Sentiment is mixed for the social media giant that's expected to report a 59% jump in earnings to $4.75 a share in the second quarter, from a year earlier, according to analyst estimates compiled by Bloomberg. Revenue for the parent of Facebook, Instagram, WhatsApp and Meta Horizon, is seen climbing about 20% to $38.3 billion, the estimates show. The company's results are due after the market closes on Wednesday.

catchy2 : $SPDR S&P 500 ETF (SPY.US)$

103539497 : hi

Clement Lemons : okk

104868187 : TQ

On Paris : Good morning

Money Beast Tech : Higher

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

BelleWeather : I think META way ahead in AI. Accumulating shares accordingly.

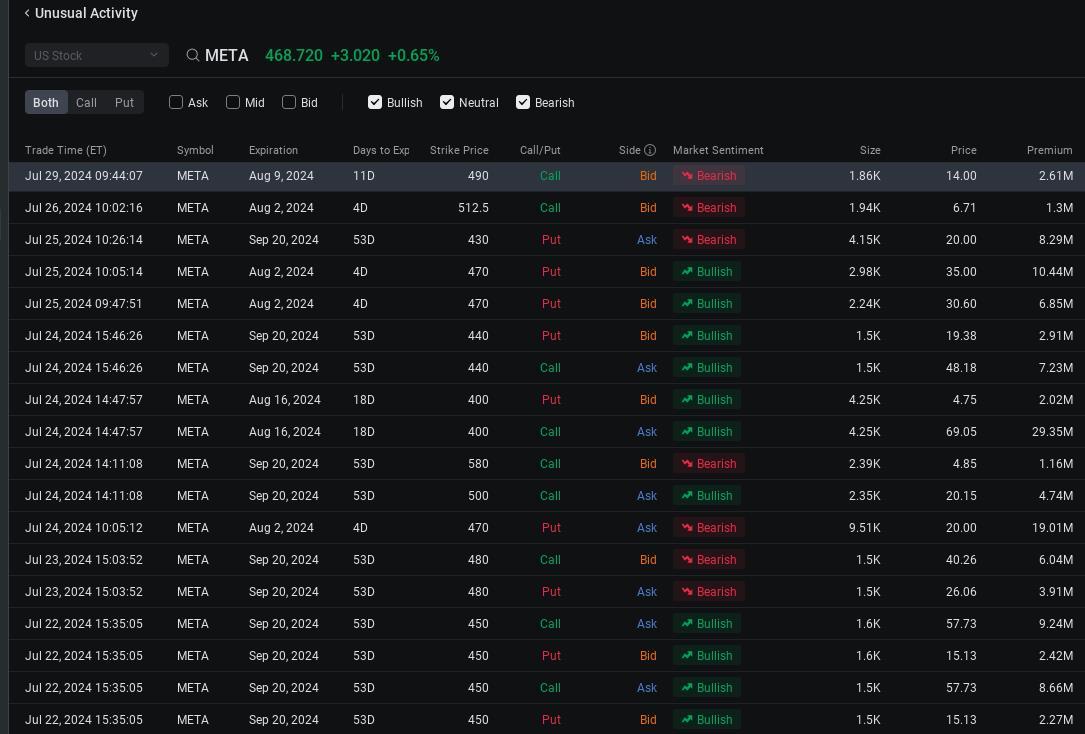

Derpy Trades : After reading "At 9:44:07 a.m. in New York Monday, an unusual bearish trade was posted costing $2.61 million for call options that give the holder or holders the right to buy 186,000 Meta shares at $490 by the end of next week" I stopped reading the rest. Buying calls is anything but bearish.