Metals & Mining Monitor | Gold Hits Record High Again; Pilbara Minerals and China Ganfeng Lithium Plan to Collaborate Outside of China

Hello mooers! Welcome to Mining & Metals Monitor, your source for weekly insights into key commodities and fundamental changes in leading companies.

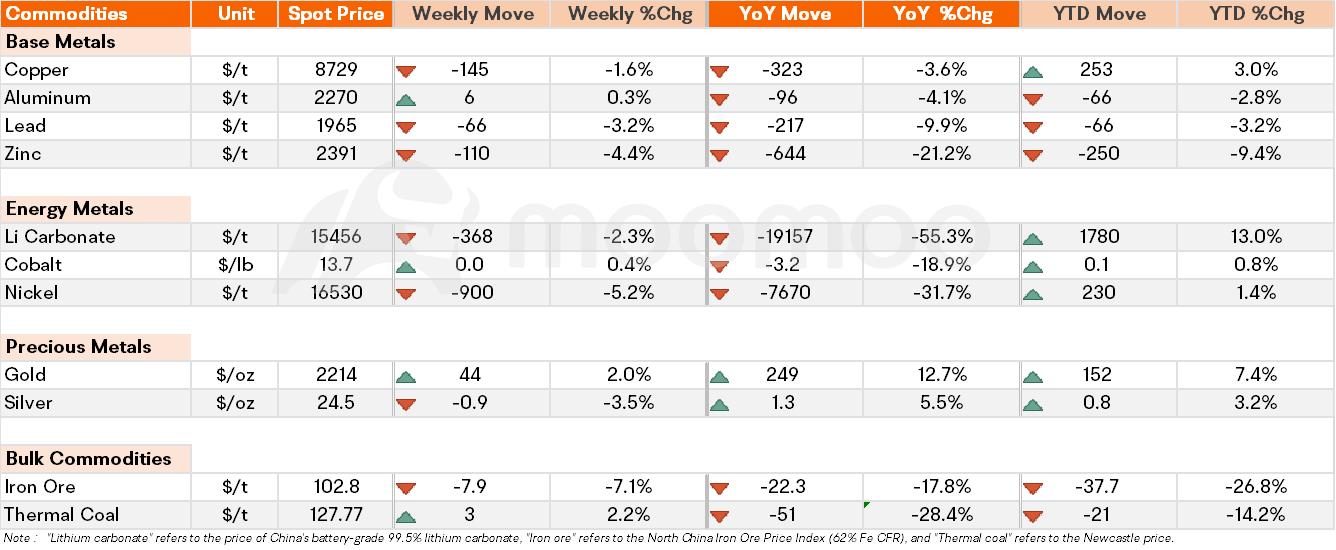

Spot Price Snapshot

Key Price Moves

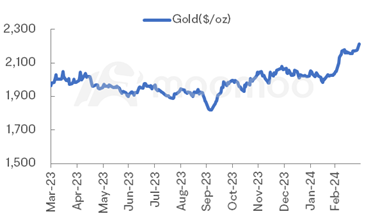

Gold: On Thursday, the price of gold reached an all-time high and experienced its strongest month in more than three years due to high demand for safe-haven assets and expectations of a cut in U.S. interest rates. As of last week, the spot price reached to $2214/oz and continued to rise in this Monday.

Gold could see further price increases if the markets start to expect a deeper Fed cutting cycle, and there is potential for it to "hold on to these highs, but we do see signs of buying exhaustion emerging in the very near term", said Daniel Ghali, commodity strategist at TD Securities

Aluminum: spot prices touched an 11-week high over concerns over slow recovery in production in China's Yunnan province and supported by a strong technical outlook. As of last week, the LME spot price ended $2270/ton, after touching $2336/ton, its highest since January 3.

Iron ore: Last week, the price of iron ore in China decreased by approximately 7% due to sluggish construction activity in China and a sudden surge in supply. Futures in Singapore plunged by nearly 4%, falling below $100 a ton early this Monday. Atilla Widnell, the managing director at Navigate Commodities Pte, stated that this decline is a result of a return to fundamental factors. Furthermore, he predicted that the incoming influx of raw material shipments from Australia will exacerbate China's already bloated port-side inventories.

Top Company News

Pilbara Minerals and China Ganfeng Lithium to establish battery-grade lithium processing plants outside China

$Pilbara Minerals Ltd (PLS.AU)$, the largest lithium mining company in Australia, is collaborating with $Ganfeng Lithium Group (002460.SZ)$, the world's third-largest producer of lithium compounds and China's largest producer of lithium, to establish battery-grade lithium processing plants outside of China. The decision has been made to avoid any apprehensions raised by Western nations, particularly the US, and to leverage the benefits of new markets that are expected to grow with US subsidies. Pilbara Minerals aims to capitalize on these markets by establishing new battery materials processing facilities outside of China.

Chile's Codelco Reports Profit Dip in 2023 Due to Decreased Production

Codelco, the world's largest copper miner, reported a gross profit of $3.12 billion in 2023, a 34% decrease from the previous year due to operational and production challenges. The state-owned producer disclosed that its production for the year was 1.325 million metric tonnes, the lowest in twenty-five years. Codelco forecasts steady copper output of between 1.325 and 1.390 million metric tons for 2024, with an anticipated capital expenditure of $4 billion to $5 billion.

Vale Acquires Remaining 45% Stake in Alianca Energia for $541M

Brazilian mining company $Vale SA (VALE.US)$ signed an agreement to purchase a 45% stake in Alianca Energia from Cemig GT, a subsidiary of energy firm Cemig, for 2.7 billion reais ($540.9 million). This acquisition will provide Vale with complete ownership of Alianca Energia, which holds seven hydroelectric plants and three wind units in its portfolio of assets.

Northern Star Submits Application to Expand Super Pit Gold Mine

$Northern Star Resources Ltd (NST.AU)$, through its subsidiary Kalgoorlie Consolidated Gold Mines Pty Ltd, has submitted a proposal to expand the Super Pit gold mine in the WA goldfields. The current expansion program at the Super Pit, which involves doubling the capacity of the mine, is already costing the company over $1.5 billion. Northern Star aims to increase production across the Goldfields from 2027 to 2028, ultimately reaching its goal of 27 million tonnes per year by 2029. The proposal includes plans to widen and deepen the Super Pit.

Barrick Gold Withdraws from El Quevar Silver Project Earn-In Agreement

$Golden Minerals Co (AUMN.CA)$ announced that $Barrick Gold Corp (ABX.CA)$ is terminating its earn-in agreement on the El Quevar silver project in Argentina, effective April 20. Golden Minerals views the return of the El Quevar project positively and plans to advance the project further, subject to the availability of capital, and update its resource.

Alamos Gold to Buy Argonaut Gold for $325M, Spin Off Argonaut's Non-Canadian Assets

$Alamos Gold Inc (AGI.CA)$ has reached a definitive agreement to buy $Argonaut Gold Inc (AR.CA)$ for $325 million, with the aim of building one of Canada's largest and most profitable gold mines. The acquisition will give Alamos access to the Magino mine in northern Ontario, which it intends to integrate with its nearby Island Gold mine. Argonaut's U.S. and Mexico assets will be spun out to its existing shareholders as a newly created junior gold producer. After the deal's completion, Alamos's shareholders will own roughly 95% of the combined company, while Argonaut's owners will own the remaining 5%.

If you have any suggestions, please feel free to leave us a message. We welcome your feedback and ideas!

Source: moomoo, Yahoo Finance, Wind

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment