Markets Unfazed by Fed Officials' Hawkish Stance, Anticipation Grows for Powell's Speech

As Wall Street began to anticipate Fed rate cuts, the S&P 500 surged higher for a seventh consecutive day, approaching the key 4,400 mark. On November 8th, the Nasdaq 100 also climbed nearly 1%.

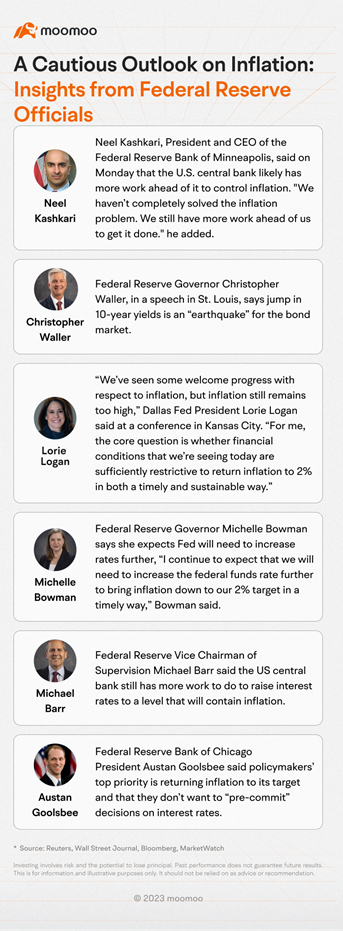

However, Several Federal Reserve officials sent hawkish tones, signaling that Fed inflation fight not over. Officials generally stated that inflation remains too high, and Fed has more work to do to control inflation.

Despite statements from the Federal Reserve officials, market expectations are becoming increasingly dovish. CME FedWatch shows that traders now expect 92 basis points of rate cuts next year, compared with Fed officials' estimate of a half a point of easing for 2024, according to the FOMC dot plot.

The bond market is betting on a "dovish pivot" for the seventh time since the Federal Reserve and other central banks embarked on a tightening cycle, raising the prospect of another false down, according to Deutsche Bank macro strategist Henry Allen.

"The Fed is not thinking about rate cuts right now at all", Fed Chair Powell said after last week's November meeting, the central bank hasn't begun considering a rate cut, and it won't until inflation is brought under control.

Will Powell deliver another "hawkish shock" to the market? Powell will deliver a speech on Wednesday 9:15 am at the Division of Research and Statistics Centennial Conference in Washington, D.C. Powell will also speak at Policy Panel Discussion hosted by the IMF this Thursday. The market expects that Powell's comments may have further impacts on the US dollar and bond markets. Additionally, Powell may reveal some key information on whether investors should expect further interest rate hikes this year to ensure inflation returns to the Fed's 2% target.

Mooers, what are your thoughts on whether interest rates might go up in the future?

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Picholo : High interest rates for too long anyway, time to liquidate assets and begin short trough the end of 2023