Metals & Mining Monitor | Accumulating Signals Point to Energy Metals Cycle Bottom; ALB, GOLD, AGI, CCJ Release Quarterly Earnings

Hello mooers! Check out the latest market dynamics of the metals and mining industry over the past week.

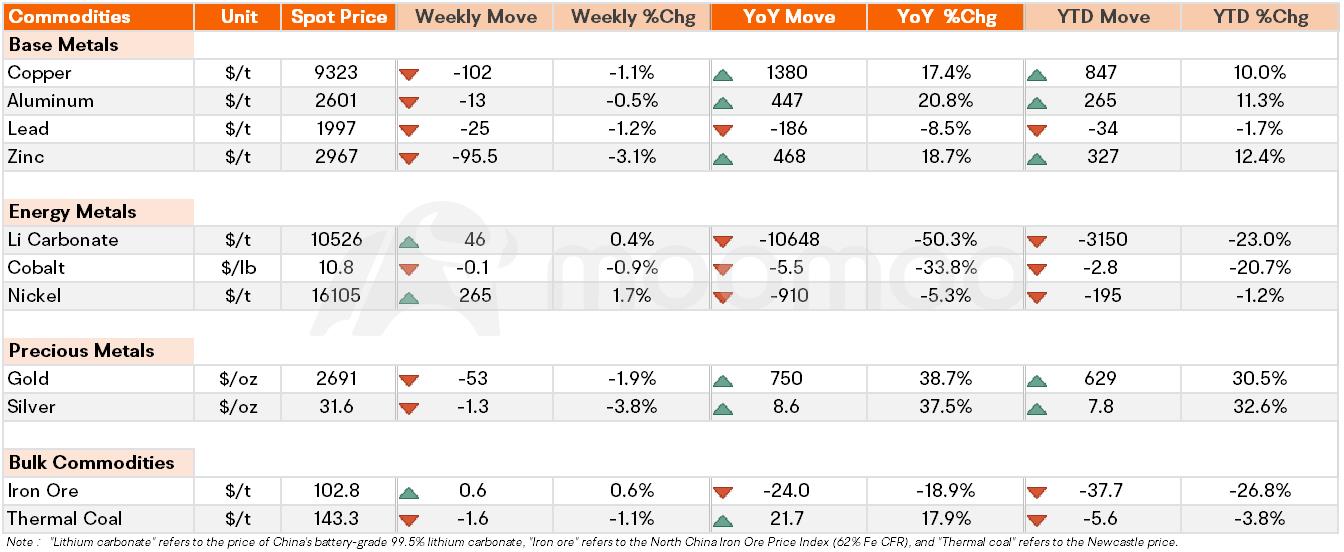

•Base metals: Copper prices drop to $9,323 per tonne

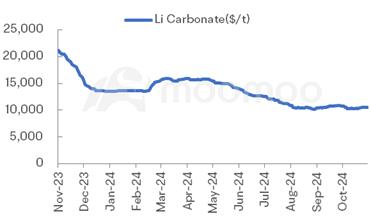

•Energy metals: Li carbonate prices rise 1.7% in the past week

•Precious metals: Silver prices fall 3.8% to $31.6 per oz

•Bulk commodities: Thermal coal prices lose 1.1% in the past week

Spot Price Snapshot

Key Price Moves

Since reaching a three-year low in late October at 73,240 RMB per ton, the price of lithium carbonate has remained stable, currently standing at about 75,460 RMB per ton, which is approximately $10,564 USD per ton. Although a reversal in supply and demand dynamics may take time, there are clear indicators that the price cycle has bottomed out, with expectations of mid-term improvements in both supply and demand. The accumulation of signals suggesting a market bottom is limiting further downward movement in prices due to cost support. Top lithium miner Yabao reported a loss in the third quarter, yet some domestic companies have seen a narrowing in quarterly losses, showing signs of bottoming out and recovery, particularly leaders in the industry like Tianqi Lithium and Ganfeng Lithium. Additionally, RIO's recent acquisition of Acradium Lithium signals strategic buying at the market's low point.

Silver prices dropped to $31.6 per ounce, nearing a one-month low as market participants assessed future demand in light of subdued stimulus measures from China and a higher interest rate forecast in the US. The Chinese government unveiled a $1.4 trillion initiative allowing local governments to convert off-balance sheet debts with Beijing to improve future financing costs. However, it stopped short of introducing new stimulus measures aimed directly at bolstering weak consumer spending in the economy. This restraint negatively impacted the outlook for industrial metals, including silver, which is extensively used in electrification, particularly in solar panels. Furthermore, following Trump's election victory, which raised the prospect of higher tariffs, Chinese-owned solar panel manufacturers reportedly began reducing production. Trump's win also influenced silver prices by heightening expectations for interest rates, as the Federal Reserve is anticipated to maintain elevated borrowing costs to counterbalance the expansionary fiscal policy expected under the new administration. $Silver Futures Current Contract (SIcurrent.US)$

Top Company News

Albemarle Reports Q3 Loss, Falls Short of Revenue Expectations

$Albemarle (ALB.US)$ reported a significant quarterly loss of $1.55 per share, starkly underperforming against the Zacks Consensus Estimate of a $0.31 loss per share. This result marks a drastic shift from the previous year's earnings of $2.74 per share, after adjustments for non-recurring items. This quarter's results represent a substantial earnings surprise of -400%. In the preceding quarter, the specialty chemicals company was anticipated to report earnings of $0.53 per share, yet actual earnings were only $0.04 per share, resulting in a -92.45% earnings surprise. Historically, Albemarle has beaten consensus EPS estimates only once in the past four quarters.

