Meme-Stock Mania 3.0 Redux? GameStop Call Options Demand Surges

Since Roaring Kitty made a comeback on social media on May 12, triggering a meme mania 2.0, $GameStop (GME.US)$'s stock price soared by 180% in a single day. However, since then, GME's stock price has slumped by nearly 60%, bottoming out on September 19.

Is GameStop 3.0 now in the works? Some options market activity hints at that possibility.

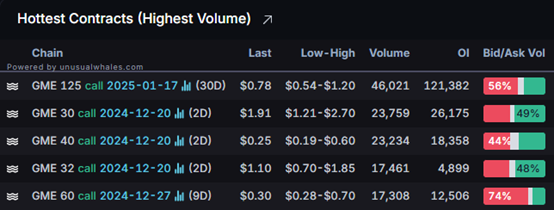

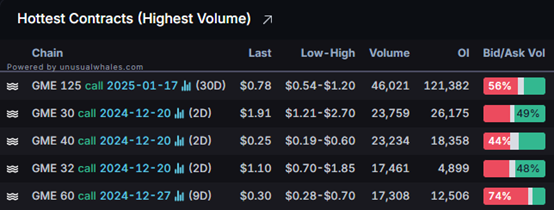

Most notably, near the close on Monday, there was a massive flurry of trades in GameStop calls with a strike price approximately four times the current price, set to expire in a few weeks. These all appear to be new positions, based on the corresponding increase in open interest.

30 days to expiry for a rally in excess of 300%? That’s only happened to GameStop during two periods: the first half of 2021 — the initial meme stock mania and its echo booms — and the meme-stock mania 2.0 that took place in the second quarter of this year.

Additionally, the current Put-Call Ratio is only 0.13, the lowest level since the end of April this year. That coincides with the time when Keith Gill(also known as Roaring Kitty)returned to social media on May 12, and he had begun accumulating a huge call options position in GameStop prior to his comeback.

However, will the surge in demand for GameStop call options be similar to the previous two times?

Currently, the trading volume of GME call options is far lower than during the meme stock frenzy 2.0, when about 700,000 contracts changed hands on Monday (May 13). Not to mention at the peak of the 2021 meme mania, when the most active day that year—January 22—saw 2.2 million contracts change hands. Besides, after releasing its first-quarter results on June 7th, GameStop's options trading volume exceeded 2.3 million.

However, the surge in demand for deep out-of-the-money call options could potentially drive a new wave of increases in GameStop's stock price, so investors should keep a close watch on recent developments.

Source: Barchart, Unusual Whales

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies.Optionstransactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

10baggerbamm : there is no gamma squeeze people need to get over it at this point the level of short interest compared to years ago is a non-event at this point

104088143 : like