Market Struggles, Earnings Are Not As Hot As Q4 | Morning Moovers

Morning mooers! It is Thursday, Arpil 18th, the market is open and struggling to find direction.

My name is Kevin Travers, it is raining and cold again in Jersey City. Here are you morning moovers today: NOW IN AUDIO FORMAT vvv

MOOVERS

The largest decliner of important relative market cap on the Nasdaq was $Monarch Casino & Resort, a casino stock that posted disappointing earnings Wednesday. It fell about 4%, while $Las Vegas Sandsalso fell 7% on earnings, the largest decliner on the S&P 500.

$UnitedHealthcontinued to pull up the Dow Jones, up 4% after their earnings were not as disappointing as investors feared following a cyber attack.

$Genuine Partspulled up the S&P with its 10% gap up gain after reporting less net income a year earlier, but a higher full year eps forecast.

$Taiwan Semiconductor fell 4% after earnings Thursday morning that showed NT$.90B in year-over-year revenue growth, but not as exciting of an outlook as expected.

SECTORS

In sectors tracked by moomoo, 'Internet Content Services' and 'Semiconductors' faced off with opposing gain and loss.

Internet companies, lead by an 8% jump in $Trump Media & Technology, climbed 0.83%.

Semiconductors, after a 3% industry wide drop after disappointing $ASML Holdingnumbers Wednesday, fell a further 0.84%, lead by a 4% drop in$Taiwan Semiconductor.

RECAP

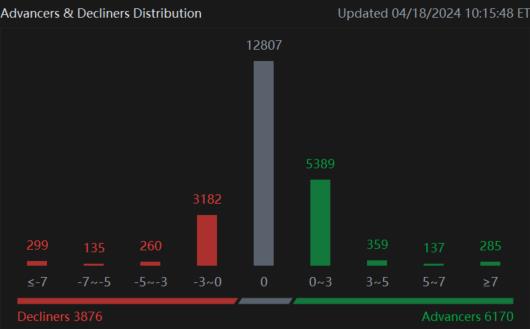

Indexes opened downward for the fifth session in a row, but close to noon trended higher.

The $S&P 500 Index traded +0.53% at 11:32 AM EST. The $Dow Jones Industrial Average climbed about 0.72%, and the $Nasdaq Composite Index climbed 0.50%.

MACRO

This morning saw weekly initial jobless claims stay at the same level as last week, at about 212k. Federal reserve New York President John Williams spoke in the morning and said interest rates were in a "good place," and there was no rush to lower them.

He said raising them would not be his next choice either, but rather keep them in place, and eventually they must come down. The comments come after a myriad of Fed commentary, including the official Beige Book of economic qualitative data from the Feds twelve districts.

Fed's Powel Tuesday warned rates would have to stay in place for longer until the Fed was sure of the results. Thursday morning, the$U.S. 10-Year Treasury Notes Yield climbed to 4.63, up 0.58%, and the $U.S. 2-Year Treasury Notes Yield climbed to 4.98, up 0.70%.

Mooers, what are you watching today? Comment below and I may feature your comment tomorrow!

Source: Bloomberg, Dow Jones, CNBC, Reuters

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

RDK79 : Earnings / economy good… Market struggles. Earnings not as good as Q4 …. Market struggles.

Market does what it wants when it wants, random excuses tolerated. Good luck

RDK79 : PS. Market / DOW is up 300 this morning

Kevin Travers OP RDK79 : 40% of the market movement at least is emotional response my father always said!

Kevin Travers OP RDK79 : Fantastic insight! Can I interview you to share your investing journey with the moomoo audience?

What are you watching today RDK79?

miracle mantarou : Demand for semiconductors will continue in the future, and I think there is no doubt that they are essential products.

I think it has already been factored into stock prices due to expectations due to that fact and announcements in the development competition process, and isn't it heating up slightly too much? I also had the impression that.

Unfortunately, a new conflict (I think this is war) has broken out.

If you're going to invest, be defensible.

Depending on the situation, I think there are investors who will pull it out of the market.

How would you move, Kevin?