Metals & Mining Monitor | Gold and Copper Prices Fall Amid Expectations of the Fed's Hawkish Policy

Hello mooers! Check out the latest market dynamics of the metals and mining industry over the past week.

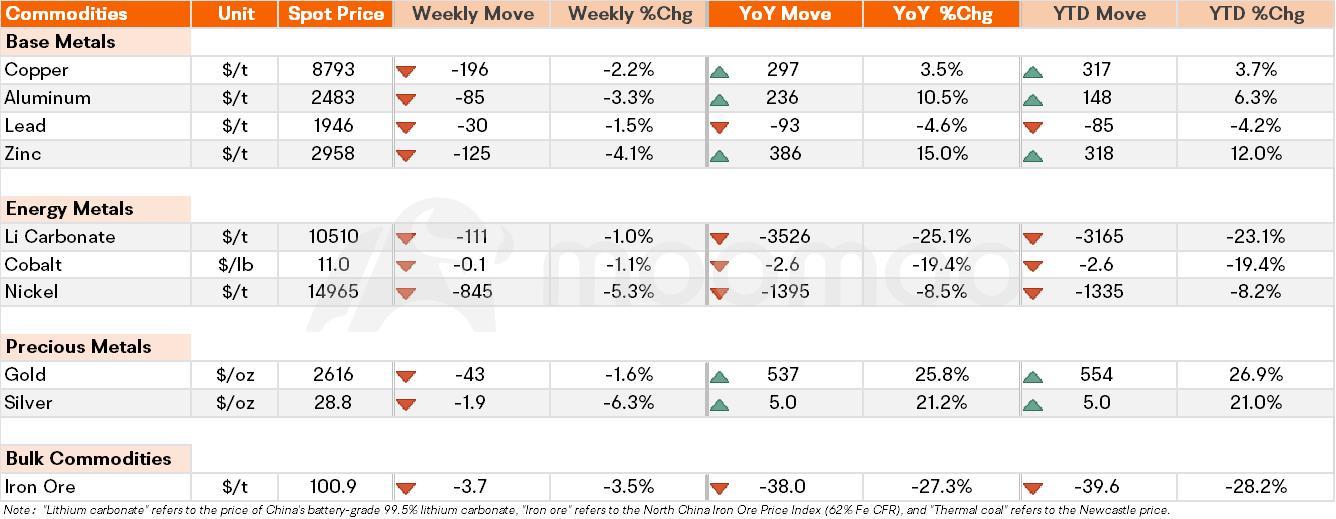

• Base metals: Zinc prices drop to $2958 per tonne

• Energy metals: Li Carbonate prices drop 1.0% in the past week

• Precious metals: Gold prices drop 1.6% to $2616 per oz

• Bulk commodities: Iron ore prices drop 3.5% in the past week

Spot Price Snapshot

Key Price Moves

Spot gold fell by 1.6% to $2616 per ounce last week. Despite a rise in gold prices following the release of the latest U.S. inflation data, the downward pressure for the week could not be avoided. Spot gold closed down by 0.98% for the week. The pullback in the U.S. dollar and Treasury yields provided some support for gold, but the hawkish policy expectations from the Federal Reserve continue to weigh on it, with officials forecasting only two rate cuts in 2025, each by 25 basis points. However, the potential impact of Trump's policies after he takes office next year, and the uncertainty surrounding his policy outlook, also offer some support to gold prices. Amid a rise in Treasury yields and the U.S. dollar, gold has plummeted over the past week. If the 10-year U.S. Treasury yield remains above 4.50%, gold may struggle to hold above the $2,600 level and could potentially test support at $2,530 again. Many analysts predict that gold prices will reach $3,000 per ounce next year, but it is expected that the upward trend will only materialize in the second half of 2025.

In addition to the Federal Reserve's monetary policy, geopolitical risks remain a significant support factor for the gold market. The risk of another U.S. government shutdown adds to this political uncertainty, increasing the market's demand for gold as a safe-haven asset. Geopolitical uncertainties, turmoil in the U.S. political landscape, and expectations of a slowdown in global economic growth will continue to bolster demand for gold as a safe haven. $Gold Futures(FEB5) (GCmain.US)$

Copper futures stabilized around $4.04 per pound on Friday, but were on track to decline by over 2% for the week, as a hawkish Federal Reserve outlook and demand uncertainties in China weighed on prices. Earlier this week, the Fed delivered a widely anticipated quarter-point rate cut but signaled fewer reductions in 2025 due to persistent inflation. Recent US economic data, including weekly jobless claims and a revised third-quarter GDP, also indicated robust activity, reinforcing expectations of higher interest rates. Additionally, the looming threat of higher US tariffs under the incoming Trump administration added further uncertainty to the market outlook.

Top Company News

Agnico Eagle Mines Initiates Cash Bid to Purchase All Outstanding O3 Mining Shares

$Agnico Eagle Mines Ltd (AEM.CA)$ announced on Thursday that its subsidiary has launched a bid to purchase all outstanding common shares of O3 Mining that it does not already own, offering 1.67 Canadian dollars ($1.16) per share in cash.

The company described the proposal as part of a friendly takeover that has the full backing of O3 Mining's board of directors. The board has unanimously advised shareholders to accept the offer by tendering their shares.

Furthermore, Agnico Eagle reported that key stakeholders of O3 Mining, including directors and officers, its largest shareholder Gold Fields Limited, Extract Advisors, and several funds managed by Franklin Templeton, who together hold approximately 39% of O3 Mining’s outstanding shares, have agreed to lock-up arrangements committing to tender all their shares in support of the acquisition.

BHP, Rio Tinto, and BlueScope are set to build a pilot plant for electric furnace ironmaking in Australia

$BHP Group Ltd (BHP.US)$ and $Rio Tinto (RIO.US)$ , are teaming up with BlueScope to construct Australia's largest electric furnace for ironmaking, a move that could expedite the decarbonization of steel production. The pilot project, located in Kwinana near Perth, is set to produce between 30,000 and 40,000 tons of molten iron annually. Initially, it will utilize natural gas and hydrogen supplied by their new partner, Woodside Energy Group, to convert iron ore into direct reduced iron (DRI). According to a joint statement from the companies, the project aims to generate power using hydrogen once it becomes operational.

This technology has the potential to reduce emissions by up to 80% if renewable energy sources and green hydrogen are employed.The project could demonstrate that iron ore from Australia's Pilbara region can be smelted using an electric furnace, potentially replacing traditional blast furnaces that are coal-powered. Currently, over 70% of steel production relies on coal as an energy source.

Source: Trading Economics, AFR, Wind, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Griffon : News about the mining sector greatly appreciated