Barrick Gold Reports Increased Q3 Earnings and Revenue

$Barrick Gold (GOLD.US)$ announced on Thursday that both earnings and revenue saw an uptick in the third quarter. The company reported earnings of $0.30 per diluted share, an improvement from $0.24 per share from the same period last year. However, these figures fell slightly short of the $0.32 earnings per share anticipated by analysts polled by Capital IQ. Revenue for the quarter reached $3.37 billion, up from $2.86 billion a year earlier, marking an 18% year-over-year increase. Despite this growth, revenue was below the $3.41 billion forecasted by Capital IQ analysts. Notably, the company saw a nearly 30% increase in the gold price realized compared to the previous year, and a 13% rise in the realized price of copper for the quarter.

Alamos Gold Hits Record Highs in Production and Revenue

$Alamos Gold (AGI.US)$ announced a record-setting performance for the third quarter of 2024, attributing the success to a substantial rise in gold production and robust gold prices. The integration of the Magino mine was a key factor, boosting production by 20%. Additionally, ongoing expansion efforts at the Island Gold site and developments in the Mulatos District are expected to drive further growth and enhance cost efficiency.

Cameco Posts Strong Q3 Results as Nuclear Demand Surges

$Cameco (CCJ.US)$ has reported a strong performance for the third quarter, underpinning its strategic and financial objectives. The company, buoyed by growing demand for nuclear power, has raised its annual dividend, signaling confidence in sustained long-term growth. Noteworthy financial highlights include net earnings of $7 million and an adjusted EBITDA of $308 million, despite some financial adjustments due to purchase accounting for Westinghouse. Additionally, Cameco has revised its 2024 uranium production forecast upwards to as much as 37 million pounds, thanks to robust operations at the Key Lake mill. However, production at JV Inkai faced setbacks due to supply issues.

Kinross Gold Delivers Impressive Q3 Performance with Record Free Cash Flow and Debt Reduction

$Kinross Gold (KGC.US)$ Corporation announced strong results for the third quarter of 2024, highlighting significant margin growth and a record-setting free cash flow of $414.6 million. In a decisive move to strengthen its balance sheet, the company also repaid $350 million in debt. Kinross maintained robust operational performance across all its mining locations, confidently staying on course to meet its yearly production targets. Further underscoring its commitment to shareholder returns, Kinross declared a quarterly dividend, reinforcing its dedication to delivering shareholder value amidst favorable market conditions.

Cleveland-Cliffs Reports Q3 Results Amid Soft Steel Demand, Optimistic About Future

$Cleveland-Cliffs (CLF.US)$, a major player in the steel production industry, disclosed its financial outcomes for the third quarter of 2024 on November 8, 2024. CEO Lourenco Goncalves drew attention to the strategic acquisition of Stelco (TSX:STLC) and emphasized the company's readiness to capitalize on political support for the U.S. steel sector. Despite a downturn in steel demand impacting the adjusted EBITDA, which stood at $124 million, Cleveland-Cliffs remains optimistic about a potential rebound in automotive demand and stable pricing by the first quarter of 2025. The company also outlined its strategy for cost reduction, expecting to realize significant savings from renegotiated coal contracts and enhanced operational efficiencies. Notably, it anticipates $120 million in cost synergies from the Stelco acquisition within the first year, positioning Cleveland-Cliffs to potentially enhance profitability as market conditions improve.

Rio Tinto Partners with China's State Power Investment to Pilot Battery Swap Technology

$Rio Tinto Ltd (RIO.AU)$ announced a collaborative project with China's State Power Investment to test a cutting-edge battery swap technology for electric haul trucks at the Oyu Tolgoi copper mine in Mongolia. This ambitious two-year trial, detailed by the company on Tuesday, will deploy eight mining haul trucks, equipped with 13 batteries, and a robotic battery swap and charging station.

The innovative battery swapping technology enables trucks to quickly exchange a depleted battery for a fully charged one, bypassing the need for time-consuming recharging at fixed stations. This method is aimed at enhancing efficiency and reducing downtime in mining operations. Rio Tinto highlighted that this technology has already been successfully implemented in some mining operations across China.

During the trial, the electric haul trucks will be utilized for tailings dam rehabilitation and topsoil movement, essential for environmental management and operational efficiency at the mine. The trucks will be operated and maintained by the existing personnel at Oyu Tolgoi, ensuring a seamless integration of new technologies with the current workforce. This initiative not only underscores Rio Tinto’s commitment to innovation but also aligns with broader industry trends towards sustainability and reduced carbon emissions in mining operations.

Source: moomoo, Trading Economics, Yahoo Finance, Wind

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment