NVDA

NVIDIA

-- 139.670 TSLA

Tesla

-- 430.600 PLTR

Palantir

-- 80.690 AMD

Advanced Micro Devices

-- 124.600 RGTI

Rigetti Computing

-- 10.9600

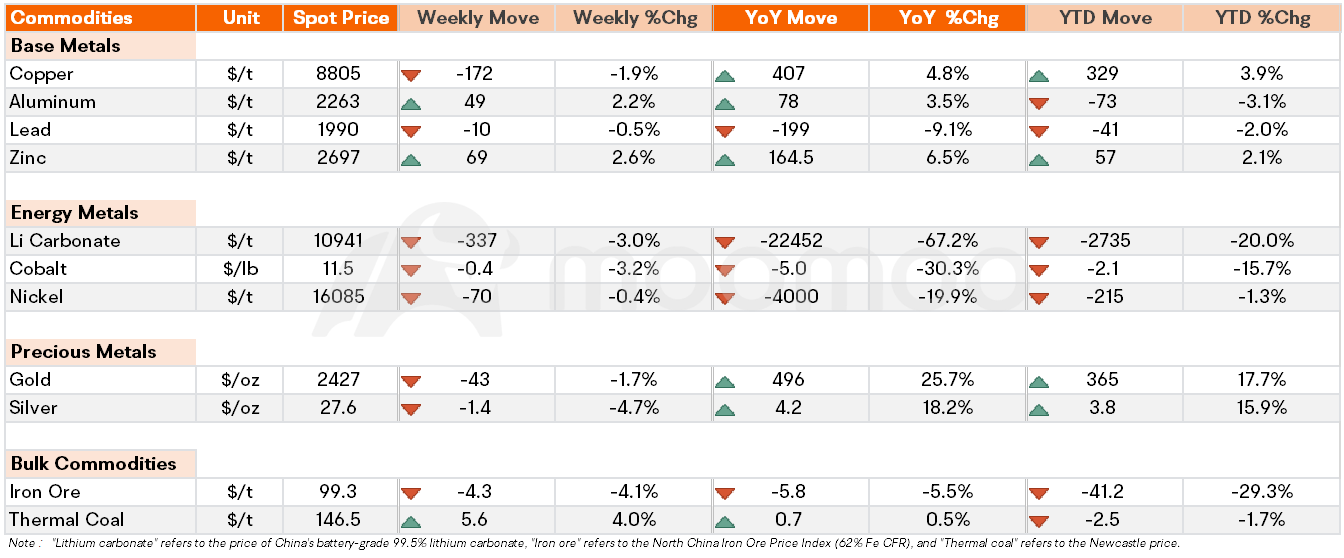

Hello mooers! Check out the latest market dynamics of the metals and mining industry over the past week.

•Base metals: Copper prices decline by 1.9% in a week

•Energy metals: Li carbonate prices drop to three-year low

•Precious metals: Gold prices fell by 1.7% in the past week

•Bulk commodities: Thermal coal prices rise to three-month high