What Will Be the Next Growth Driver for Meta After its Record Single-Day Market Cap Gains?

On February 2nd, $Meta Platforms (META.US)$ reported its strongest earnings ever, which not only exceeded Wall Street's expectations for Q4 2023 and Q1 2024 guidance but also announced its first-ever dividend and a massive $50 billion share buyback plan.

The series of surprises ignited the market sentiment, driving Meta's stock price to surge by over 20% to a historic high of $474.99. As of the latest, Meta's stock price has surged by over 450% since hitting its bottom in November 2022, making it the second-best performer in the S&P 500 components, trailing only Nvidia in terms of rebound magnitude. Moving forward, there is a growing interest among investors and Wall Street analysts in pinpointing the key drivers of Meta's future growth.

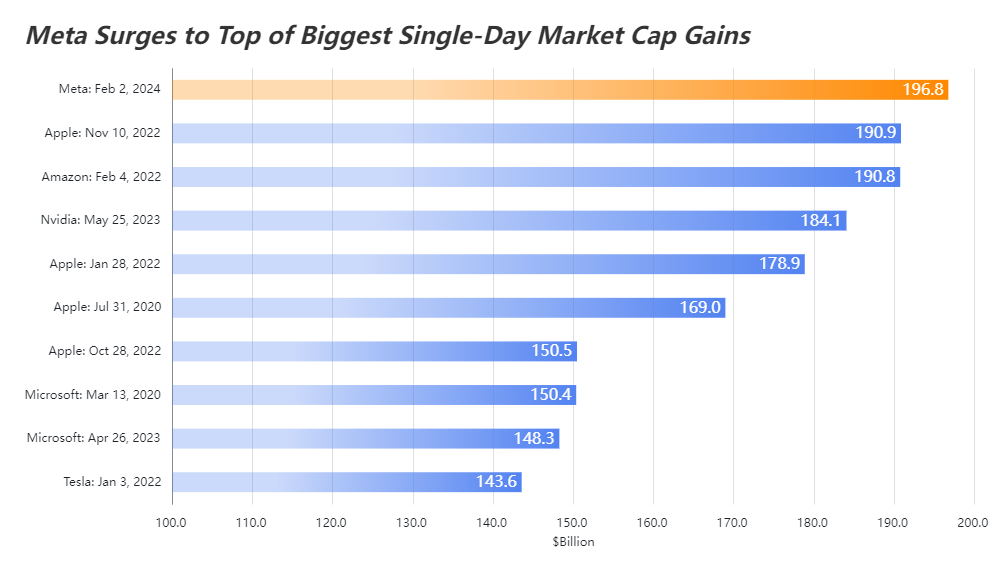

Due to the positive news shared during Meta's Q4 earnings call, the company's market capitalization skyrocketed by $197 billion in just one day, making it the top single-day gainer in the US stock market.

1. Thanks to strong growth in Chinese e-commerce advertising by companies like Temu and Shein, Meta's Q4 revenue surpassed analyst predictions of $39.08 billion, reaching $40.11 billion. Additionally, the company's cost-control efforts led to significant profit growth, with Q4 EPS increasing by over 200% YoY.

2. The management's 2024Q1 guidance is in full alignment with the market's bullish outlook on the company's growth potential in the midst of elevated valuations. Moreover, the company has revised its annual capital expenditure projection to between $30 billion and $37 billion, thereby expanding its presence in the realm of artificial intelligence.

3. By announcing increased shareholder returns, including an additional share buyback of $50 billion and a first-ever cash dividend of 50 cents per share, Meta's management has demonstrated a strong vote of confidence in the company's future prospects.

In response to the positive news, investment banks like Goldman Sachs, Barclays, and Citigroup have raised their target prices for Meta to above $500.

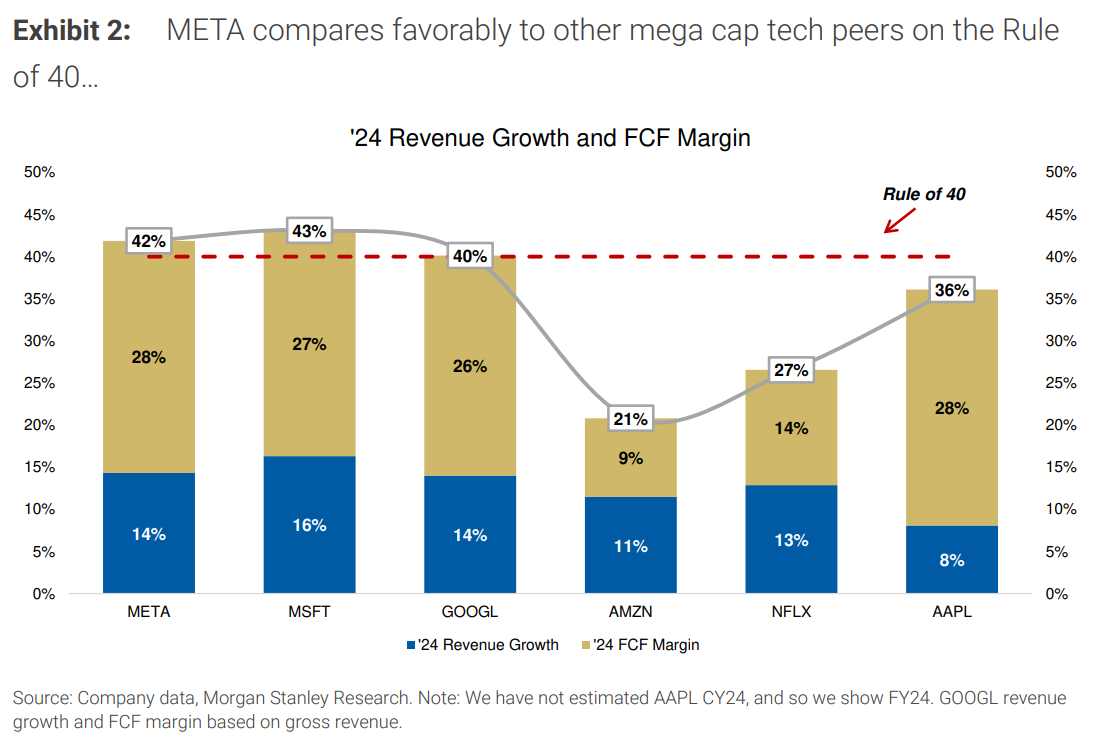

The Rule of 40 is a commonly used valuation method that evaluates the balance between growth and profitability in software companies, including those that are not yet profitable. This method is a strong indicator of a company's survival and competitive edge.

One of the essential metrics used to evaluate companies under this rule is whether the sum of their Revenue Growth and Free Cash Flow (FCF) Margin exceeds 40%. This rule is particularly relevant to fast-growing tech companies as it measures both their current earnings potential and future opportunities for market share and growth.

Morgan Stanley used this rule as a benchmark to evaluate the growth and profitability levels of mega-cap tech companies in a report late last year, revealing that META is near the top of its peers.

Morgan Stanley analyst Brian Nowak and his team have analyzed the drivers behind Meta's ad revenue growth, looking at sectors such as Reels, Click to Message, and Core from the bottom up.

1. Reels

As Meta's short-form video platform, which directly competes with Tiktok, Reels is expected to continue to drive significant growth in the next phase. According to Morgan Stanley's analysis, as the monetization rate of Reels increases, this business segment is expected to achieve high growth in the next two years, with its contribution to the overall advertising business expected to significantly increase from about 9% in 2023 to 23% in 2025.

“We expect growth to be driven by ad load, further improvements in matching/attribution and performance-driven pricing in the auction market. Given the ramp to date and positive advertiser trends, even this level of relative Reels monetization may prove conservative by '25.”

2. Click to Message Ads

Morgan Stanley predicts that click-to-message ad growth will remain stable in 2024-2025, driven by new advertiser adoption, new ad formats, and AI-based innovation. This business segment is expected to contribute steadily to advertising revenue, accounting for around 10%.

3. Core business

Brian Nowak and his team believe that the core drivers of Meta's traditional business will come from increased engagement, further AI-driven ad tools such as Advantage+ Toolkits, higher pricing due to AI investments improving ad performance, and a range of next-generation AI offerings. With these factors in play, Meta's core business is expected to achieve at least low-to-mid single-digit growth.

Meta is very active in both AI modeling and computing power. The company has not only launched multiple open-source models such as LLaMA2 but also announced the construction of its own AGI at the beginning of the year. In terms of computing power, the company is estimated to have 350,000 H100 chips by the end of 2024, and with additional AI chips, the company will have computing power equivalent to around 600,000 H100 GPUs. Meta's significant investment in AI technology has helped to match users' preferences and has helped improve advertising efficiency, including Ad pricing, app user growth and user engagement.

Source: Bloomberg, Meta, moomoo, Morgan Stanley

By Moomoo US Irene

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Nicco330 : nice