchanged, maintaining the rule of riding.

$MicroStrategy (MSTR.US)$ The strongest miner, currently closed below the 10MA for the first time. It can only tolerate a short-term adjustment limit at 20MA. Currently, the stop loss remains unchanged, maintaining the rule of riding.

$Eos Energy (EOSE.US)$ For the names that have been profit protected, this week's closing fell below the 20MA. It is observed that it has been on an upward trend based on the 30MA all the way, so it is more appropriate to track it with the 30MA. Currently, the hard stop loss has been slightly increased, maintaining the rule of riding for free.

$ProShares UltraPro QQQ ETF (TQQQ.US)$ $ProShares UltraPro S&P500 ETF (UPRO.US)$ $Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ Regarding the market dividends traded around September 19 and recent days, it is best to continue holding according to the plan until the recent formation is broken.

$Core Scientific (CORZ.US)$ Profit protection has been done, using the 30MA for tracking. The remaining position's stop loss maintains the balance of profits and losses unchanged, continuing to ride for free according to the rule.

$LexinFintech (LX.US)$ There is still no progress at the moment, the stop loss remains unchanged, follow the rules to ride.

$GE Vernova (GEV.US)$ Profit protection was done very early on, observing that the closing price has never been below the 10-day moving average (10MA), so it is more appropriate to track using 10MA, raising the hard stop loss again, and keeping the rules for riding free.

$Viking Therapeutics (VKTX.US)$ Profit protection has been done, the current stop loss is at breakeven, maintain the rules for riding free.

$Upstart (UPST.US)$ This week's RS decreased by 1, profit protection has been done, the hard stop loss has been raised, maintain the rules for riding free.

$MARA Holdings (MARA.US)$ One of the lagging positions of miners, already cleared 3/5, the remaining will be cleared opportunistically before Christmas.

$Super Micro Computer (SMCI.US)$ The biggest sore spot in the positions, a typical textbook example for traders to learn from 🤭, emphasizing the importance of stop loss. It may never recover, and it may take a long time to recover. Let this 'counterexample' give its own answer over time🙂.

Current cash ratio: 15.51%.

Currently holding 19 names, including:

2 historical legacy hold positions: MARA (-3/5), SMCI;

4 market/BTC leverage etf trades: TQQQ, UPRO, SOXL, BITU;

13 trades within the system,

9 of which have completed profit protection: EOSE (-1/3), VKTX (-1/3), UPST (-1/3), SMR (-1/3), NN (-1/2), SOUN (-1/2), CART (-1/2), GEV (-1/2), CORZ (-1/2);

The remaining 4 still need to prove whether they can stay: NVDA, PBI, MSTR, LX.

"Master the art of not being affected by results.

Set rules, specify what not to do, what not to look at, and what not to know."

Set rules, specify what not to do, what not to look at, and what not to know."

-Yumi

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment