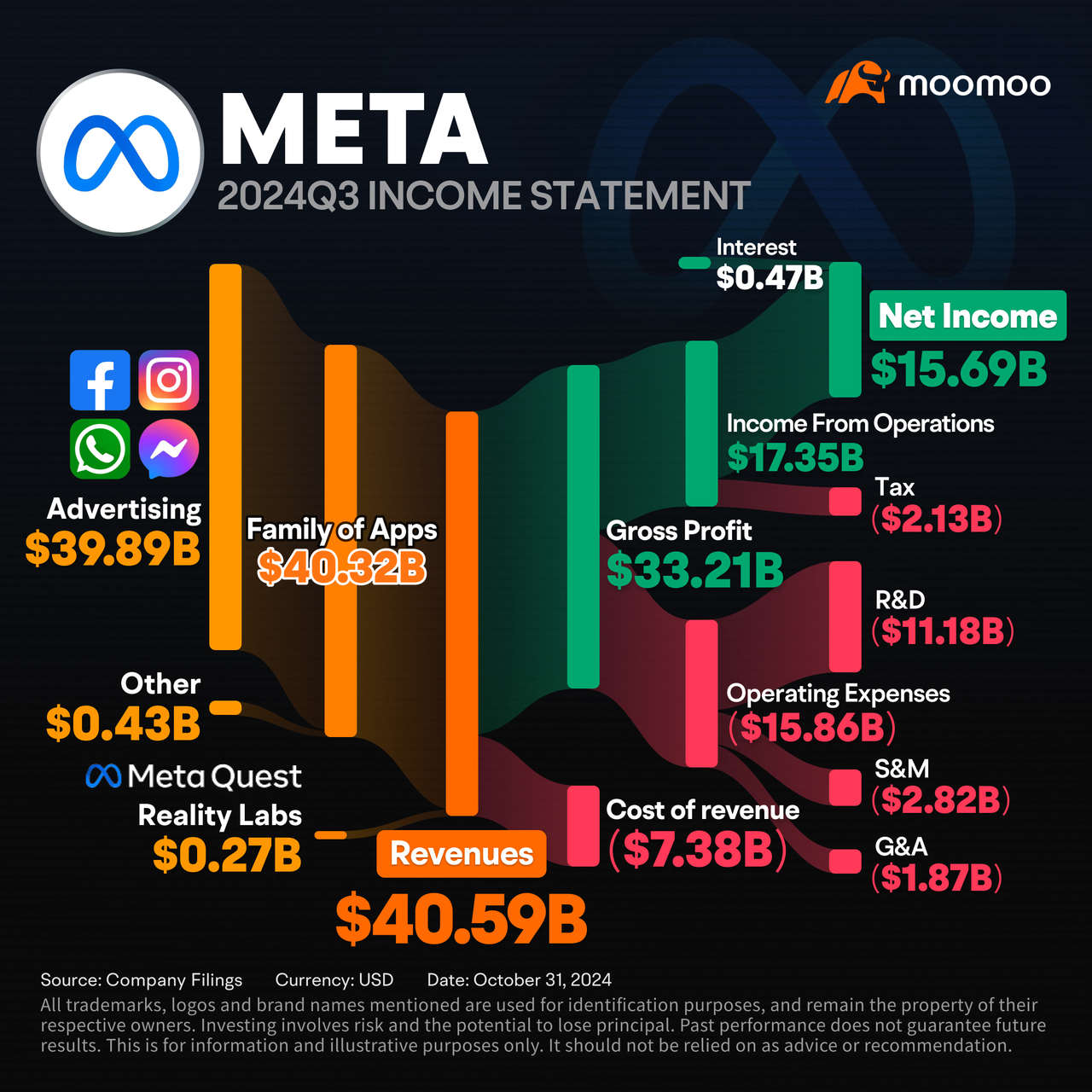

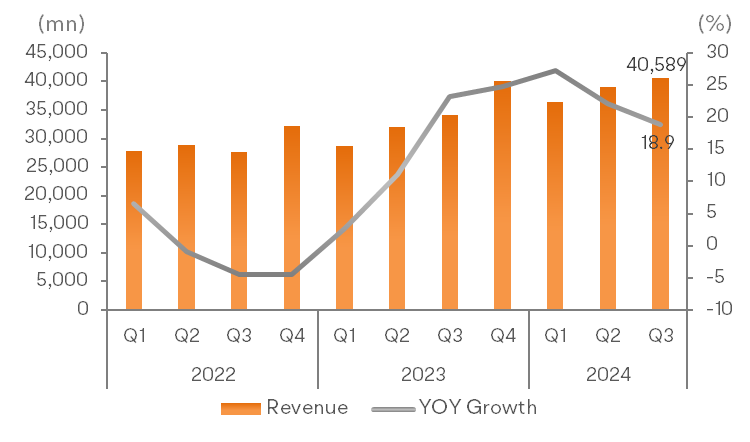

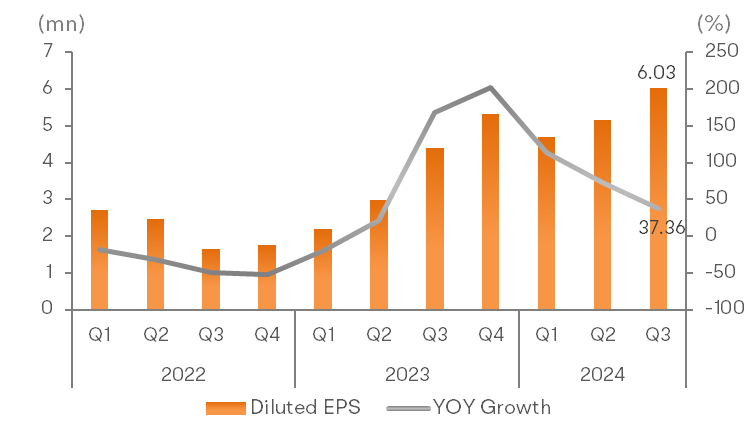

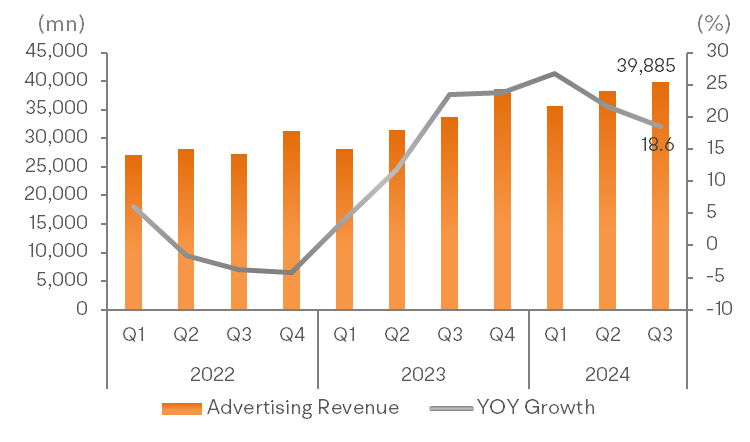

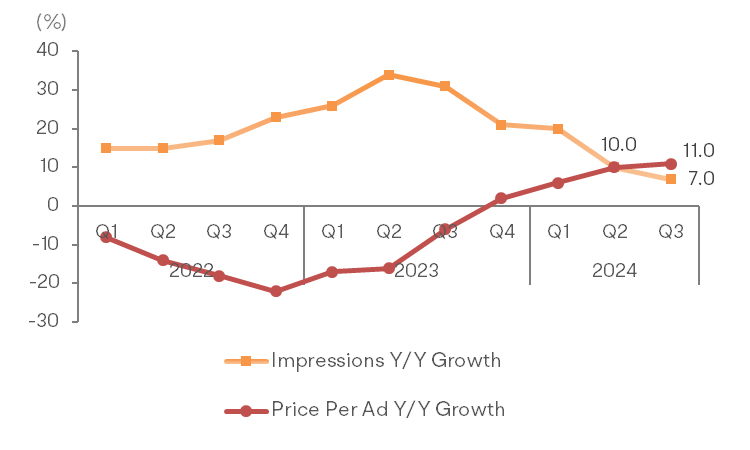

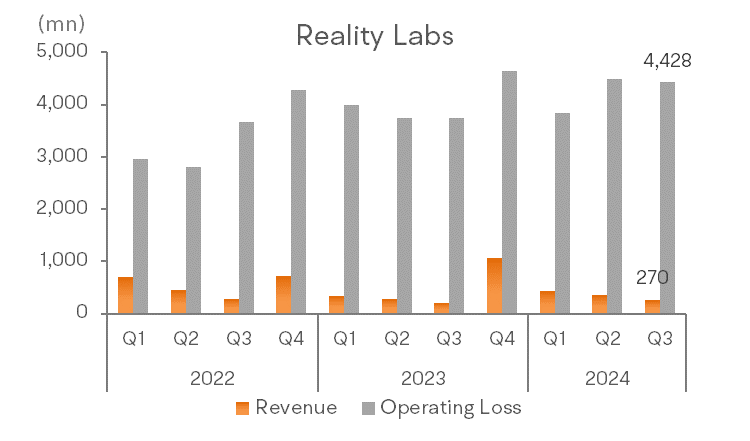

Barclays analyst Ross Sandler increased Meta Platforms' price target to $630 from $550, maintaining an Overweight rating after its Q3 earnings. Meta "seems to have its mojo back," evidenced by growth well above the digital ad industry, artificial intelligence improving the business, and CEO Mark Zuckerberg "flexing the roadmap with a willingness to bet big," the analyst wrote in a research note. While these moves should be praised by long-term tech investors, Sandler warns of potential risks as Meta's valuation reaches new highs.

NoDragonsPlz : to the moon?